China has announced sweeping new export curbs on rare earths and other critical materials, tightening its grip on global supply chains just weeks before Donald Trump and Xi Jinping meet for trade talks, according to Bloomberg.

The Ministry of Commerce said Thursday that foreign exporters using even trace amounts of Chinese rare earths must now obtain export licenses, citing national security. Equipment and technology for processing rare earths and manufacturing magnets will also face new restrictions.

Beijing later expanded the list of controlled products, effective November 8, to include five additional rare earths — holmium, europium, ytterbium, thulium and erbium — along with lithium-ion batteries, graphite anodes, synthetic diamonds, and related equipment.

The rules mirror U.S. restrictions that bar Chinese firms from accessing advanced chips and manufacturing tools. China supplies about 70% of the world’s rare earths, which are critical for semiconductors, electric vehicles, military equipment, and other high-tech industries.

“This is to raise the stakes and demonstrate China has leverage and cards to play,” said Dylan Loh of Nanyang Technological University. “It’s done to put them in the strongest possible position in trade negotiations with the US.”

Bloomberg Intelligence noted that the new policy explicitly denies exports for defense use, sharpening earlier language that only required licensing. Analyst Eric Zhu said the rules could derail Western efforts to build supply chains independent of Beijing.

Bloomberg writes that some measures appear aimed directly at the U.S. chip sector. The Commerce Ministry said rare earths used in developing computer chips and artificial intelligence with military potential would now face case-by-case scrutiny. “The implicit threat is that Beijing could throttle rare-earth exports to chipmakers in retaliation for foreign export controls on chip sales to China,” said Christopher Beddor of Gavekal Dragonomics.

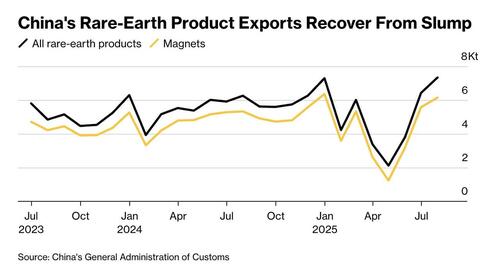

The U.S. Defense Department has tried to reduce reliance on China, including a $400 million investment in MP Materials for a new magnet plant. But industry leaders remain worried. “Anyone that is sourcing equipment from China might not get it — which happened before — and also if you’ve got tech or equipment from China you might not get service requests answered,” said Wade Senti, president of Advanced Magnet Lab.

Meanwhile, Beijing added 14 foreign organizations, including BAE Systems, to its “unreliable entity list” in apparent retaliation for Washington’s expanded sanctions on Chinese firms.

China’s Commerce Ministry warned that some overseas organizations had allowed rare earths to flow into sensitive sectors such as defense despite licensing rules. “Such actions have had a negative impact on international peace and stability,” it said.