Tl;dr: Fed's favorite inflation indicator dipped as expected but all eyes were on the sudden surge in incomes and plunge in 'spending' in January (that sent the savings rate for Americans soaring) as USAID flows to the rest of the world dried up...

Incomes up, spending down - very positive for Americans' savings rate...

...and a sign that DOGE is working!

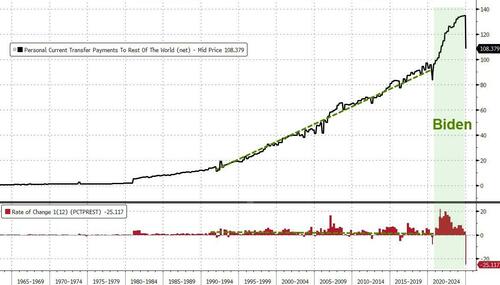

Notice anything odd about the shift in trend of payments to the rest of the world during the Biden administration (relative to the past 60 years?)...

And in case you don't believe us 'digital dickweeds' and our far-right propaganda, here's the St. Louis Fed's source data...

* * *

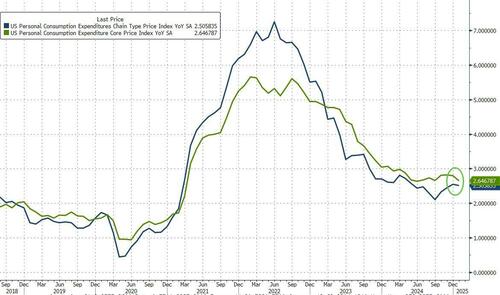

After hotter-than-expected CPI and PPI (and various survey-based inflation expectations), today brings the Big Kahuna - The Fed's preferred inflation indicator, Core PCE - which is expected to show a dovish downturn (from +2.8% YoY to +2.6% YoY). And that is exactly what happened with headline PCE rising 0.3% MoM (as expected) and Core up 0.3% MoM (as expected). That pushed the YoY shifts lower on a sequential basis (Core PCE YoY at its lowest since June 2024)...

Source: Bloomberg

That is the biggest MoM jump in headline PCE since April 2024...

Source: Bloomberg

Core services prices - a closely watched category that excludes housing and energy - rose 0.2% from a month earlier.

Goods prices excluding food and energy were up 0.4%, the most since early 2023.

The so-called SuperCore PCE (Services ex-shelter) rose 0.2% MoM, dragging the YoY print down to 3.09% - its lowest since Feb 2021...

Source: Bloomberg

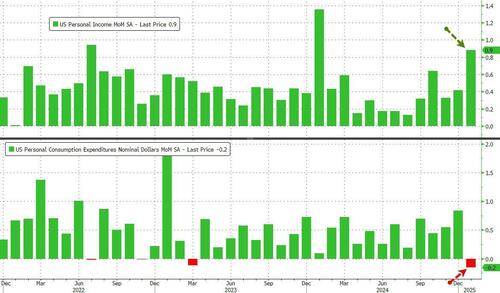

On the other side of today's data binge, Personal Spending tumbled 0.2% MoM in January (+0.2% MoM exp) even as incomes soared 0.9% MoM (+0.4% exp). That is the biggest drop in spending since Feb 2021

Source: Bloomberg

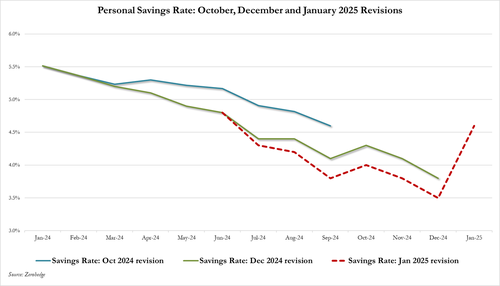

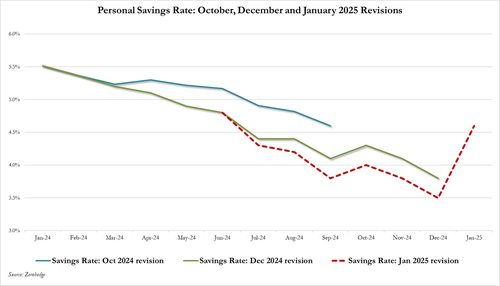

Sending the savings rate soaring (after all those revisions)...

Where did the sudden jump in incomes come from? Why, the dear old government of course - transfer payments spiked over $80BN...

Source: Bloomberg

BUT - and it's a big but!!

Simple - goodbye USAID - and the billions of outflows to foreign nations...

Source: Bloomberg

Inflation-adjusted consumer spending fell 0.5%, marking the biggest monthly decline in almost four years...

Source: Bloomberg

Finally, we note that PCE was the only one of the 'hard' inflation indices to drop in January...

Source: Bloomberg

How long can The Fed rely on this gauge with liquidity rebounding?