The Fed's latest beige book released this afternoon was a boring affair, one signaling the US economy remained sluggish at best, and describing economic activity as "little changed overall in April and early May." Four Fed districts reported small increases in activity, six no change, and two slight to moderate declines. Expectations for future growth deteriorated a little, though contacts still largely expected a further expansion in activity. A summary of the big picture:

Turning to labor markets, the Beige Book notes that "employment increased in most Districts, though at a slower pace than in previous reports." Overall, the labor market continued to be strong, with contacts reporting difficulty finding workers across a wide range of skill levels and industries. That said, contacts across Districts also noted that the labor market had cooled some, highlighting easier hiring in construction, transportation, and finance. Many contacts said they were fully staffed, and some reported they were pausing hiring or reducing headcounts due to weaker actual or prospective demand or to greater uncertainty about the economic outlook. Staffing firms reported slower growth in demand. As in the last report, wages grew modestly.

And turning from wage inflation to broader inflation, the report notes that prices rose moderately over the reporting period, though the rate of increase slowed in many Districts. Contacts in most Districts expected a similar pace of price increases in the coming months. At the same time, consumer prices continued to move up due to solid demand and rising costs, though several Districts noted greater price sensitivity by consumers than in the prior report. Overall, nonlabor input costs rose, but many contacts said cost pressures had eased and noted price declines for some inputs, such as shipping and certain raw materials. Home prices and rents rose slightly on balance in most Districts, after little growth in the prior period.

Turning to the specific regional Feds, we found the summaries:

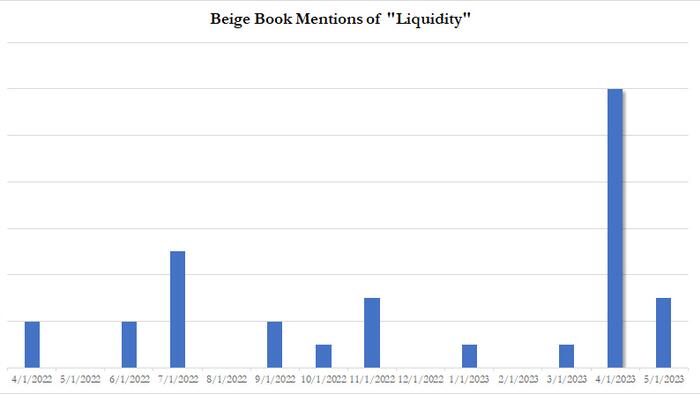

As for the cause of the recent apprehension about loans, lending standards and tightening conditions, one look at the chart above showing the frequency of mentions of one key word in recent Beige Books should be sufficient at just how much more comfort the Fed now has.