Fed governor Chris Waller may have thought he was a shoo-in for Powell's replacement (and the role of shadow Fed chair) when he said last week that, contrary to the Powell narrative and FOMC consensus, the Fed should cut as soon as July.

Well, not so fast.

Recall late last summer, it was Fed vice chair Michelle Bowman who staked out a bid for Powell's replacement when she first dissented with the Fed's jumbo 50bps rate cut meant to ease Biden/Kamala's election, and second when she (correctly) lashed out at illegal immigrants as the source of "upward pressure on rents."

Fast forward to this morning, when Bowman officially reminded the world that she is also in the running for Powell's replacement, when she echoed Waller in saying that she would favor an interest rate cut at the next policy meeting in July so long as inflation pressures stay muted (which is doing just that).

With her speech delivered in Prague, Bowman became the second central banker in recent days to suggest that President Donald Trump’s tariffs are likely to have a temporary and muted impact on prices, thus paving the way for lower rates.

“Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market,” she said in prepared remarks. “In the meantime, I will continue to carefully monitor economic conditions as the Administration’s policies, the economy, and financial markets continue to evolve.”

Trump has been pressuring the Fed to lower interest rates as a way to save financing costs on the nation’s ballooning national debt. However, the Federal Open Market Committee at its meeting last week voted to hold its key interest rate in a target between 4.25%-4.5%.

For her part, Bowman said she supported the change in approach the post-meeting statement took noting that policy uncertainty has diminished and the focus is now tilting towards potential labor market weakness.

Economists had worried that Trump’s tariffs would spike inflation, but measures have shown little if any impact so far. In fact, as we showed overnight, Trump has been spot on, and export prices for Japanese cars destined to the US have cratered as it is Japanese car makers that eat the tariff cost.

“I think it is likely that the impact of tariffs on inflation may take longer, be more delayed, and have a smaller effect than initially expected, especially because many firms frontloaded their stocks of inventories,” Bowman said. “As we think about the path forward, it is time to consider adjusting the policy rate.”

Trump has said he thinks the Fed should lower by at least 2 percentage points. Bowman’s remarks did not mention how much she thinks the rate should be lowered, and Waller said there is no need for such dramatic cuts.

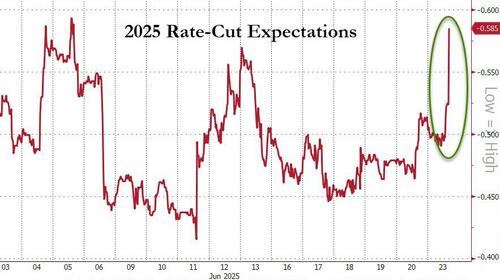

The FOMC next meets July 29-30. Traders are assigning just a 23% probability to a move at the meeting, with a likelihood of about 77% that the Fed will cut in September, according to the CME Group’s FedWatch gauge measuring futures market pricing.

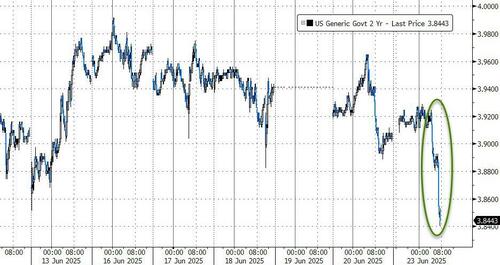

Bowman's comments sent 2Y yields and the dollar tumblig...

... and sent odds of a rate cut surging.

Expect this to last the next war freakout sends oil - and inflation - expectations surging, and undoing all of the above.