By Peter Tchir of Academy Securities

We will spend a few minutes on the Fed because it is pretty much obligatory ahead of the FOMC, though hopefully our view has been quite clear. Then we will touch on Russia/Ukraine as there have been some really interesting developments.

We got to cover a lot of topics that generated a lot of feedback on Wednesday morning on Bloomberg TV (Academy’s segment starts at the 6:45 mark).

We laid out a bunch of hypotheticals in August on how We Would Drive Yields Lower. We started focusing attention on flatteners then. One of our August interviews got condensed into a smaller clip Focus On Long End of the Curve, Not Fed Cuts: Tchir.

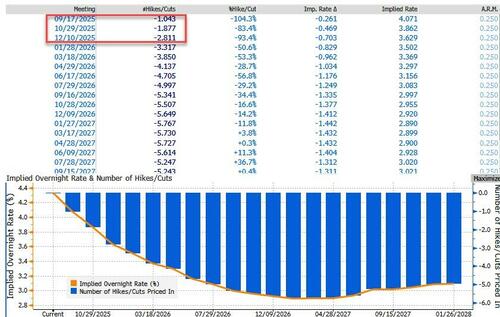

Currently, according to WIRP, the market is pricing in 1.04 cuts at this meeting, 1.9 cuts in October, and 2.8 cuts by the end of the December meeting.

That seems a touch low.

We remain in the 75 to 100 bp cut camp for the year, so there is room to price in a higher probability of 4 cuts this year than the market currently has priced in.

For this meeting, we see a 0.00001% chance of no cuts (we guess there is always some possibility), but only a 60% chance of 25 bps, with a 40% chance of 50 bps. Actually, we only view it as a 25% chance, but this seemed like a good opportunity to dig up a fun report in the Wall Street Journal that we were involved with – How Do Pundits Never Get It Wrong? Call a 40% Chance.

The market doesn’t seem to be prepared for a big shift to the dovish side. We think a bigger cut than 25 has a real shot, and that the dots could surprise with more cuts occurring sooner.

Our assumption is there are always some people who don’t have a strong opinion, and for ease, just adopt the consensus and/or the recommendation of the leader. So, Powell had what seemed like more support, or conversely, less obvious dissent than really existed.

With the tide changing at the Fed, and other voices gaining strength as we prepare for a new Chair, it seems reasonable to assume some of those who just followed along as hawks will now follow along as doves – impacting the messaging. Any mention of “additional” measures does not seem priced in at all.

It is probably too early to mention that things like another Operation Twist are on the table (Operation Twist is where the Fed sells shorter-term bond holdings to buy longer-maturity bonds).

The Treasury Department announced Increased Buybacks. This fits with our theme of a “tandem” approach to managing the yield curve. Where the Treasury and Fed work in conjunction with each other to complement their tools. This helps contain the longer end of the curve, and also likely generates some revenue to create lower deficits (I haven’t confirmed this, but to the extent they are buying bonds below par and retiring them, there should be an accounting gain).

Probably a touch early for Powell to address some non-traditional programs (though they now seem pretty standard), but even after recent flattening, you seem to be getting this potential option very cheaply. Though maybe he could admit that changes in short-term rates are not as effective (as a policy tool) as they once were.

Finally, we are seeing rate cut expectations increase, while curves flatten for two other reasons, which we’ve mentioned before:

The corollary, or counterpoint, or outlet of this view is a weaker dollar. We could see a break below 90 on DXY. Given the administration’s desire to reduce imports and increase exports, a weaker dollar would likely be viewed (behind closed doors, because we “cannot” publicly say we have a weak dollar policy) as a feature and not a bug.

China has the upper hand in regards to controlling “usable” rare earths and critical minerals. They refine and process the vast majority of rare earths and critical minerals. Even as the U.S. starts getting access to the rare earths and minerals themselves, it will take years, heavy investment, and potentially a lot of deregulation, to be sufficient in producing the “usable” forms of these crucial components for so many products.

