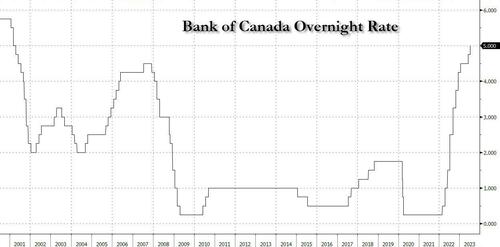

Two weeks before the Fed hikes another 25bps despite today's softer than expected CPI print, moments ago the Bank of Canada did what virtually all expected, and hiked rates by 25bps to 5%, the 10th consecutive increase and the highest rate since April 2001.

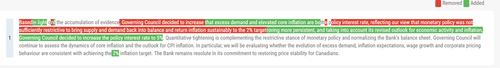

In the surprisingly hawkish statement, the BOC said that it now sees CPI returning to the 2% target six months later, or by the middle of 2025 - even though headline inflation has been falling quickly. Previously that was the end of 2024. The central bank also removed language from the June statement that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target

A redline comparison of the BOC statement is below:

Here are the other highlights from the hawkish statement:

Inflation

Growth

Policy

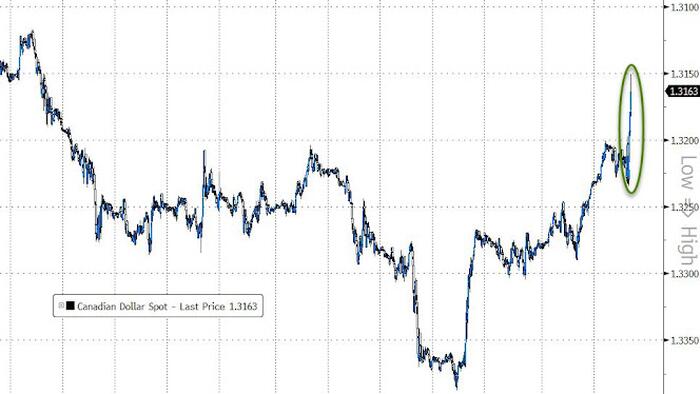

In reaction to the hike and the hawkish commentary, USDCAD fell from 1.3188 to 1.3155 before extending the move to a low of 1.3149 and then trimming the move.