Bank of America, the second largest US bank, was the latest big money-center bank to report earnings this morning, and in keeping the trend started by JPM, Wells and Citi last Friday, it not only beat expectations, but reported Q3 numbers that were the strongest in at least seven years as net interest income topped analysts’ estimates as the lender continues to reap the benefits of Federal Reserve interest-rate hikes and market swings.

Here are the highlights:

“We added clients and accounts across all lines of business,” CEO Brian Moynihan said adding that "we did this in a healthy but slowing economy that saw US consumer spending still ahead of last year but continuing to slow.”

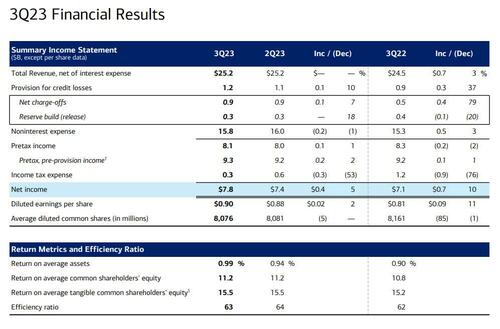

Looking at the bank's Q3, here too it beat expectations across the board

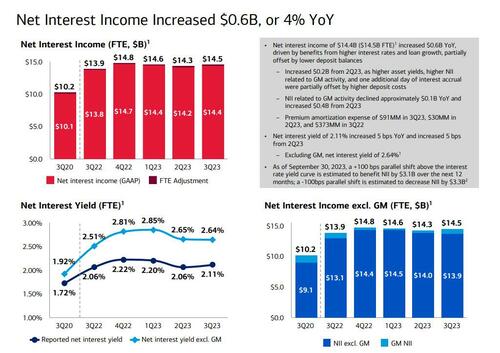

We'll look at BofA's non-interest income in a second but first this is how the bank took advantage of its massive balance sheet:

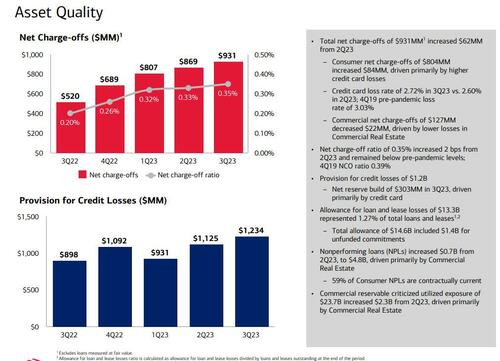

Looking at the bank's charge offs, which will be a closely watched topic since Bank of America has one of the highest carried Held to Maturity losses of all banks, the bank reported net charge-offs of $931 million, below the estimate of $995.4 million while the provision for credit losses rose to $1.23 billion, but below the estimate $1.3 billion. Unlike JPM, BofA actually built reserves for future losses to the tune of $303 billion, "driven primarily by credit cards" which together with CRE is emerging as the biggest threat to the financial system. Some more details:

Some more details:

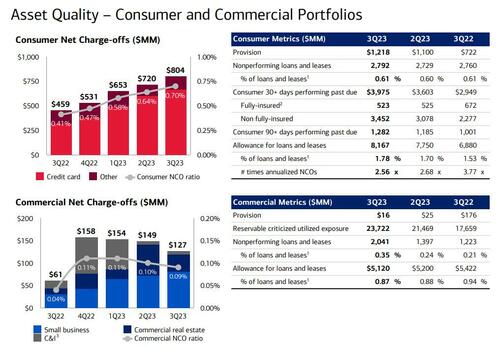

And another way to visualize the deteriorating credit card and CRE trends on the BofA balance sheet.

