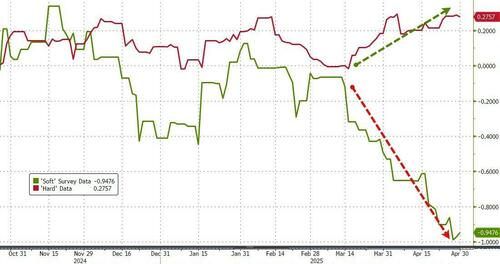

Following a slew of regional Fed surveys (and various other sentiment readings) sending 'soft' data dramatically lower (as 'hard' data continues to strengthen), this morning's Manufacturing PMIs are expected to signal further weakness.

Source: Bloomberg

The final S&P Global Manufacturing PMI did indeed disappoint, sliding from 50.7 flash print to 50.2 - exactly in line with March's final print (but below the 50.5 expected).

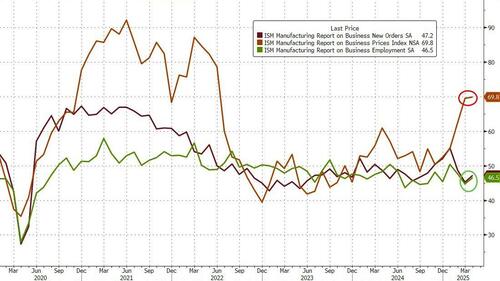

ISM's Manufacturing PMI beat expectations, printing 48.7 (down from the 49.0 in March but better than the 47.9 expectations) - lowest since Nov 2024.

So Hard data up, PMI flat, ISM down... take your pick

But none of the three factors point to a recession:

“The past relationship between the Manufacturing PMI® and the overall economy indicates that the April reading (48.7 percent) corresponds to a change of +1.8 percent in real gross domestic product (GDP) on an annualized basis,” says ISM's Timothy Fiore.

Under the hood, all the main components beat expectations with New Orders and Employment improving and Prices Paid rising (but less than expected)...

Admittedly, respondents are fearful of the impact of tariffs to come:

"Manufacturing continued to flat-line in April amid worrying downside risks to the outlook and sharply rising costs," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Factory output fell for a second successive month as tariffs were widely blamed on a slump in export orders and curbed spending among customers more broadly amid rising uncertainty.

But, even they were forced to admit a small silver lining in the report...

"Although the survey saw some producers report evidence of beneficial tariff-related switching of customer demand away from imports, any such sales increase was countered by worries over tariff-related disruptions to supply chains and lost export sales.

This served to drive business confidence about prospects in the year ahead down sharply to the gloomiest for 10 months.

And just like all the other surveys, PMI respondents sees Prices rising...

"Concerns have also spiked in terms of input costs, especially for imported materials and components, due to the triple whammy of tariff-related price hikes, supply shortages, and the weaker dollar.

"Manufacturers are responding to these changing demand, supply and cost conditions by raising their selling prices and trimming headcounts to help protect their margins."

So, take what you will from this - are these data points a reflection of reality or the incessant FUD being peddled by the mainstream media?

If you need a reminder, as we noted earlier, there is a massive gap between what CEOs are saying and what CEOs are doing...

Will CEOs suddenly announce massive waves of layoffs, or, with stocks now having erased all of the post-Liberation Day losses, will CEOs suddenly find a renewed optimism?