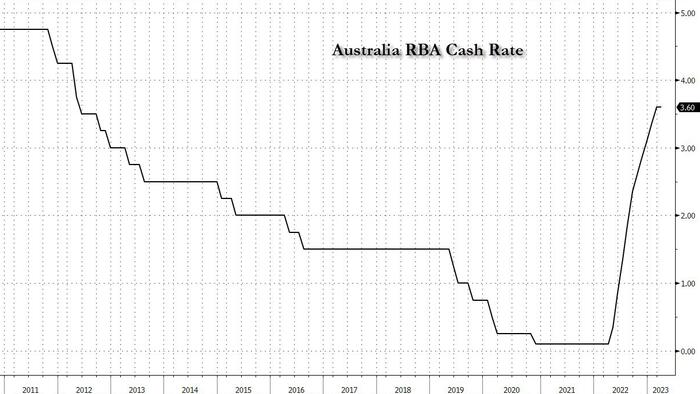

First it was the Bank of Canada which in January announced it would pause its rate hike campaign; then overnight the RBA became the second bank to join the bandwagon when it put its year-long hiking campaign on pause after leaving the cash rate unchanged at 3.6% at April's Board meeting, marking the first pause since the RBA starting raising rates in May 2022. Ahead of the meeting, 19/30 economists surveyed by Bloomberg expected a pause, while 11/30 expected a +25bp hike. Financial markets were pricing in just 4bp of hikes, so the decision was mostly priced in.

The attending statement noted the Board decided to keep rates steady to "assess the impact" of increases in rates to date. While reiterating that Australia's labour market remained "very tight", the statement also noted that timely data suggested CPI inflation had peaked and that a "substantial slowing" in household spending was occurring.

Looking forward, the statement noted the Board expects further tightening "may well be needed", a somewhat softer tightening bias compared to last month ("will be needed").

Here are the main points from the announcement:

Commenting on the decision, Goldman writes that from its perspective, "while today's decision was always a close call, we viewed the pause as revealing a somewhat more dovish reaction function than we had anticipated, particularly given ongoing upside risks to wages growth and inflation in Australia."

And while there is significant uncertainty around the outlook, Goldman now expects the RBA to remain on hold for several months while it 'assesses' the impact of prior tightening - including the roll-off of many fixed rate mortgages over the June quarter - before raising rates in July (+25bp) and August (+25bp) to a terminal rate of 4.1%. By this time the RBA will have a better read on inflation momentum over the June quarter and the Fair Work Commission's decision on minimum and award wages growth for FY2023/24.

That said, even GS is mindful of the significant uncertainty around the macro outlook, both domestically and globally, and acknowledges that the RBA could remain on hold if downside risks to growth and/or inflation are realised. Alternatively, the RBA could restart hikes as soon as May if the 1Q2023 CPI data (26 April) surprise to the upside.

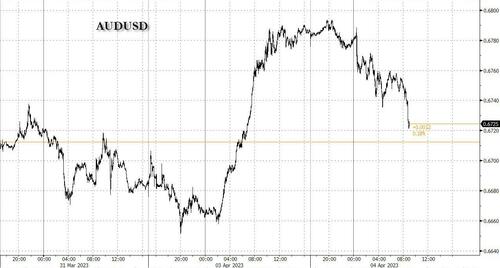

In response to the pause, Australian stocks rebounded into the green, while the Australian dollar fell 0.9% to 0.6723, below 200-DMA at 0.6750.

Finally, as Bloomberg speculates this morning, with the JOLTS data looming in the US this morning, it "feels like a lower-than-expected result would kindle more serious speculation that the Fed may also be done with its tightening campaign."