American Eagle shares surged in premarket trading in New York after the clothing retailer reported second-quarter revenue that exceeded Wall Street consensus estimates, as tracked by Bloomberg. The stronger-than-expected results were primarily driven by buzz around the "Sydney Sweeney has great jeans" ad campaign launched in July.

"The fall season is off to a positive start. Fueled by stronger product offerings and the success of recent marketing campaigns with Sydney Sweeney and Travis Kelce," AE CEO Jay Schottenstein wrote in a statement to investors.

AE reported same-store sales down 1% in the second quarter that ended August 2, exceeding the average analyst estimate. Revenue also outpaced expectations.

Here's a breakdown of second-quarter results:

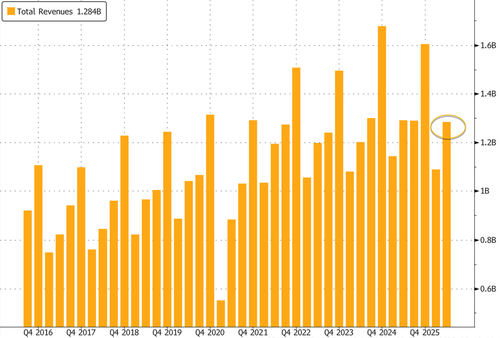

Total Revs 2Q

The third quarter forecast also topped consensus estimates:

Shares of American Eagle rose more than 24% in premarket.

Here's what Wall Street analysts are saying (courtesy of Bloomberg):

Bloomberg Intelligence

Analyst Mary Ross Gilbert says American Eagle is poised to exceed low-single-digit comparable-sales growth in 3Q, with performance likely aided by its viral Sydney Sweeney campaign and Travis Kelce collaboration

"Operating income guidance, which is above consensus, also has upside amid more full-price selling"

Morgan Stanley (equal-weight, PT $10)

Analyst Alex Straton says the company "seems to have mostly corrected 1Q25 product mis-execution quickly"

"Higher campaign-related SG&A (selling, general, and administrative ) spend has not come with as much potential profitability degradation as we cautioned"

Jefferies (hold, PT $11)

Analyst Corey Tarlowe says AEO provided 3Q and FY guidance that exceeds the Street's expectations for comp sales and operating income

"Overall, we are encouraged by the results and 2H guidance"

Vital Knowledge

AEO reported big upside on EPS, with the beat driven by higher GMs, cost controls, and better sales (comps were -1% vs. the Street -2.6%, w/particularly robust performance at Aerie, which posted comps +3% vs. the Street -1.8% while the AE brand fell a bit short with comps -3%)," writes analyst Adam Crisafulli

Says that while the FQ2 results are very strong, the shortfall in AE comps and the inline F25 guide could temper investor enthusiasm

Corporate America, take note:

. . .