Retail money-market funds inflows continued this week, and more troubling (ahead of the coming regional bank earnings), usage of The Fed's emergency funding facility jumped to a new record high over $109BN. Big banks had a good day today on earnings.

That's the not-so-rosy picture ahead of tonight's bank deposit data debacle from The Fed.

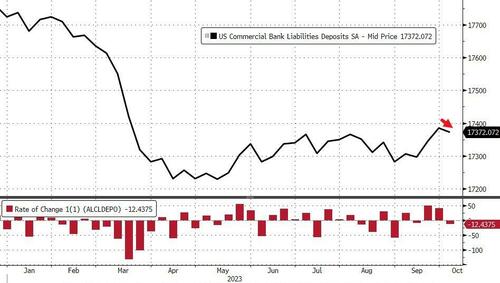

On a seasonally-adjusted basis, total deposits declined by $12.4BN (after two big weekly deposit inflows)...

Source: Bloomberg

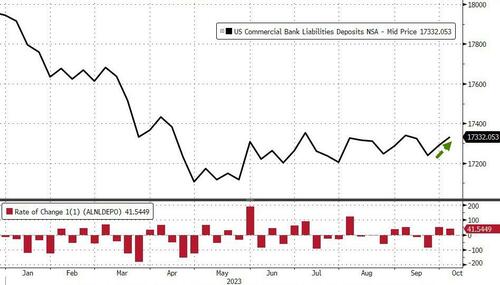

However, on an unadjusted basis, total deposits rose $41.5BN...

Source: Bloomberg

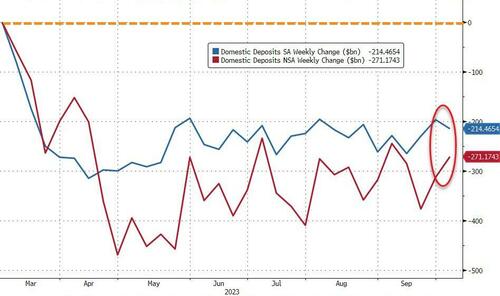

And so, removing foreign bank flows, we see domestic banks diverging on an SA vs NSA basis once again ($41.6BN inflows NSA, $17.5BN outflows SA)...

Source: Bloomberg

On the bright side, the gap between SA and NSA deposits outflows since the SVB crisis is narrowing (only $57BN now)...

Source: Bloomberg

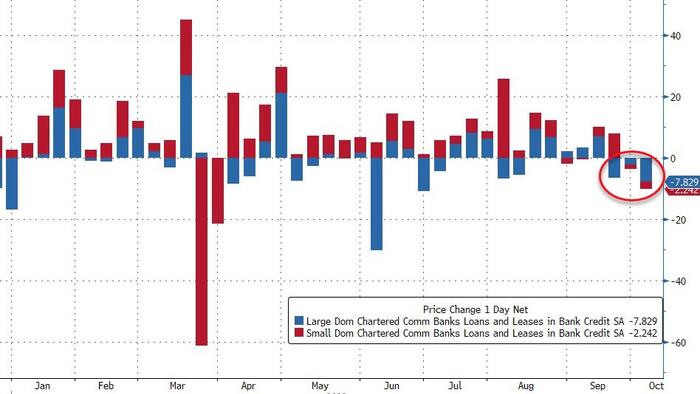

On the other side of the ledger, loan volumes shrank again by over $10BN with large bank loan volumes declining for the 3rd straight week...

Source: Bloomberg

The key warning sign continues to trend lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now)...

Source: Bloomberg

...we sure hope these banks are making plans to fill the $109BN hole in their balance sheets they are filling with expensive Fed loans.