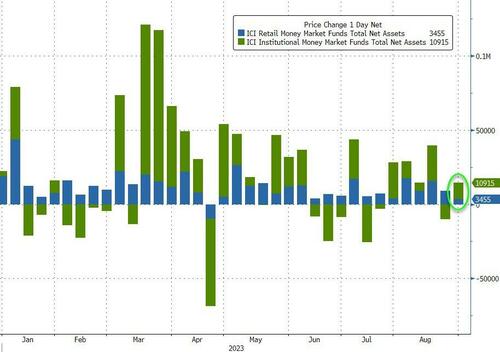

After last week's brief (and small) dip, US money-market funds saw inflows once again last week, adding $14.4BN to reach a new record high of $5.5TN...

Source: Bloomberg

Retail funds saw inflows for the 19th straight month (+3.5BN) and Institutional funds returned to inflows (+10.9BN) after a $10.1BN outflow last week...

Source: Bloomberg

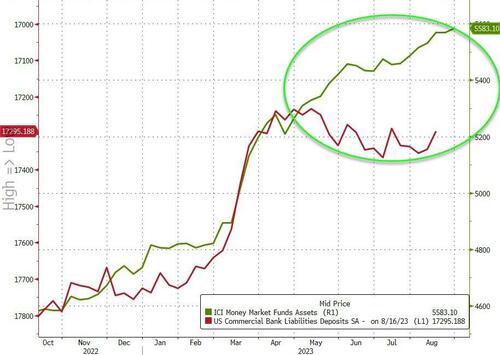

Although bank deposits did see significant outflows last week, the decoupling between money-market fund inflows and bank deposits continues...

Source: Bloomberg

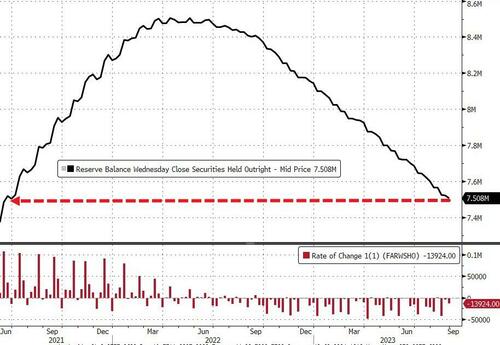

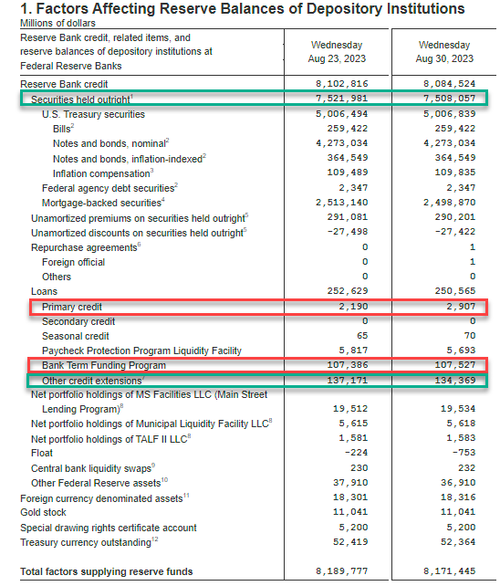

The Fed's balance sheet shrank by $17.75BN last week to its lowest sicne July 2021...

Source: Bloomberg

The Fed's QT continues with $13.9BN of securities sold last week to its lowest level since June 2021...

Source: Bloomberg

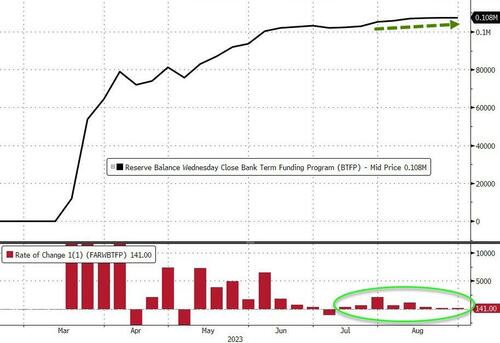

Usage of The Fed's emergency funding facility for banks reached a new record high of $108BN (up $144MN last week)...

Source: Bloomberg

Breaking down the details of the H/4/1...

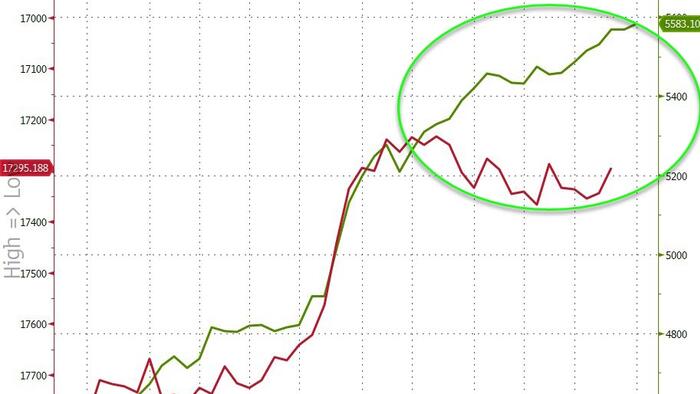

Finally, while US equity markets were lower in August, they remain notably divergent from their historical relationship with bank reserves at The Fed...

Source: Bloomberg

We leave you with one thought - in 6 months and counting, America's 'smaller' banks will need to find that $100-billion plus from somewhere as that is when the BTFP bailout program ends (theoretically). Will regional bank balance sheets be stabilized by then? They better hope for a serious recession to smash yields back down (and TSY prices up).