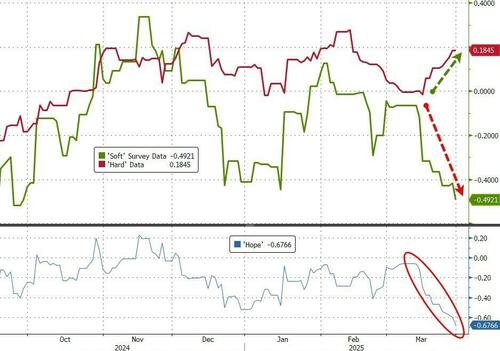

Another day, another set of mixed messaging from macro (soft survey) data...

On the bright side, MNI's Chicago Manufacturing PMI surged higher this morning as March data printed 47.6 (above expectations but still in contraction <50) - the highest since December 2023.

On the not so bright side, The Dallas Fed Manufacturing PMI survey tumbled to -16.3 (well below expectations) - the lowest since July 2024.

It gets better though...

While Chicago's data shows Prices Paid slowing, New Orders falling, and Inventories falling.

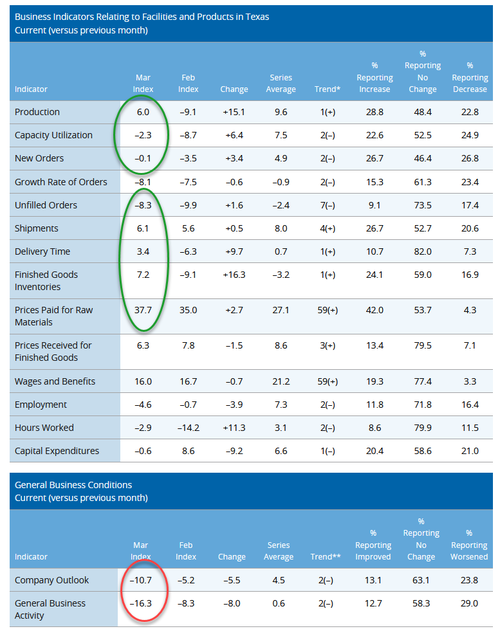

Dallas' data showed Prices Paid higher, New Orders higher, and Inventories rising...

The Dallas Fed outlook also tumbled as the comments from respondents was almost entirely focused on tariff fears...

We leave you with this final comment...

Despite all of the doomsaying in the press, we are not seeing any drop in orders.

We have invested heavily in equipment and production capacity in the last 12 months and are seeing the benefits from that now.

While a short recession is a possibility due to the reductions in government spending, we view this as a net positive for the economy and our business in the medium term.

Finally, we can focus on business rather than policy. It is great to get back to work.

So, who do we believe - Chicagoans or Texans?