By Philip Marey, Senior US Strategist at Rabobank

In the underappreciated scifi series Battlestar Galactica, a ragtag fleet of surviving humans is chased through the galaxy by artificial lifeforms known as the Cylons. However, on this side of the galaxy we are still concerned whether our Cylons are made by the Chinese or the Americans, oblivious of the Cylon destiny to join forces and remove us all from this planet.

Yesterday, President Biden signed an executive order on investments by US persons in semiconductors, quantum computing and artificial intelligence in China. It will be required to inform the US government about investments in these three sectors and investments in some of these technologies will even be prohibited.

Both Democrats and Republicans are worried that US knowledge and investment will help China develop technology that can be used in a military conflict with the US. However, US industrial lobby groups have tried to limit the scope of the executive order, and found the US Treasury Department and the US Commerce Department on their side. Balancing economic interests and national security priorities will be a challenge. Since this executive order has been more than one year in the making, it has already impacted the behavior of US investors, delaying or slowing down their transactions in China.

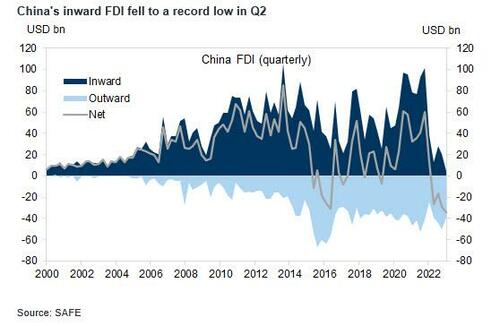

In some areas, by now, China may actually prefer domestic investment because they don’t want US regulators to have access to sensitive information in areas where the Chinese are leaping ahead of the Americans, in particular in artificial intelligence and quantum computing. In other areas, venture capital and private equity from third countries may step in. Still, the executive order will contribute to the further disentanglement of the high tech sectors and related funding ecosystems of the two geopolitical rivals (and a bigger problem for China's investment was discussed here: "China's Inward Foreign Direct Investment Falls To The Lowest Level On Record").

Banking stocks continued their decline yesterday, sustaining the market unrest that followed Monday’s downgrade by Moody’s of the credit ratings of 10 small and midsize US banks. Moody's quoted higher funding costs, potential regulatory capital weakness and rising risks to CRE loans amid weakening demand for office space for these small and midsize banks.

Note that CRE loans are concentrated at these type of banks, rather than at large banks. The Fed's stress test only focused on large banks. More about this in last week's special The commercial real estate - small bank nexus.