An avalanche of macro data this morning presented a positive blend of updates across growth (better), inflation (lower), and labor markets (looser/worse).

The ECB followed The Fed with a 'pause' (as expected), but for now, the monetary policy transmission route of tightening US financial conditions are NOT reaching the economy...

Source: Bloomberg

All of that sent bond yields flying lower (down 8-11bps across the curve)...

Source: Bloomberg

...along with big-tech - which has pushed the Magnificent 7 stocks to a total market cap loss of around $1 trillion in the last two weeks...

Source: Bloomberg

Also, Nasdaq down, yields down...

Source: Bloomberg

...haven't seen that much recently.

A volatile day in equity-index land today (just look at the scale of those swings) but Nasdaq was always the biggest loser (thanks to GOOGL - and MSFT!) and Small Caps were the prettiest horse in the glue factory (managing to hold on to modest gains on the day)...

The constant ebb and flow of short-squeeze attempts was there of course...but failed to help today...

Source: Bloomberg

VIX spiked up to just shy of a 22 handle today.

Cyclicals have been dominated by Defensives this month and today saw the performance gap widen...

Source: Bloomberg

The Nasdaq Composite joined the rest of the majors below its 200DMA today... (Nasdaq 100 still barely above its 200DMA)...

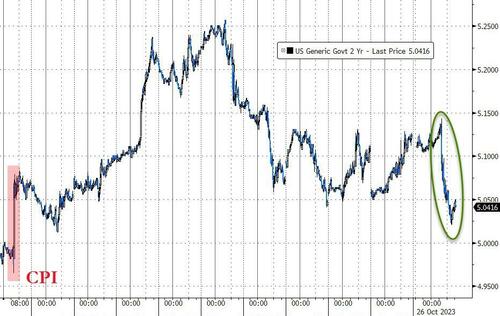

2Y tumbled after weaker than expected core PCE, back near 5.00% at two-week lows

Source: Bloomberg

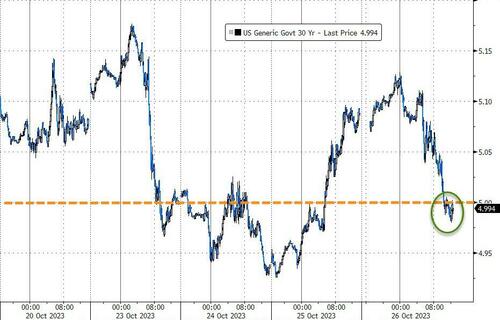

30Y broke below 5.00%

Source: Bloomberg

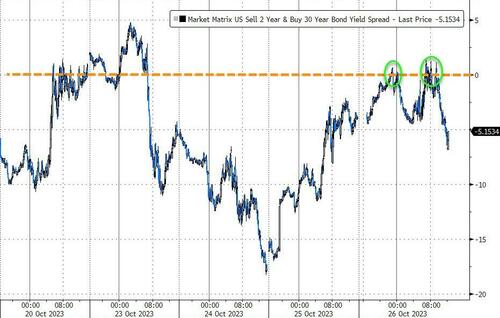

The yield curve (2s30s) un-inverted again intraday (twice), but was unable to hold it...

Source: Bloomberg

Gold was flat on the day, having tested above $2000 (futs) overnight...

Oil dumped back yesterday's gains today with WTI testing down to a $82 handle (and still holding just above pre-Israel-attack levels...

Finally, is the AI exuberance about to be annihilated?

Source: Bloomberg

As goes NVDA, so goes the entire world?