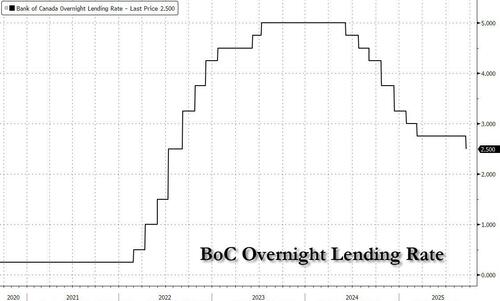

The Bank of Canada cuts rates by 25bp to 2.50%, as expected. This was the 8th consecutive rate cut since the easing cycle started one year ago, and took place after the bank paused following its last rate cut in March, 6 months ago.

Governor Tiff Macklem said that while "considerable uncertainty remains", there was a "clear consensus" within the committee for the first rate cut since March, as slowing population gains and a weak labor market were a drag on consumption while the economy was weaker and there was "less upside risk to inflation." The BoC head explained that the "Governing Council judged that a reduction in the policy rate was appropriate to better balance the risks going forward." Additionally, he noted the upward pressure on CPI has diminished.

The BoC removed the language from the prior statement which said, "if a weakening economy puts further downward pressure on inflation and the upward price pressures from the trade disruptions are contained, there may be a need for a reduction in the policy interest rate".

Some more highlights from the report:

Trade

Economy

Inflation:

Ahead:

In summary: the BoC cut rates by 25bps as expected, with Governor Macklem noting a "clear consensus" to ease policy. The accompanying statement stated that the reduction was appropriate given the weaker economy and fewer upside risks to inflation. Additionally, the board judged that a reduction in the policy rate was appropriate to better balance the risks. On the trade front, policymakers remain cautious over the risks stemming from US tariff actions. Moving forward. The Bank will continue to assess the risks, look over a shorter horizon than usual, and be ready to respond to new information.

In immediate kneejerk response, the USDCAD rose modestly from 1.3760 to a session high of 1.3770 before retracing some of the move with much of the decision in line with expectations.