The U.S. has the upper hand in chips for AI and data centers, but China seems to be digging in their heels in this area to promote and develop their domestic chip industry – which is far behind but seems to be closing the gap in some segments.

Secondary tariffs on trade with Russia? We will delve into Russia next, but the idea that the U.S. may be close to getting Europe to place high secondary tariffs on China (after which the U.S. would follow suit) has gained a lot of traction. It seems difficult to believe that it will occur, but it would be incredibly disruptive. It seems like it would be very difficult to get China to negotiate in good faith on a bilateral deal if the U.S. is really pushing hard on this front (because China would not see the U.S. negotiating in good faith under these circumstances).

I find this chart mesmerizing as it seems so counter-intuitive from the news flow, yet it is real.

Every day we are inundated with “all-time high” headlines. We get a lot of coverage on our policies and the impacts they are (or are not) having here. We hear so little about China, clearly the country where policy should be focused.

Yet, since the election, FXI is up 60% versus 23% for QQQ. 34% versus 15% since the start of the year in favor of FXI. QQQ holds a slight edge since the post-Liberation Day lows (40% versus 38%). A portion of the return is related to FX, another portion can be attributed to positioning, but there is something about this chart that captivates me and makes me wonder how well we are doing as the globe tries to adapt to big changes in US policy. The chart would look worse if we focused on the Russell 2000 which hasn’t benefited as much as the Nasdaq 100 from the spending on AI and Data Centers.

Thinking about some big changes in Europe this week got this song stuck in my head. Some of the lyrics seem to apply just as well to Putin as to Rasputin (most people looked at him with terror and fear). “There was a cat that really was gone. It was a shame how he carried on. In all affairs of state, he was the man to please. The demands to do something about this outrageous man became louder and louder.” I was shocked that this song was not a one-hit wonder, but we digress.

It also seems like a good time to channel some Clockwork Orange, my droog, as the violence and “aggro” have the potential to escalate – which unfortunately, may be a necessary step towards achieving peace.

Academy published a SITREP this week – NATO Jets Shoot Down Russian Drones Over Poland. This incident caused Poland to invoke Article 4 of the NATO treaty to prompt a formal discussion within the alliance. The SITREP analyzes the situation extremely well.

We’ve already addressed the “chatter” about actually, truly enforcing sanctions and we briefly addressed secondary tariffs against China (with India being the other target, and more likely to face some tariffs than China). Finally, after over 3 years, our quotes in Time Magazine – Sanctions on Russia Won’t Work may turn out to be incorrect. At the time, we argued that the willingness to truly enforce sanctions were low, therefore sanctions would be ineffective. We would turn a blind eye to strategies that would avoid sanctions (like some of the “stans” suddenly having massive trade with Europe – wonder where they were getting the stuff to sell? Or China and India not abiding by sanctions).

It is time to turn the screws on Putin economically.

When we argued, post-election, that President Trump could be successful in achieving a relatively quick cessation of hostilities, we laid out the carrots and sticks that would likely be needed on both sides.

We all know how the first Oval Office meeting between Trump and Zelensky went.

Ukraine seemed to be getting the stick, while Russia primarily got carrots. That has been changing over time. The new “circle” where the U.S. sells weapons to Europe which in turn “provides” them to Ukraine seems to be renewing the flow of equipment to Ukraine (without adding to the deficit woes of the U.S.).

There seems to be more willingness (if not encouragement) to allow the Ukrainians to implement pretty standard tactics (like hitting supplies and disrupting transit in Russia). Many of these tactics had been denied to Ukraine in the past.

With the Department of War and Peace Through Strength there is reason to believe that Ukraine will be able to do more.

This new system somewhat resembles the proxies we have been facing.

Did the U.S. supply the weapons? No. Not directly.

Did the U.S. give permission for Ukraine to use the weapons they have, of U.S. origin, more effectively? No, but we didn’t say they couldn’t.

More carrots for Ukraine and a bit of a stick for Russia.

