Weak labor market data (JOLTS big miss) and mixed Orders (Manufacturing beat, Durables miss) sent 'hard' data' to its weakest since the start of the year..

Source: Bloomberg

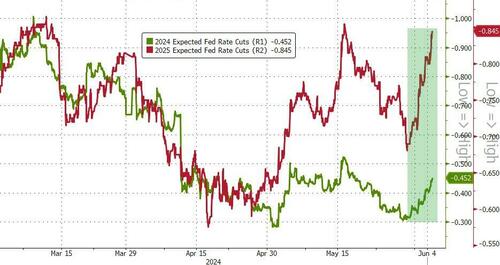

...and that 'bad' news was enough to spark another dovish leg higher in rate-cut expectations...

Source: Bloomberg

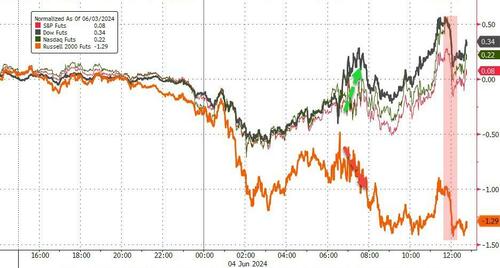

BUT... and its a big but, stocks didn't love the 'bad news'. Small Caps were particularly ugly but an afternoon srge lifted the majors green but they could not hold all the gains...

Source: Bloomberg

As David Rosenberg noted on X:

"The fact that equities are not responding well to the renewed pullback in Treasury yields and the swaps market beginning to price in a September rate cut is signaling something important: that stock market investors are also becoming concerned about the economic slowdown and what it means for the earnings outlook."

And as Goldman's trading desk noted, volumes extremely muted tracking -15% vs the 20dma with S&P top of book down after elevated levels in May.

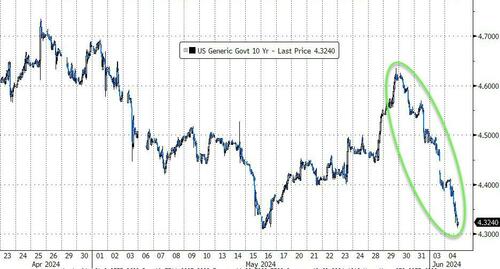

On the other hand, bonds were clear on which direction to head (lower in yield) with the long-end marginally outperforming, and the yield curve flattening (inverting deeper) for the last four days...

Source: Bloomberg

The 10Y yield closed at its lowest in two months...

Source: Bloomberg

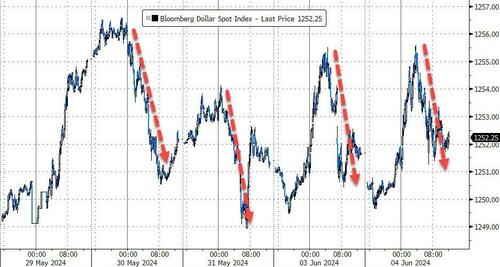

The dollar whipsawed AGAIN today, spiking overnight, only to be sold during the US session to end flat on the day...

Source: Bloomberg

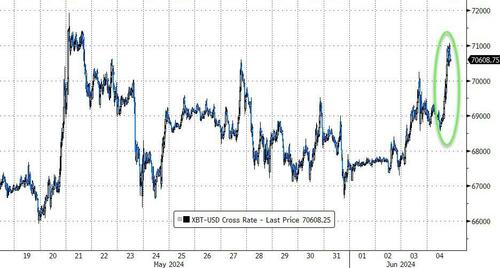

Bitcoin surged back up to $71,000 today...

Source: Bloomberg

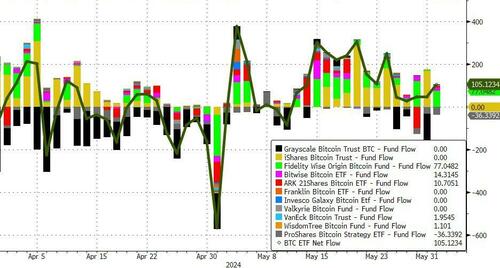

...after the 15th straight day of net inflows into BTC ETFs...

Source: Bloomberg

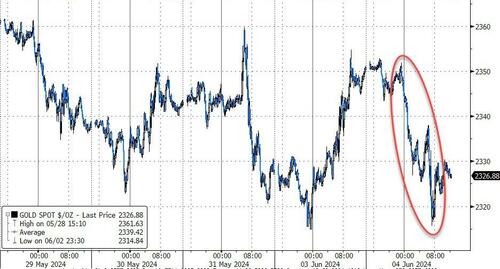

Gold slipped back to yesterday's lows (ignoring the dollar' retreat this afternoon)...

Source: Bloomberg

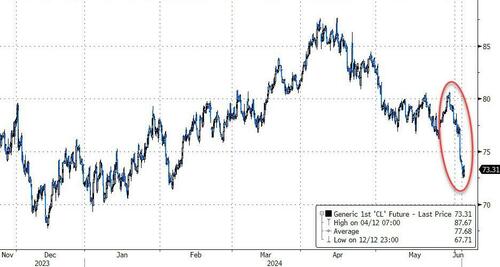

Oil prices plunged back to a $72 handle (WTI) - the lowest in four months...

Source: Bloomberg

Finally, as economic data continues to underwhelm (ISM Manuf, JOLTs), the US economic surprise index has inflected to its lowest level in 5+ years...

Source: Bloomberg

..but Goldman's Cylicals vs Defensive pair remains in full growth mode.

Who will be right?