The equity market was mixed today with The Dow lagging and Small Caps leading (S&P/Nasdaq modestly lower) ahead of tomorrow's big day. NOTE the drop in the morning was reportedly triggered by WSJ HLs that Russia is suspected of a plot to send incendiary devices on US-bound planes, citing Western security officials, but that was quickly BTFD back...

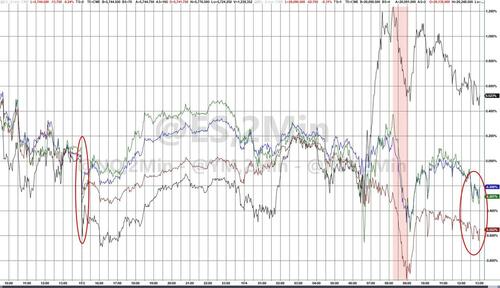

The bigger theme of the day was profit-taking on the so-called "Trump Trade" after extreme outpereformance of the Kamala basket in recent weeks...

Source: Bloomberg

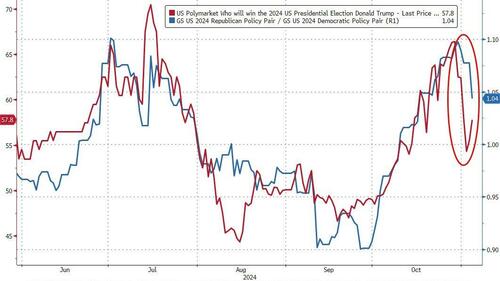

VIX ended the day notably elevated with the vol term structure extremely inverted ahead of this week's extreme event risks...

Source: Bloomberg

...in fact this is the VIX's longest stretch above its 200dma since 2019...

Source: Bloomberg

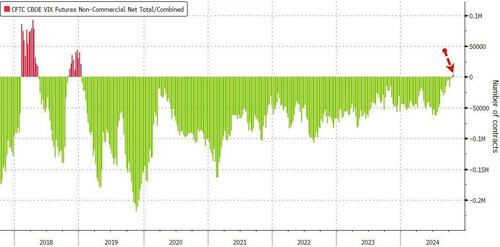

For the first time since early 2019, VIX Specs are net long futures...

Source: Bloomberg

Maybe this is more than an election-uncertainty trade... maybe it's structural...

Source: Bloomberg

Mega-Cap Tech fell once again today but has found support for now...

Source: Bloomberg

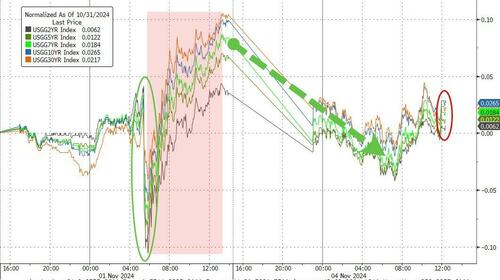

After Friday's utter chaos in bond land, reality set in that piss poor payrolls means lower yields and Treasury yields tumbled across the board with the long-end outperforming (2Y -3bps, 30Y -8bps). Yields are still marginally higher from Thursday's close...

Source: Bloomberg

The 10Y yield ended back at pre-payrolls levels...

Source: Bloomberg

The dollar continued to drift lower (ignoring the manic buying after payrolls)...

Source: Bloomberg

Arguably another "Trump Trade" continues to build as the Mexican Peso plunges to its weakest since Sept 2022

Source: Bloomberg

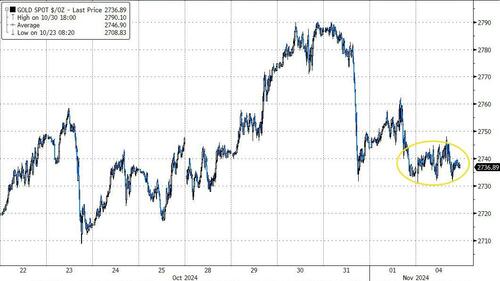

Despite the dollar weakness, gold trod water today, holding just above support around $2730...

Source: Bloomberg

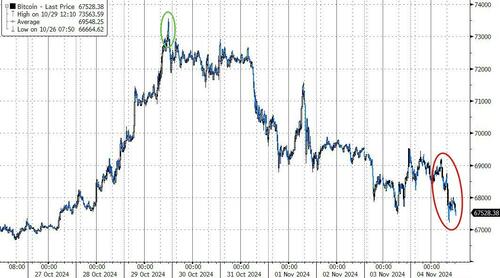

Bitcoin fell again after tagging record highs last week. BTC is finding support in the $67-68k region for now

Source: Bloomberg

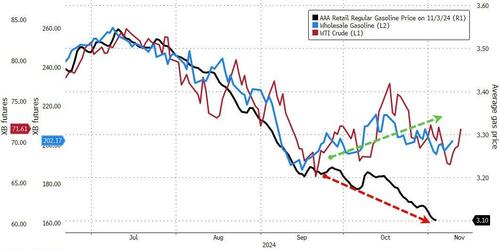

Oil prices rallied (with WTI back up near $72), erasing last week's plunge on Israel-Iran optics...

Source: Bloomberg

With oil prices rising again, we wouldn't question you for being surprised that pump-prices are testing multi-year lows (right ahead of the election)... probably nothing, right?

Source: Bloomberg

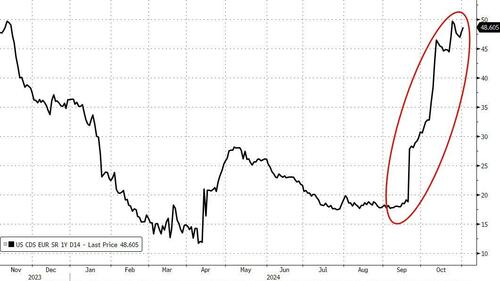

Finally, what happens to USA Sovereign Risk tomorrow?

Source: Bloomberg

From 12-month highs - will a divided govt soothe the pain?