One month after the lukewarm January Beige Book found "little or no change" In US economic activity, which in turn followed the fare more downbeat November Beige Book found which economic activity was "slowing", moments ago the Fed released the latest, March, Beige Book in which we find more green shoots glimmers as economic activity "increased slightly", on balance, since early January, with eight Districts reporting slight to modest growth in activity, three others reporting no change, and one District noting a slight softening. Oddly enough, the Fed found a modest acceleration in economic activity even though "consumer spending, particularly on retail goods, inched down in recent weeks." To justify this assessment, the Fed mentioned several reports which cited heightened price sensitivity by consumers and noted that households continued to trade down and to shift spending away from discretionary goods.

Taking a closer look at various economic segments, we find the following notable recent developments:

Unlike the recent ISM reports, both mfg and services, the Fed found that employment "rose at a slight to modest pace in most Districts" while labor market tightness eased further, with nearly all Districts highlighting some improvement in labor availability and employee retention. Some more labor market details:

And in bad news for those expecting a soft landing, the Fed cautioned that price pressures persisted during the reporting period, although several Districts reported some degree of moderation in inflation. Furthermore, while contacts highlighted increases in freight costs and several insurance categories, including employer-sponsored health insurance, businesses found it harder to pass through higher costs to their customers, who became increasingly sensitive to price changes. The good news is that the cost of many manufacturing and construction inputs, such as steel, cement, paper, and fuel, reportedly fell in recent weeks.

Looking ahead, the Fed said that "the outlook for future economic growth remained generally positive, with contacts noting expectations for stronger demand and less restrictive financial conditions over the next 6 to 12 months." Boy are they in for a surprise.

Turning to the specific regional Feds, we found these summaries notable:

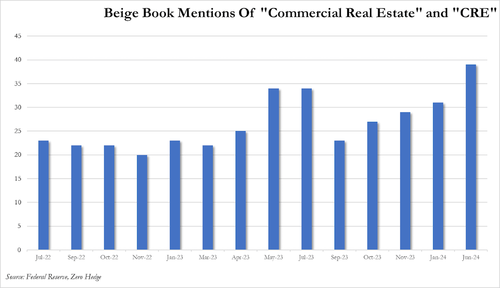

One particular highlight: The Atlanta Fed notes said that "commercial real estate conditions slowed", while the Kansas City Fed said that "Commercial real estate contacts indicated skepticism around recent appraisals of property valuation, not wanting to be in a position of trying to “catch a falling knife.”

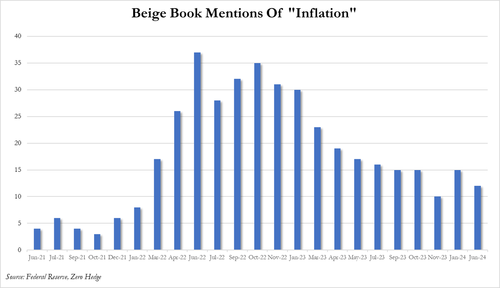

Finally, taking a visual approach to the data, we find that after mentions of inflation dropped to 10, or the lowest since Jan 2022 in November, before rebounding in January to 15, in March the number of mentions dipped again, this time to 12, suggesting that prices may indeed be resuming their grind lower.

And speaking of commercial real estate, while Powell is doing his best to pretend that there is nothing to worry about, today's bailout of NYCB notwithstanding, the Fed itself is clearly worried as shown in the chart below which summarizes all mentions of "commercial real estate" and "CRE" in the latest beige book.

More in the full Beige Book (link).