Unlike yesterday's Facebook's earnings, which were viewed by many including JPM, as the "least controversial" mega tech name of all, with most expecting stellar results - and judging by the move today they were not wrong - today's tech giant on deck after the close on this busiest day of Q1 earnings season is Amazon, which JPM's Jack Atheron writes is "number 2 to GOOGL on the list of most controversial mega cap tech names."

Here is what the JPM trader expects from the online retail giant:

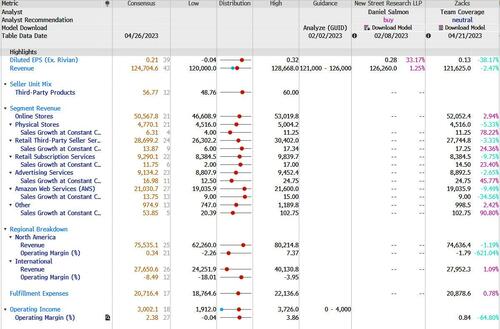

Taking a step back, here is what Wall Street's median sellside consensus expects AMZN to report: EPS of $0.21, Revenue of $124.7BN (around the mid-line of the company's $121-126BN guidance) and operating income of $3BN (guidance of $0-$4BN), translating into 2.38% operating margin.

Some more details:

Earnings: Analysts surveyed by FactSet expect Amazon to record 21 cents a share in earnings for the first quarter, whereas the company generated a 38-cent per-share loss in the year-prior period. On Estimize, which crowd sources projections from hedge funds, academics and others, the average estimate is for 23 cents a share in earnings.

Revenue: The FactSet consensus calls for $124.6 billion in total revenue for the first quarter, while those contributing to Estimize anticipate $125.5 billion in average. A year ago, Amazon logged $116.4 billion in revenue.

As MW notes, investors will be keenly focused on Amazon's online sales, which are expected to have declined to $50.7 billion in the latest quarter from $51.1 billion a year prior, as well as on sales from the Amazon Web Services cloud-computing unit, which are expected to increase to $21.3 billion from $18.4 billion, according to FactSet estimates. The forecasted AWS revenue implies a 15.3% growth rate, below the 20.2% rate seen in the December quarter and the 36.6% clip seen in the year-earlier March quarter.

Stock movement: Amazon shares have declined following eight of the company's past 10 earnings reports, including each of the last two. The stock is up 25% so far this year, as the S&P 500 has increased 6%. Of the 53 analysts tracked by FactSet who cover Amazon shares, 47 have buy ratings, five have hold ratings, and one has a sell rating, with an average price target of $130.71.

What else to watch for:

Citi Research analyst Ronald Josey will be paying attention to AWS growth and North America retail margins in particular.

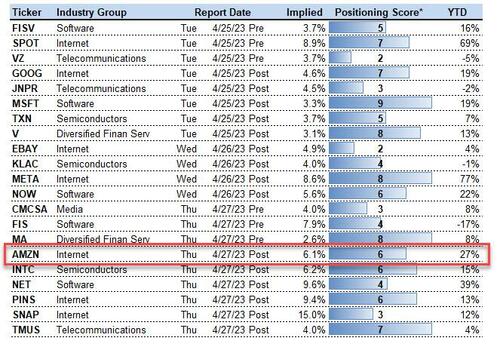

Finally, looking at Goldman's positioning score, we find that unlike META which was at the top of the rankings, positioning in AMZN (with a Positioning Score of 6) is far shakier. As a reminder, positioning is determined by the Goldman desk based on flows, positioning data, and feedback .