Welcome to the last day of March ahead of the hotly anticipated "Liberation Day" on Wednesday. US and European markets are sharply lower and Asian equity markets are also sinking as the fear of what it may contain continues to build (the Nikkei tumbled into a correction overnight). As Goldman trader John Flood writes, "brace yourself for a crazy week ahead. S&P 500’s implied move through Friday" (4/4) is 260bps (he will take the over).

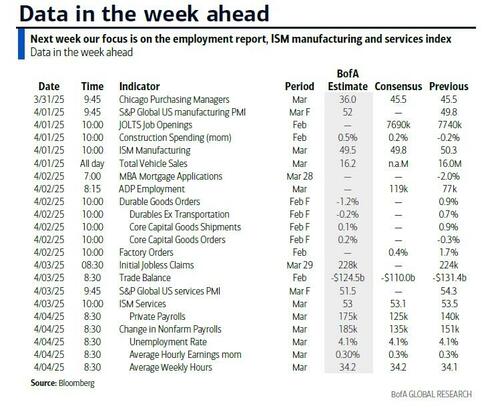

On the economic data front we get China’s NBS PMIs on Monday morning, US Manufacturing ISM (Tuesday morning; the Street is modeling 49.8, down from 50.3 in Feb), Services ISM (Thursday morning; the Street is modeling 53.1, down from 53.5 in Feb), and Jobs (Friday morning; the Street is modeling 135K, down from 151K in Feb, and according to Michael Hartnett this number is more important than Trump's tariff announcement). Also need to keep an eye on the first major political contests since Trump’s reelection taking place on Tuesday 4/1 (the judicial election in Wisconsin and the special House races in Florida).

According to Flood, the Grand Daddy of this week's events is the tariffs announcement on April 2: he notes that Goldman economists believe that "risks lean towards a negative surprise on announcement day for 2 main reasons: First, administration officials have said that the soon-to-be announced tariff rates are intended as the basis for negotiation, which incentivizes the proposal of higher rates at the outset. Second, their recent survey showed that market participants anticipate the reciprocal tariff rate to be 9% on average, while GS economists believe the initial proposal could be closer to double that expectation."

Moving back to this week, outside of "liberation day" and 25% tariffs on imported autos commencing on Thursday, it's also a big week for macro with all roads leading to Friday's payrolls and a speech by Powell. Before that, the main highlights are: today's German CPI; tomorrow's US manufacturing ISM, US auto sales, US JOLTS, China's manufacturing PMI, Japan's Tankan, Eurozone CPI, the RBA rate decision, and a speech from Lagarde; Wednesday's ADP report; Thursday's US ISM services, China's services PMI, Eurozone PPI, and the ECB account of the March meeting; all before the big end to the week on Friday.

In terms of what to expect from "Liberation Day" on Wednesday, the bid-offer is huge. As DB's economists laid out last week reciprocal tariffs could add roughly 4 (best case) to 14ppts (worst case) to the overall US tariff rate relative to its 2024 level of 2.5%. The hit to 2025 real US GDP growth could be as little as -25bps to as high as -120bps. For core PCE inflation, reciprocal tariffs could add anywhere from a couple of basis points to potentially 1.2ppts. Importantly, these impacts are additional to the risks to growth and inflation from previously announced tariff actions.

DB's economists calculate that the trade actions taken to date (if they remain in place through year end) imply an overall US tariff rate of roughly 10.5%, which is the highest since WWII. The Trump Administration's auto tariffs could push the US tariff rate as high as another couple of percentage points higher depending on the implementation details. So the starting point before "liberation day" is 10.5-12.5%. As such by the end of this week we could be looking at a aggregate US tariff rate of (very roughly) between 15 and 25%.

Over the weekend, Trump told NBC that he "couldn't care less" if automakers had to raise prices in the US as it would force Americans to buy US made cars. The 25% tariffs are due to come into force on Thursday. So its becoming ever clearer that this administration is serious about bringing massive change to economic policy. If and where their pain threshold is in terms of markets and the economy is the next most important question. The rhetoric from the administration at the moment seems to suggest its high but there is an extraordinary amount of uncertainty at the moment.

The pain isn't showing up in the hard data at the moment and in terms of US payrolls on Friday there's only likely to be a small impact, DB forecasts +150k for both headline and private against +151k and +140k respectively last time. Incorporated in that is a roughly 20k drag from federal layoffs which have been complicated by court actions against them. DB expect the unemployment rate to just round up to 4.2% from 4.1% last time. Before that it will be interesting to see if the US manufacturing ISM (Tuesday) and services (Thursday) show any sentiment hit.

As an aside, several weeks ago, DB's Jim Reid referred to a "rather insightful" podcast featuring US Treasury Secretary Scott Bessent on the "All-In" podcast (link here). He outlined his ideologies and, in my view, committed the administration to potentially transformative policies. Shortly thereafter, US Commerce Secretary Howard Lutnick appeared on the same podcast (link here) and presented perhaps an even more radical perspective on the potential policy direction.

As Reid notes today, "these are valuable podcasts to listen to and have helped convince me that this administration is serious about radical change." We will have more to say about this shortly.

Back to this week's events, tomorrow sees two special congressional elections in Florida to fill the seats of Matt Gaetz and Michael Waltz in the US House of Representatives. These are Republican strongholds but some polling has suggested it could be close. The Republicans will still control the House regardless but only have the narrowest of majorities so these are important elections in terms of breathing space for their agenda.

In geopolitics, the focus will be on a meeting of NATO foreign ministers on April 3-4. Its the first time they've met since Trump's inauguration. So they'll have plenty to discuss

Staying on this theme, over the weekend, Trump suggested he was angry at Putin over his recent comments that Zelenskiy should be replaced as a price for peace negotiations. Mr Trump used slightly stronger language according to NBC. Trump said that if Russia was to blame for there being no peace deal he's prepared to put secondary sanctions on Russian oil.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 31

Tuesday April 1

Wednesday April 2

Thursday April 3

Friday April 4

Finally, looking at just US macro, the key economic data releases this week are the ISM report on Tuesday and the employment situation report on Friday. President Trump is expected to announce new tariff policies on Wednesday. There are several speaking engagements from Fed officials this week, including speeches by Vice Chair Jefferson on Thursday and by Chair Powell on Friday.

Monday, March 31

Tuesday, April 1

Wednesday, April 2

Thursday, April 3

Friday, April 4

Source: DB, Goldman