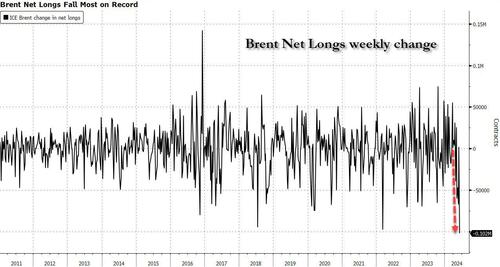

Two weeks ago we observed that with oil prices tumbling, a full-blown capitulation was taking place in the market as the weekly bullish bets on Brent had just plunged the most on record...

... which we said a was "a clear sign of the surge in bearish sentiment and the extent of the technical selling that pressured crude" and which we concluded signaled that "a price rebound was imminent."

We were right: oil proceeded to rip higher in the past two weeks, pushing Brent to $86, the highest since the fake Iran-Israel confrontation in April which ended with a whimper and quickly eliminated the fear of any geopolitical crisis from the oil market.

And as the price rose, so did the number of shorts who got steamrolled, and as shown in the next chart, two weeks after the biggest weekly drop in Brent net longs on record, we have just seen the biggest covering of Brent shorts in the past two weeks since 2016!

Money managers cut outright wagers against Brent by the most since 2020 for a second consecutive week, contributing to a big overall gain in net-long positions, just days after prevailing Wall Street consensus was that oil would proceed to plunge to $70 per barrel if not lower. As Bloomberg notes, several Brent spreads were again at the strongest levels since late April on Friday, but it was not just Brent: gasoil net longs jumped by the most on record last week.

And since narrative on the ever-so-clueless Wall Street is always dictated by price, the analyst commentary has flipped a U-turn and seemingly everyone is suddenly bullish, starting with Standard Chartered whose head of commodities research Paul Horsnell writes today in a note that “the rally has significantly further to run” as the oil market heads into a supply deficit of more than 2 million barrels a day in Aug. and Sept. Some more observations from Horsnell:

Others quickly piled on: here is Macquarie global oil and gas analyst Vikas Dwivedi who just raised his 3Q Brent price forecast to $86/bbl from $83, while WTI is seen at $81.50, up from $78.50 earlier

Next is Sparta Commodities analyst Neil Crosby, who writes that European buying needs to be strong and sustained to keep the North Sea’s recent bullish pricing intact, or else BFOET premiums may have to cool a little

Turning from Europe to China, OilChem writes that Chinese refiners and fuel suppliers are planning to export 3.19m tons of oil products in July, down from 3.72m tons in June

Finally, Goldman's iuk abaktst Yulia Grigsby writes that "Brent crude prices continued their advance toward the higher end of our range-bound forecast, with the Q2 average coming in line with our $85/bbl forecast" as US-led strong summer traveling demand continues to support Brent as global jet demand hits a new post-pandemic high. Geopolitical concerns also remain on the market's radar as Houthi's attacks on Red Sea ships and drone attacks on Russia oil infrastructure intensified.

Here are several more reasons why Goldman is sticking with its bullish call for higher prices:

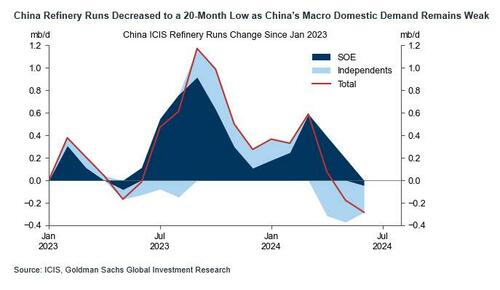

The final reason why Goldman remains rather bullish side is China. Here's why:

And visually: