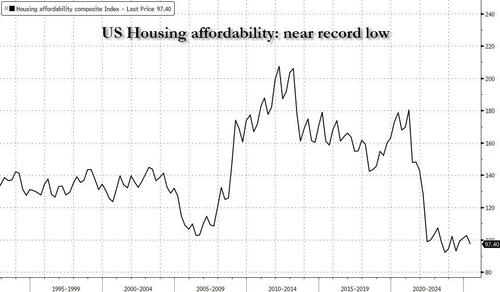

While US home prices remain elevated and despite some price drops in recent months, affordability remains near all time lows, the housing picture is far worse in various other countries.

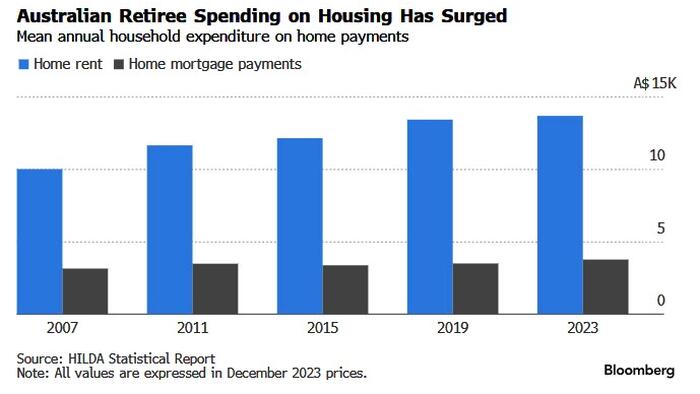

One such place is Australia where more retirees are renting than ever, as soaring housing costs and longer working lives expose the limits of the nation’s much-hailed pension system.

The portion of retirees living in private rentals has doubled over the past two decades to 12%, according to a a recent government-funded survey. Over the same period, those who (can afford to) own their home outright slipped from 75% to 66%.

“Retirees who rent are far more exposed to housing stress,” said Kyle Peyton, co-author of the Household, Income and Labour Dynamics in Australia survey, which tracks the same 16,000 people annually. “This group of renting retirees is only likely to grow.”

As Bloomberg notes, the findings highlight how housing policy has long prioritized demand while neglecting supply, pushing prices to record highs and widening the wealth gap between owners and renters. In Sydney, the median house price has more than tripled in two decades to above A$1.5 million ($990,000).

Australia’s ongoing housing crisis means that the country’s A$4.3 trillion pensions system, projected to be the world’s second largest by the early 2030s, will fall short for many retirees.

“Superannuation alone will not be enough to support the growing number of younger Australians locked out of homeownership,” Peyton said.

The survey also showed more Australians are working longer. In 2003, 70% of women and 49% of men aged 60 and 64 were retired; by 2023, that had fallen to 41% and 27%. Higher pension eligibility ages, cost pressures and better health have all pushed retirement further back.

To retire comfortably at 67, couples need about A$690,000 in savings and singles A$595,000, according to the Association of Superannuation Funds of Australia. That’s assuming they own a home and receive a part government pension on top of their superannuation, and as the data shows, that has become an extremely generous assumption.