As widely expected after significant dovish commentary in recent months, moments ago the Bank of Canada cut rates by 25bps from 5.00% to 4.75% as a majority of economists expected, and signaled that it is "reasonable to expect further cuts" if inflation eases.

The 25bps cut, which comes just under a year since its last 25bps rate hike in July 2023, means that Canada is the first G7-member central bank to launch an easing cycle.

In the drafted opening remarks of Governor Tiff Macklem wrote that: "If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time."

Here is the balance of his commentary:

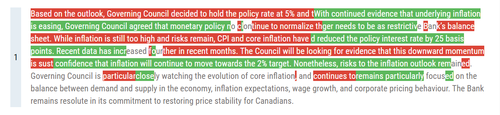

Taking a closer look at the BOC statement we find the following highlights:

While the decision was largely expected, Canadian stocks are enjoying a broad-based rally on the central bank’s interest rate cut and dovish tone. All 11 S&P/TSX Composite Sectors are green at 9:52 a.m. in Toronto, led by interest-rate sensitive utilities. At the moment, 168 index members rising, 47 falling and 7 unchanged. In FX, the USDCAD rose 0.2% after the decision while Canada 2y yield dips 4bp.