But that isn’t what we want to talk about.

Finally, the President seemed to encourage Europe to take steps to “take” some of Russia’s frozen reserves.

There is approximately $300 billion of frozen reserves.

The vast majority of this sits in the European Union as, according to Grok, over $200 billion (of euros) was frozen. Our understanding is that some of the $65 or so billion of USD reserves frozen are not fully controlled by the United States.

We’ve written about this multiple times as a key element to forcing any peace.

We also discussed our very strong view that the President was extremely reluctant to take or use Putin’s frozen USD reserves. There was a view in the admin that the U.S. didn’t have the law on its side. It is also possible, that at the time, the admin wasn’t willing to be too aggressive, as the President seemed to believe that his relationship with Putin would be enough to achieve peace, and threatening his reserves would not help their relationship.

We have heard from multiple sources that Putin fully expects to receive these reserves (it seems logical, that behind the scenes, some countries helping him the most, have helped him “monetize” these reserves, making their “freezing” less effective).

Well, Europe keeping a big chunk of the money would be a wakeup call for Putin.

It “solves” the issue of how Ukraine (or Europe) is going to afford the weapons they are buying from the U.S. $200 billion is one heck of a war chest.

Threatening Russia’s frozen reserves may be the best thing I’ve seen in terms of pushing this conflict towards some sort of deal.

European Bond Rally?

Imagine if Europe is successful in keeping even $100 billion?

What does that do for their borrowing needs? For their borrowing needs for defense spending?

Part of the reason we have seen yields behave stubbornly across the globe is concerns about the amount of spending Europe needs to embark on to meet their commitments on military spending. (Japan has been a big problem too for global yields, but let’s just focus on the European contribution to higher global yields here). Btw, there is supposedly $37 billion in pounds that England might be happy to get their hands on.

Wow, that song is really stuck in my head, but I cannot reiterate how profound Friday’s “nod” to go after Russia’s frozen reserves is. That along with Article 4 from NATO and an admin that does not seem afraid to be tougher on sanctions and tariffs (in no small part because it hurts the U.S. less than it hurts Europe to go in that direction) could pave the way for some real progress.

We always thought that this would be about balancing carrots and sticks with the two combatants, and that balance seems to be happening.

Look for American corporations to be given big advantages over corporations from other countries in any rebuilding efforts once peace is achieved. We believe this is an important goal for the administration as they feel we did not get enough of a head start/advantage after the Gulf Wars.

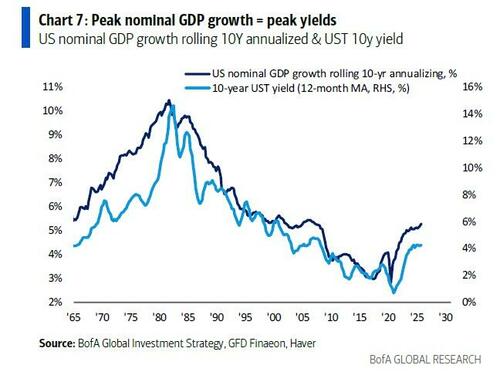

Lower yields, flatter curves. In no small part because of global economic sluggishness, as the world adapts to a new trade order.

Peace between Russia and Ukraine, especially if it accompanies taking some of Russia’s frozen reserves, would help bonds, and we don’t think that is on anyone’s radar.

The equity grind continues. Good news is good. Bad news is good. No news is good. We did say last week that we thought there was a better chance of 5% downside before 5% upside. Even though we “only” got 1.6% this week on the S&P 500, we are still sticking with that view, though with yields coming down, potential surprises from the Fed, and what we see as an improvement in the odds of some peace in Europe, it is difficult to stick to that view.

Credit remains boring in a “good” way and crypto continues to benefit from this shift to easier monetary policy in the U.S., the momentum created by the GENIUS Act, and other regulatory actions.

Hopefully, you are reading this while enjoying some coffee and moloko as you prepare for what should be another interesting week.