The Fed's latest Beige Book, which based on information collected on or before April 10, 2023, indicated seemingly little change in the Us economy, reporting that "overall economic activity was little changed in recent weeks" but when one reads deeper between the lines, some stark issues begin to emerge.

But first, let's start with the basics: according to the periodic note, Nine Districts reported either "no change or only a slight change in activity this period" while three indicated modest growth. Expectations for future growth were mostly unchanged as well; however, two Districts saw outlooks deteriorate.

Contrary to reports of a sharp drop in spending following the March bank crisis (confirmed by the drop in March retail sales), the Beige Book reported that consumer spending was generally seen as flat to down slightly amid continued reports of moderate price growth. Some more details:

Turning to labor markets, the beige book notes that employment growth moderated somewhat this period as several Districts reported a slower pace of growth than in recent Beige Book reports. A small number of firms reported mass layoffs, and those were centered at a subset of the largest companies. Some other firms reportedly "opted to allow for natural attrition to occur, and to hire only for critically important roles." As a result, Fed contacts reported the labor market becoming less tight as several Districts noted increases to the labor supply. Additionally, firms benefited from better employee retention, which allowed them to hire for open roles while not constantly trying to back-fill positions. And while wages have shown some moderation, they still remain elevated as several Districts reported declining needs for off-cycle wage increases compared to last year.

The slowdown wasn't only in labor markets but also in inflation: overall price levels rose moderately during this reporting period, though the rate of price increases appeared to be slowing. While peak inflation is clearly behind us, some regions are already experiencing defaltion: "Contacts noted modest-to-sharp declines in the prices of nonlabor inputs and significantly lower freight costs in recent weeks." Nevertheless, producer prices for finished goods rose modestly this period, albeit at a slightly slower pace. Selling price pressures eased broadly in manufacturing and services sectors. Consumer prices generally increased due to still-elevated demand as well as higher inventory and labor costs. Prices for homes and rents leveled out in most Districts but remained at near record highs. Contacts expected further relief from input cost pressures but anticipated changing their prices more frequently compared to previous years.

What we found most interesting, however, with everyone still waiting for the May SLOOS report, was the Beige Book comments on the bank sector in general, following the March bank crisis, as well as loan volumes and demand. This is what it found:

Turning to the specific regional Feds, we find the following banking comments:

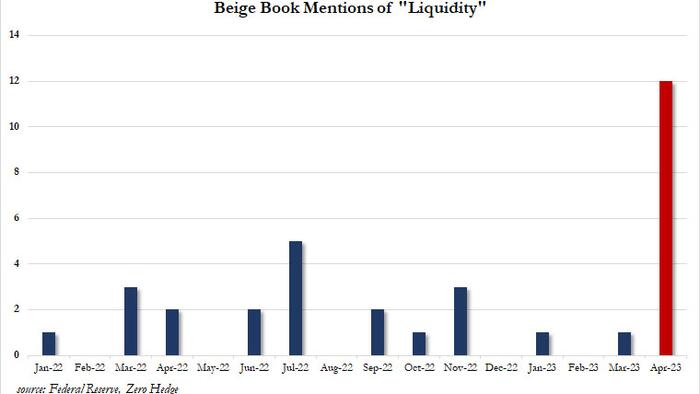

As for the cause of all this apprehension about loans, lending standards and tightening conditions, one look at the chart above showing the frequency of mentions of one key word in recent Beige Books should be sufficient.