The Fed's latest beige book released this afternoon was a rather boring affair, one signaling "little to no change in economic activity" since the September report.

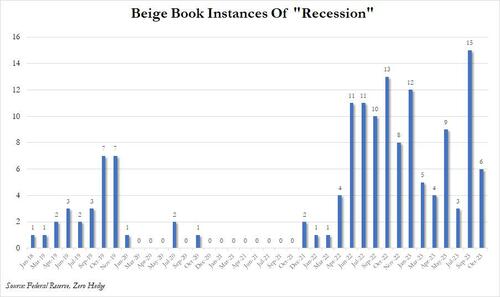

That said, one month after a rather downbeat Beige Book warned that consumers had "exhausted" their savings and recession mentions surged to a 5 year high, a more jovial tone has returned with the Beige Book indicating that while consumer spending was "mixed, especially among general retailers and auto dealers, due to differences in prices and product offerings", tourism activity "continued to improve, although some Districts reported slight slowing in consumer travel, and a few Districts noted an uptick in business travel."

At the same time, Banking contacts reported "slight to modest declines in loan demand" even though consumer credit quality was "generally described as stable or healthy, with delinquency rates still historically low but slightly increasing." Real estate conditions were little changed - meaning they remained catastrophic - and the inventory of homes for sale remained low. The report found a silver lining in manufacturing activity, which it deemed mixed, although "contacts across multiple Districts noted an improving outlook for the sector."

Turning to the bigger picture, the Beige Book concludes that "the near-term outlook for the economy was generally described as stable or having slightly weaker growth" and expectations of firms for which the holiday shopping season is an important driver of sales were mixed, suggesting continued confusion about the real state of the consumer.

Here are some more details from the Beige Book starting with labor market where "tightness continued to ease across the nation."

Prices

Turning to the specific regional Feds, we found these summaries notable:

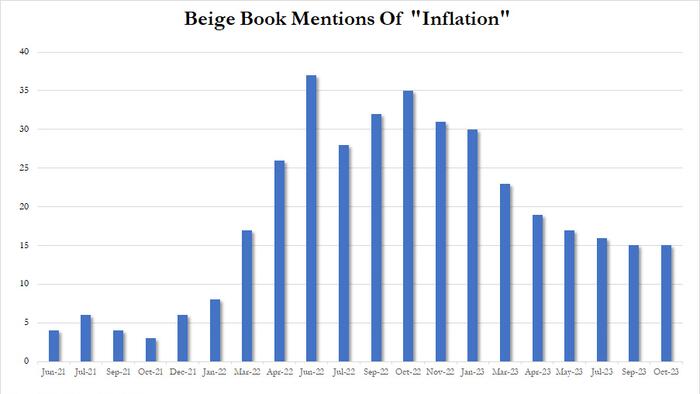

Finally, taking a visual approach to the data, we find that the mentions of inflation were the fewest since Jan 2022...

... although the chart above correlates perfectly, if with a 3 month lag, to the price of oil. So expect a jump in inflation mentions next month when the Beige Book participants realize that crude is just shy of 2023 highs and the middle-east is blowing up.

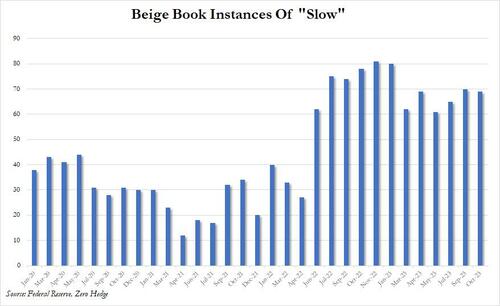

And while mentions of "slow" persisted at a far higher rate...

... what we found most interesting is that one month after mentions of recession jumped to the highest level since at least 2018, in October recession mentions tumbled by more than half, sliding to just 6, or smack on the average line for the past years.

More in the full Beige Book (link).