'Mixed' - markets, macro, and micro - today

GDP's secondary print showed weaker consumption and a slight decline in growth and PCE from the primary print (bad is good). Then the 4-week moving average of jobless claims printed at 8 month highs (bad is good). And then Pending Home Sales puked hard (bad is good).

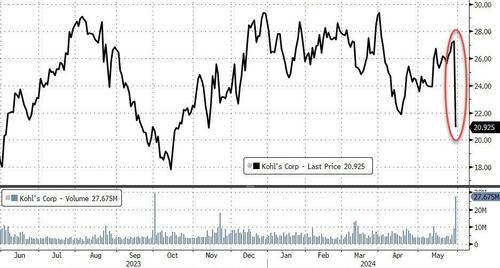

But all that 'bad is good' was dominated by the 'bad is bad' from earnings narratives around software (CRM) and the consumer (KSS).

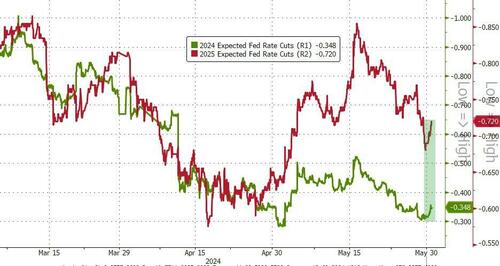

And that prompted rate-cut expectations to increase modestly...

Source: Bloomberg

...and dragged Treasury yields lower (with the 2Y now lower on the week)...

Source: Bloomberg

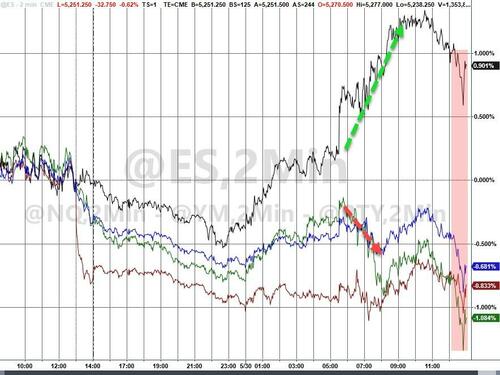

And that dragged the majors to the lows of the day.

Small Caps were squeezed higher (+1%) but the rest of the majors were red with NVDA smashing Nasdaq to be the underperformer (-1%)...

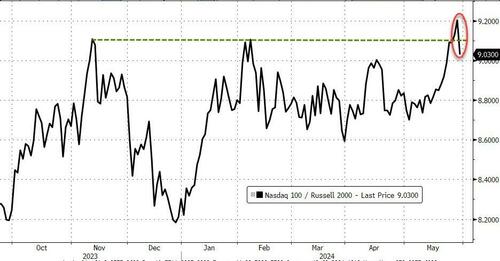

This was Small Caps best day relative to Nasdaq in six weeks (outperforming by 200bps!), seemingly stalling at resistance once again...

Source: Bloomberg

As Goldman's trading desk confirmed, stock markets were grinding lower despite move lower in 10yr yields: seeing tug of war between risk-positive macro data (inline GDP, weak home sales) and negative micro stories in tech space.

The equal-weighted S&P 500 is getting hit hard and the cap-weighted index is starting to crack...

Source: Bloomberg

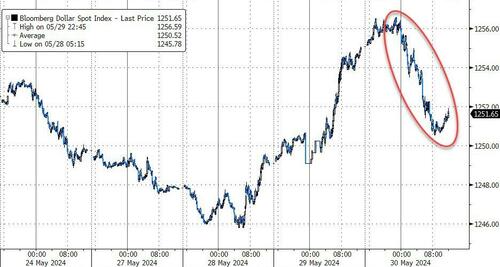

The dollar fell on the day, erasing most of yesterday's gains...

Source: Bloomberg

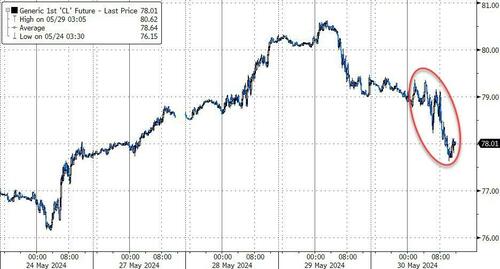

...and crude oil prices plunged on growth fears (GDP) and a smaller crude build than API reported...

Source: Bloomberg

But apart from that, traders were buying gold...

Source: Bloomberg

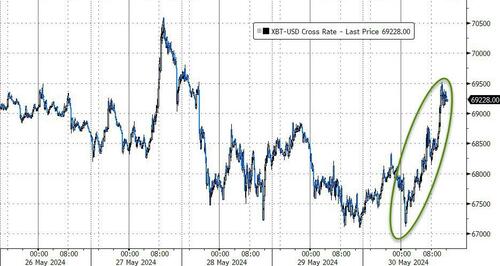

...and buying bitcoin...

Source: Bloomberg

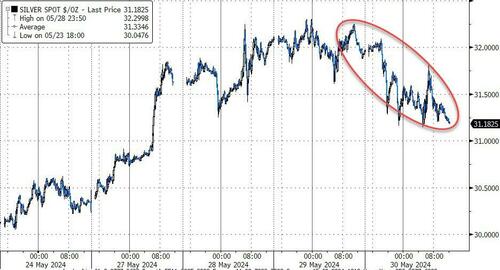

...but selling silver...

Source: Bloomberg

Finally, as stocks were tumbling this morning, all of a sudden, S&P and Dow Jones Indices 'glitched' and while individual stocks were still trading (and futures), there was no feed for the cash indices...

Source: Bloomberg

...and sure enough, that corresponded with a sudden interest in buying stocks and reversed the morning's losses. Are they getting desperate?