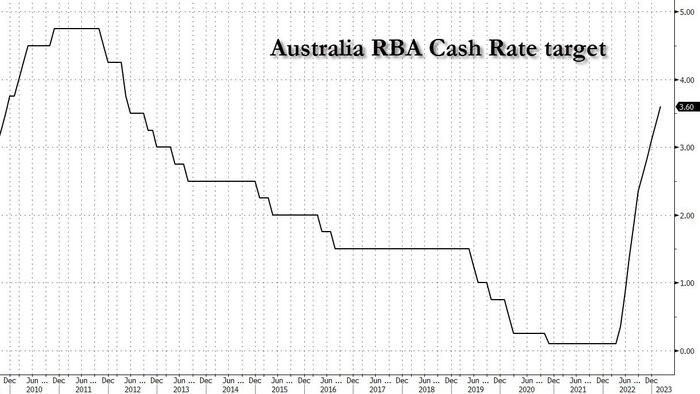

Overnight, the RBA increased the cash rate for the 10th consecutive time by +25bp to 3.60% at March’s Board meeting - the highest level since May 2012 and in line with expectations.

While the statement maintained a clear hawkish bias, noting that the Board “expects that further tightening of monetary policy will be needed”, the tightening bias was notably softer than February’s alongside the RBA’s observation that “labour market conditions have eased a little”, the risk of a price-wage spiral has lessened, and inflation has likely peaked.

According to Goldman analysts, today’s statement provides the RBA some optionality to pause the tightening cycle in the event that the recent weakness in the monthly labor force reports is sustained. That said, Goldman expects a solid rebound in next week’s employment data as unusually large seasonal distortions unwind. Ultimately, with the unemployment rate near a 50-year low, inflation far above target, substantial excess savings supporting household balance sheets, and the Fed Funds rate likely to rise to 5.25-5.50% - the bank believes that a materially higher RBA cash rate will likely be required to bring inflation back to target on a credible timeframe.

Governor Philip Lowe said in his statement that in assessing “when and how much further” rates need to go up, the RBA will pay close attention to incoming economic data.

Looking forward, Goldman expects the RBA to raise the cash rate +25bp in April and May to a terminal rate of 4.1% - with the risks skewed to a more elongated tightening cycle to a higher terminal rate.

Main Points from the RBA statement:

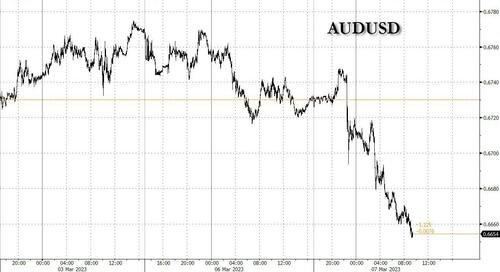

The market clearly took the RBA statement as far more dovish than Goldman, and the AUD sold off after what was seen as a dovish hike, the currency sliding more than 1.1% on Tuesday.