With econ data indefinitely postponed as a result of what is rapidly shaping up as the longest government shutdown on record, today's otherwise sleepy Beige Book was sure to get abnormal attention as it was one of the few incremental economic data points in a calendar bereft of actual news. Alas, it proved to be a dud, if only because there was virtually nothing new there: as the report which looked at recent data across the Fed's 12 district notes, economic activity was little changed on balance since the previous report, with three Districts reporting slight to modest growth in activity, five reporting no change, and four noting a slight softening. The was a continuation of the boring update we got one month ago when the Beige Book again found "little change" in econ activity (although like today, it noted that wages grew while inflation mentions slumped).

The outlook for future economic growth varied by District and sector: sentiment reportedly improved in a few Districts, with some contacts expecting an uptick in demand over the next 6 to 12 months. However, many others continued to expect elevated uncertainty to weigh down activity. One District report highlighted the downside risk to growth from a prolonged government shutdown: that must be whatever district DC is in because the only people in America impacted from the government shutdown are life-long government bureaucrats.

Here is what else today's report found, starting with overall activity

In labor markets, the picture remains one of muted stability and rising wages (thanks to the collapse of labor supply from illegal aliens). One notable change was the discussion of Artificial Intelligence as potentially taking away from labor demand. Oh, just wait: it's only starting... and it ends with Universal Basic Income. Here are the details:

And the logical consequence of slamming shut the pathway for illegals to get jobs: Wages grew across all reporting Districts, generally at a modest to moderate pace. A rare victory for ordinary, working Americans.

Last we look at prices which according to the Beige Book "rose further during the reporting period. Several District reports indicated that input costs increased at a faster pace due to higher import costs and the higher cost of services such as insurance, health care, and technology solutions." None of those, however, are the result of higher tariffs.

In short, for yet another month, and despite the constant fearmongering of liberal economists, the sky is not falling and in fact the economy continues to grow at a solid pace.

Here is a snapshot of highlights by Fed District:

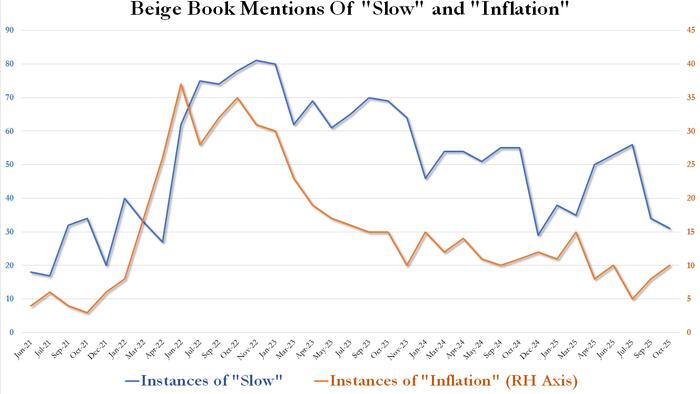

And finally, confirming that contrary to conventional wisdom the economic picture appears to have improved notably since April, the latest Beige Book found that despite media narratives to the contrary, mentions of inflation remained near a 4 year lows, at just 10 in September, and up from the cycle low of 5 in July (effectively before the Biden inflationary explosion period) while mentions of "slow" tumbled from a two year high of 56 in July to just 31, a new 2025 low, indicating that according to the Fed respondents, neither inflation nor an economic slowdown are major concerns

All of which suggests that the US economy - while hardly on fire as it was during the hyperinflationary period of Biden's admin - continues to chug along and is hardly collapsing as so many Trump foes would like to see; and it certainly is not seeing prices explode higher.