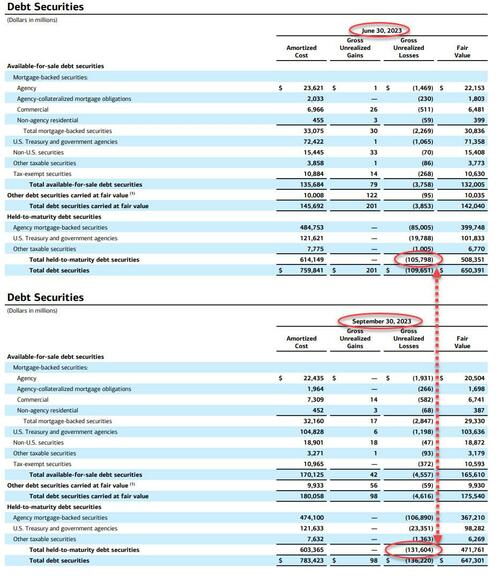

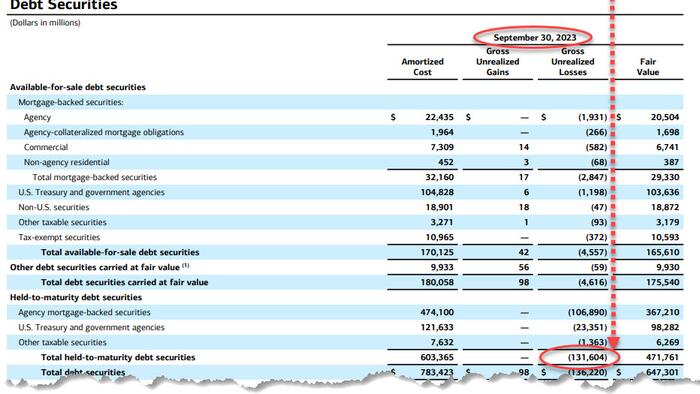

Of course, the one line item everyone will be asking about is the bank's $131.6BN in HTM losses, which increased by $26BN from last quarter and is now the highest in BofA history!

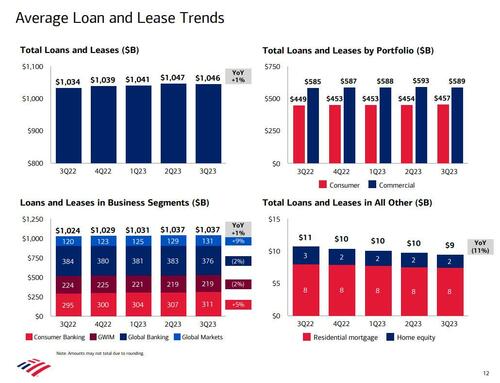

Another look at the balance sheet reveals average loans and leases of $1.05 trillion, in line with the estimate of $1.05 trillion...

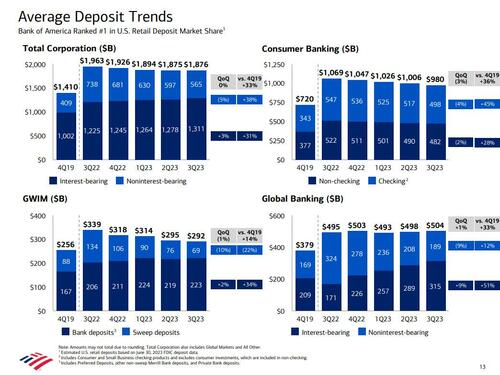

... while deposits were unchanged at $1.88 trillion, above the estimate of $1.77 trillion, but down from $1.96 trillion a year ago.

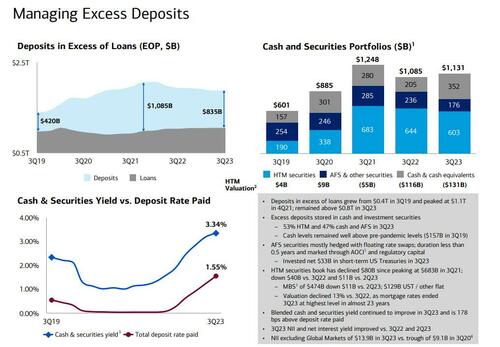

As has been the case lately, every bank is finally doing what we have been showing since 2012 when JPM's excess deposits led to the London Whale disaster, and is disclosing how it is handling its "excess deposits over loans" which these days are mostly parked in deeply underwater (but HTM) treasuries. Here are the details:

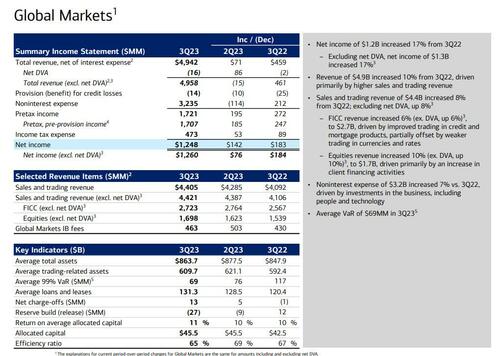

Turning to BofA's Global Markets trading desk, the bank reported trading revenue ex DVA at $4.42BN, up 8% and beating the $4.16BN expected.

Taking a quick look at the company's expenses, BofA reported that non-interest expenses rose 3.5% from a year earlier to $15.8 billion. Costs have been a focal point for investors, with persistent inflation putting pressure on spending and spurring wage growth. Analysts had expected a 3.3% increase. Broken down, compensation and benefits rose to $9.55 billion from $9.4 billion, above the estimated $9.34 billion; Other expenses dropped from $6.6BN to $6.3BN, resulting in an efficiency ratio of 63%, down from 64% but up from 62% a year ago.

The stronger than expected results offered another look at how US consumers and businesses are faring as the Fed leaves borrowing costs higher for longer than economists had predicted. Last week, JPM, Wells Fargo and Citi beat analysts’ expectations for net interest income and raised their forecasts for the remainder of the year.

Shares of the Charlotte, North Carolina-based bank which were down 19% this year through Monday, rose 0.7% to $27.19 at 8 a.m. in early New York trading as attention has yet to turn to the aggressive deterioration in the bank's books.

The company's full Q3 presentation is below (pdf link)