After weeks of intensive interviews - some running two hours, Treasury Secretary Scott Bessent has narrowed the field for the next Federal Reserve chair down to five candidates from an initial 11, according to CNBC, citing senior Treasury officials. The group includes two current Fed policymakers, Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller; former Fed Governor Kevin Warsh; National Economic Council Director Kevin Hassett; and Rick Rieder, BlackRock’s chief investment officer for fixed income.

Bessent plans a fresh round of interviews is planned in the coming weeks and months, however given next week’s World Bank and IMF meetings in Washington, officials said the process could slip until after Thanksgiving.

The current plan under discussion would have the president first nominate the chosen candidate to the Fed’s Board of Governors and then elevate that person to chair at a later date. One consideration, officials said, is the remaining term attached to specific board seats. Outgoing Chair Jerome Powell’s seat carries roughly two years left on its 14-year term, while the seat formerly held by Adriana Kugler, now occupied by Stephen Miran, expires in January and could provide a full term for a prospective chair. Officials emphasized that the sequencing and seat choice remain fluid.

Trump has already publicly named Warsh, Hassett and Waller as finalists, making Bowman and Rieder the newest additions to the White House’s short list. The administration has adopted a more open vetting process than recent predecessors, periodically announcing names as the field has grown - and now, narrowed.

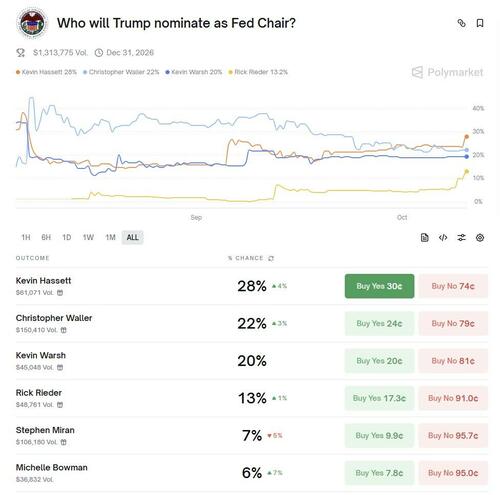

According to Polymarket, Hassett is the current favorite to be Powell's replacement...

The search unfolds amid unusually direct criticism of Fed policy from the White House. The president has repeatedly urged sharp rate cuts and previously threatened to remove Powell. He also fired Fed Governor Lisa Cook over alleged mortgage fraud - allegations she denies. Lower courts have blocked Ms. Cook’s removal, and the Supreme Court is set to hear the case in January. Those moves have intensified concern about political pressure on the central bank and raised the stakes around the chair selection.

Waller appeared on CNBC Friday morning, where he suggested more rate cuts.

"I want to move towards cutting rates, but you’re not going to do it aggressively and fast, in case you make a big mistake on which way that things go," he said.

He also suggested that "Job growth has probably been negative the last few months. it doesn't look like it's doing much better. I don't hear anybody with big hiring plans."

Full interview:

Treasury officials offered the clearest view yet of what Mr. Bessent is seeking in a nominee. He wants a central banker open to fresh thinking on monetary strategy and the Fed’s institutional design, with demonstrated experience across economics, monetary policy, bank regulation and management.

Bessent recently authored an essay sharply critical of the central bank’s trajectory, calling for reviews of its policy tools, structure and mission. He has argued the Fed has grown too large and strayed beyond its core mandate, signaling a preference for scaling back its footprint and curbing reliance on extraordinary tools - particularly when it comes to quantitative easing.

No single candidate is viewed as a front-runner, officials said. Still, they acknowledged that Mr. Rieder has left a strong impression. A fixture on Wall Street and a frequent television commentator, Mr. Rieder oversees one of the industry’s largest fixed-income platforms and is known for closely tracked analysis of the bond market and the Fed. CNBC suggests that his outsider status - he is the only finalist who has never served at the central bank - could be a selling point for an administration signaling it wants change.

Investors will parse the shortlist for clues about the central bank’s policy tilt and appetite for institutional reform. Bowman and Waller bring continuity and recent policy experience; Messrs. Warsh and Hassett would be viewed as policy veterans aligned with a more muscular critique of post-crisis Fed activism; Rieder would represent a market-savvy outsider with management scale and a data-driven reputation.