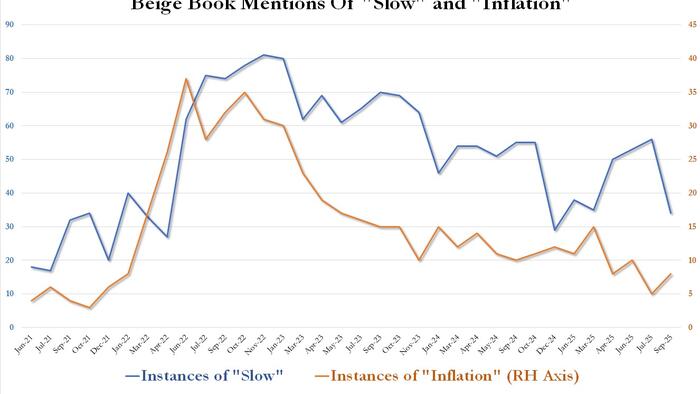

Many were shocked (again) after the latest CPI and PPI data confirmed that the experts were once again dead wrong, and instead of the widely expected inflation tsunami, Trump's tariffs have so far sparked only sporadic disinflation, which will only become more acute as the home prices slide accelerates. And yet, anyone who read our Beige Book analysis from April (not to mention our accurate prediction from last June that "The Experts Are All Wrong About Inflation Under A Trump Presidency") would have known just that: as we laid out, "Beige Book Finds Inflation Mentions Tumble To 3 Year Low" which was the clearest indication that despite the prevailing narrative, rising prices is simply not a thing businesses across the US are worried about. We got further confirmation of this last month, when the latest Beige Book found no runaway inflation (again) but instead that sentiment in the economy splitting along party lines.

Fast forward to today when the latest, September, Beige Book was released, and it revealed that 8 of the 12 Fed districts reported "little or no change in economic activity since the prior Beige Book period" when as we reported then "economic activity increased slightly from late May through early July" , while four Districts reported "modest growth." And yes, there were no regions reporting a slowdown, hardly the apocalypse so many liberals have been expecting. This is also a solid improvement from the May period, when the Beige Book found that half of Districts reported at least slight declines in activity.

The Beige Book noted that across districts, "contacts reported flat to declining consumer spending because, for many households, wages were failing to keep up with rising prices" and "contacts frequently cited economic uncertainty and tariffs as negative factors. New York reported that “consumers were being squeezed by rising costs of insurance, utilities, and other expenses." Maybe New Yorkers should look for other cities in which to live then?

The Fed's contacts also observed the following responses to the consumer pullback: retail and hospitality sectors offered deals and promotions to help price-sensitive consumers stretch their dollars, supporting steady demand from domestic leisure tourists but not offsetting falling demand from international visitors.

The auto sector noted flat to slightly higher sales, while consumer demand increased for parts and services to repair older vehicles. Manufacturing firms reported shifting to local supply chains where feasible and often using automation to cut costs.

Curiously, the Beige Book made its first mention of AI, saying that "the push to deploy AI partly explains the surge of data center construction—a rare strength in commercial real estate noted by the Philadelphia, Cleveland, and Chicago Districts. Atlanta and Kansas City reported that data centers had increased energy demand in their Districts." Notably, it has also sent electricity prices soaring.

Overall, sentiment was mixed among the Districts. Most firms either reported little to no change in optimism or expressed differing expectations about the direction of change from their contacts.

Focusing on labor markets, the Beige book reported the following:

Notably, half of the Districts noted that contacts reported a reduction in the availability of immigrant labor, with New York, Richmond, St. Louis, and San Francisco highlighting its impact on the construction industry. And clearly tied to that, half of the Districts described modest growth in wages, while most of the others reported moderate growth.

As for prices, it should come as no surprise by now that the runaway inflation everyone was expecting just isn't there. Here is Beige book confirmation

The best part: tariff deflation: "In some cases, as highlighted by Cleveland and Minneapolis, firms reported being under pressure to lower prices because of competition, despite facing increased input costs."

In short, for yet another month, the sky is not falling.

Here is a snapshot of highlights by Fed District:

And finally, confirming that contrary to conventional wisdom the economic picture appears to have improved notably April, the latest Beige Book found that despite media narratives to the contrary, mentions of inflation remained near a 4 year lows, at just 8 in September, and up from the cycle low of 5 in July (effectively before the Biden inflationary explosion period) while mentions of "slow" tumbled from a two year high of 56 in July to just 34, indicating that according to the Fed respondents, neither inflation nor an economic are major concerns any more.

All of which suggests that the US economy - while hardly on fire as it was during the hyperinflationary period of Biden's admin - continues to chug along and is hardly collapsing as so many Trump foes would like to see; and it certainly is not seeing prices explode higher.