Mixed macro and debt ceiling drama dominated the day...

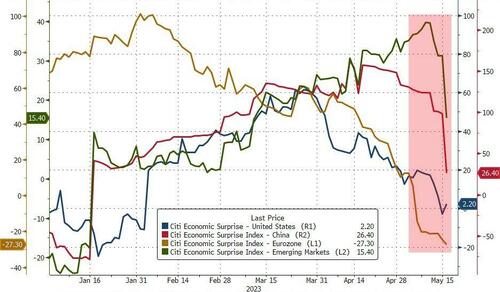

However, put it all together and global macro surprises indices are tumbling...

Source: Bloomberg

US homebuilders are all bulled up on the future (shame that homebuyers are not)...

Source: Bloomberg

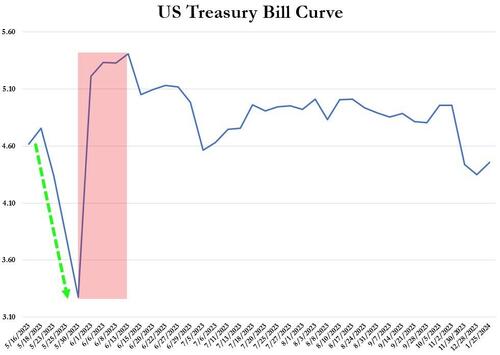

The T-Bill curve got crazier as no progress was apparent in the debt ceiling talks... Late-day headline that President Biden will be returning early (on Sunday) from his Asia trip suggested that nothing will be done any day soon...

Regional banks got no favors from any short-squeeze today and faded...

And only big-tech (Nasdaq) ended higher among the US majors with Small Caps worst (Dow and S&P behind in the red). The late day headline about Biden cutting his trip short made it clear that he doesn't expect any deal this week and markets faded into the close...

Value stocks continue to dramatically underperform relative to growth (now at their weakest in 13 months)...

Treasuries tumbled today, likely driven by a massive issuance from Pfizer, after being bid overnight after China's crappy data. The short-end underperformed modestly

Source: Bloomberg

2Y Yield broke back above 4.00%

Source: Bloomberg

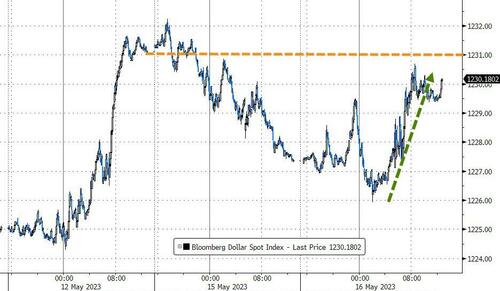

The dollar rallied back to almost unch on the week...

Source: Bloomberg

Bitcoin slipped back to hold around $27,000...

Source: Bloomberg

Oil slipped lower with WTI back at a $70 handle ahead of tonight's API data...

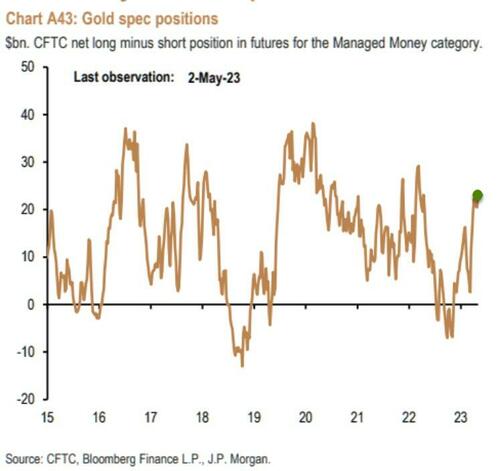

Gold broke back below $2,000 and accelerated lower...

Source: Bloomberg

As Spec longs maybe quickly unwound around that key level...

Finally, as Nomura's Charlie McElligott notes, the increasingly evident “dragging” global economic impact (that we noted at the top) is feeding a larger pivot back towards “Bonds As Your Hedge”...

Treasury-Equity correlation has swung significantly negative...

Source: Bloomberg

... and further strengthens the world of 60/40 Balanced Funds to Risk Parity to “Secular Growth / Mega Cap Tech” Equities, as “the end of the tightening cycle” looks even more evident into the increasingly global slowdown.