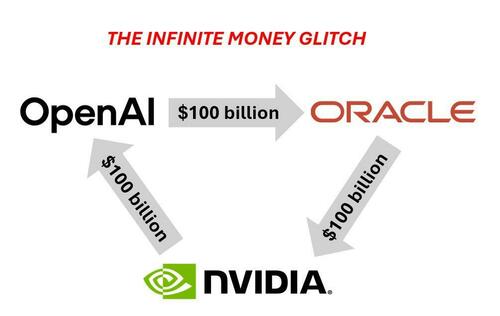

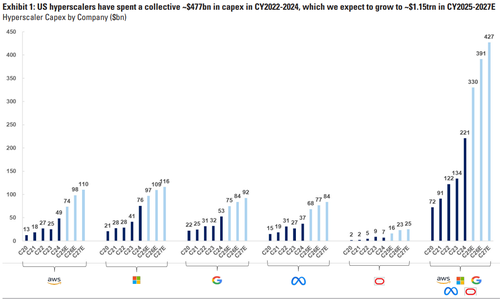

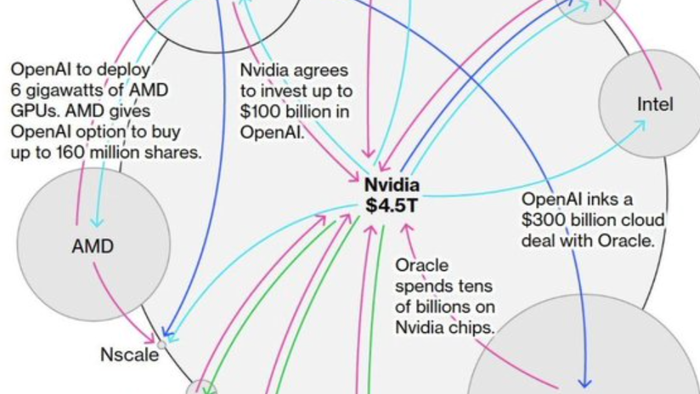

By now, readers have grasped, through several notes, how the AI bubble is inflating, primarily driven by the "circle jerk" vendor-financing scheme at the heart of the system. As for its scale, we noted last night that the AI bubble has morphed into a debt bubble as well, quietly surpassing the entire banking sector to become the largest segment of the market. And just last week, we laid out the "shocking math" showing that AI CapEx will require approximately $1 trillion in new debt within the next two years.

So far...

The Nasdaq 100's 18% rally year-to-date, trading at 28x forward earnings versus a 10-year average of 23x, has drawn comparisons to the late-1990s dot-com bubble by AI industry leaders and some of the most notable market watchers.

To begin the week, Amazon founder and executive chair Jeff Bezos told the audience at the Italian Tech Week in Turin that AI investment might look like a bubble, it's the good kind - an industrial bubble that drives progress rather than financial destruction.

"This is kind of an industrial bubble as opposed to financial bubbles. The ones that are industrial are not nearly as bad - they can even be good. Society benefits from those inventions," Bezos said, adding, "Investors don't usually give a team of six people a couple of billion dollars with no product, and that's happening today."

Given the mechanics surrounding the AI bubble, the Bank of England warned on Wednesday, following its most recent Financial Policy Committee meeting (Oct. 2), that AI-related valuations are "stretched." The irony, of course, is that central banks are almost always late to the game when they start warning about inflated valuations or emerging cracks in markets and economies.

"On a number of measures, equity market valuations appear stretched, particularly for technology companies focused on Artificial Intelligence (AI). This, when combined with increasing concentration within market indices, leaves equity markets particularly exposed should expectations around the impact of AI become less optimistic," the BoE wrote in the report.

The BoE noted that "material bottlenecks to AI progress" such as "power, data, or commodity supply chains" could "also harm valuations, including for companies whose revenue expectations are derived from high levels of anticipated AI infrastructure investment," adding, "The risk of sharp corrections in asset prices remained high."

In recent weeks, Goldman analysts identified the power grid as a "vulnerable link" at the epicenter of the energy security debate and warned it could be the next chokepoint. It's not just a lack of spare power capacity on the grid or a backlog in data centers connections to local grids; there's also the water component (for cooling data centers), which Morgan Stanley analysts recently outlined as yet another emerging issue.

In the markets, the AI bubble has single-handedly pushed stocks to their highest valuation since the Dot-Com bubble.

Separate from the AI valuation warning, the BoE also warned about central bank independence with President Trump's attempts to change the Federal Reserve's board, as well as his repeated criticism of Fed Chair Jerome Powell's monetary policy stance.

At the start of the year, Bridgewater Associates founder Ray Dalio told the Financial Times that there was already a "bubble" similar to 1998 or 1999 while Greenlight Capital founder David Einhorn said recently that expenditure on AI infrastructure is "so extreme" that there is a "reasonable chance that a tremendous amount of value destruction is going to come through this cycle".

As a reminder, here is economist John Maynard Keynes' famous quote, "Markets can remain irrational longer than you can remain solvent," which only suggests that with circle jerking vendor finance schemes and a full-of-government approach, this bubble can keep inflating. Yet there is an unpredictable nature of the bubble, because there could be another 'Deep Seek' scare or, as the BoE put it, "material bottlenecks to AI progress" that scares market participants.