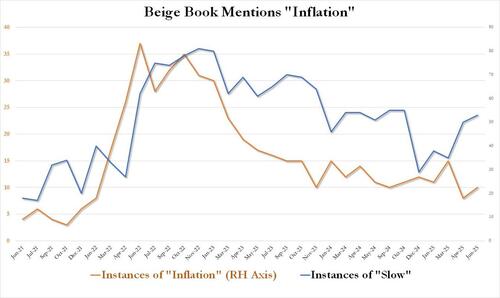

Many were stunned after the latest inflation and core PCE data confirmed that the experts were once again dead wrong, and instead of the widely expected inflation tsunami, Trump's tariffs have so far sparked only continued disinflation (which will only become more acute as home prices slide). And yet, anyone who read our Beige Book analysis from last month (not to mention our prediction from last June that "The Experts Are All Wrong About Inflation Under A Trump Presidency") would have known just that: as we laid out, "Beige Book Finds Inflation Mentions Tumble To 3 Year Low" which was the clearest indication that despite the prevailing narrative, rising prices is simply not a thing businesses across the US are worried about.

Fast forward to today when the latest, May, Beige Book was released, and it revealed that according to reports across the 12 Fed district, "economic activity has declined slightly since the previous report" with half of the districts reporting slight to moderate declines in activity, three Districts reported no change, and three Districts reported slight growth. And here an interesting divergence appears, because the Beige Book appears to reveal another party-line split. Here are the districts that reported declines in activity:

And the districts that reported flat/slowing activity:

In any case, the Beige Book said that all Districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions. Manufacturing activity also declined slightly, while consumer spending reports were mixed, with most Districts reporting slight declines or no change; however, some Districts reported increases in spending on items expected to be affected by tariffs.

Elsewhere, residential real estate sales were little changed, and most district reports on new home construction indicate flat or slowing construction activity. Reports on bank loan demand and capital spending plans were mixed. Activity at ports was robust, while reports on transportation and warehouse activity in other areas were mixed.

On balance, the outlook remains slightly pessimistic and uncertain, unchanged relative to the previous report. Yet, here too, confusion was the dominant them, with a few District reports indicating the outlook has deteriorated while a few others indicating the outlook has improved.

Focusing on labor markets, the Beige book reported the following:

As for prices, it should come as no surprise by now that the runaway inflation everyone was expecting just isn't there. Here is Beige book confirmation:

There was a new section added to this month's Beige Book, one looking at the fate of US energy:

In short, for yet another month, the sky is not falling.

Here is a snapshot of highlights by Fed District:

And finally, confirming that contrary to conventional wisdom the economic picture has been largely unchanged since April, the latest February Beige Book saw just 1 mention of recessions, the lowest this year, and down sharply from 6 three months prior. Where there was some concern is that mentions of "slow" rose from from 50 in April (which was down to 53, the biggest highlight for another month is that contrary to prevailing media narratives, mentions of inflation actually rose ever so modestly from a three-year low of 8 to 10, the second lowest going back to the start of 2022.

All of which suggests that the US economy - while hardly on fire as it was during the hyperinflationary period of Biden's admin - continues to chug along and is hardly collapsing as so many Trump foes would like to see; and it certainly is not seeing prices explode higher.