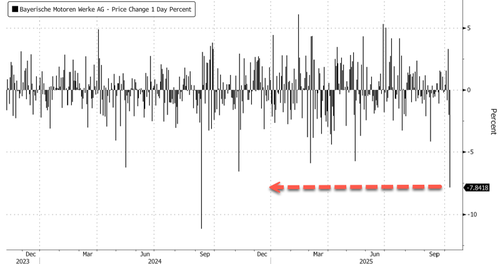

BMW shares in Germany plunged the most in a year after the company issued a profit warning, citing weaker-than-expected sales in China and ongoing trade uncertainty between the U.S. and the European Union.

The German producer of luxury cars now forecasts its automotive margin for 2025 will be in the range of 5% to 6%, down from its previous forecast of 5% to 7%.

Here's the snapshot of BMW's new guidance (courtesy of Bloomberg):

Analysts at Bernstein said the downgraded guidance aligns with the consensus of 5.6% but called the update on soft sales in China and tariff-related costs disappointing.

Other commentary from Wall Street analysts (courtesy of Bloomberg):

Morgan Stanley (overweight)

Analyst Javier Martinez de Olcoz Cerdan says lowering of volume and margins had been expected, as BMW was the only European auto OEM not to issue a profit warning during 2Q releases

However, free cash flow is below expectations and could have an impact on dividends

JPMorgan (overweight)

Narrowing of auto margins appears to be impacted equally by China volume and pricing momentum, Chinese dealer compensation, and higher global tariffs, analyst Jose Asumendi writes

Sees most of the flagged impacts to earnings and cash flow as temporary, and BMW should be able to claw these back between 4Q25 and 1H26, which maintains confidence in buyback and dividend

Ability to stabilize volume momentum and pricing power in China in FY26 is seen more important than tariffs in protecting the firm's longer-term competitiveness

Citi (neutral)

Analyst Harald Hendrikse says China exposure had been a concern, and BMW China issues may be "irreversible"

BMW, as with many other auto OEMs, appears to be guilty of providing overly optimistic guidance and seemingly has "managed to snatch defeat from the jaws of victory"

While free cash flow has been cut by 50%, cash return remains solid

Jefferies (buy)

Pace of China recovery and the timing of tariff implementation had been well flagged, and have now come to pass, analyst Philippe Houchois writes

Auto margin consensus already in the lower part of the range, with some modest downside risk

It is important to note that BMW's exposure to China is concerning, as FactSet data show it is the automaker's largest market by revenue, at 22%, compared with 19% from the U.S.

In markets, BMW shares in Germany are flat on the year, as the European auto sector sputters in the second half amid numerous issues, such as waning sales in China and an influx of Chinese brands (BYD) entering Europe, which is squeezing market share.

The Stoxx 600 Autos & Parts Index is down 2% today. Shares are well below the 2024 peak.

This is concerning...

. .