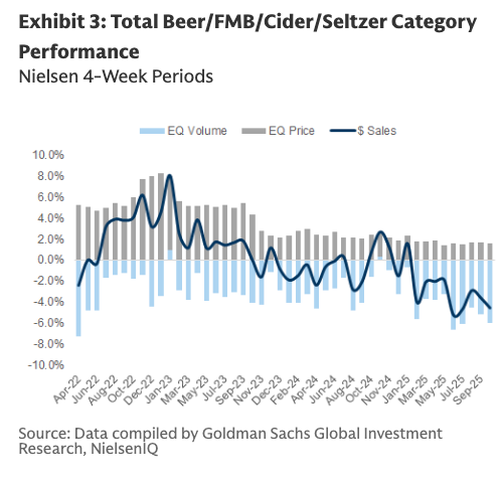

Reaffirming that the sober revolution in America is continuing full steam ahead into fall, a new Goldman report shows total alcoholic beverage sales fell 3.9% in the two weeks ending September 20, consistent with prior 4-week and 12-week declines.

There's a lot to unpack in Goldman's alcoholic beverage trends note, which cites NielsenIQ data through September 20. A team of analysts led by Bonnie Herzog wrote the report. Here's the breakdown:

Overall U.S. Market

Total alcoholic beverage sales fell -3.9% in the 2 weeks ending 9/20/25, consistent with prior 4- and 12-week declines.

Volume remained under pressure (-3.0%), while pricing slipped slightly (-0.7%).

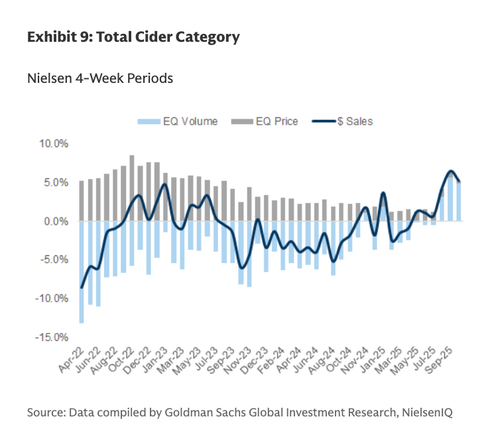

Spirits and Cider were the only categories avoiding volume contraction.

Beer Category

Beer sales declined -3.8%, driven by a -5.2% volume drop, partially offset by +1.5% pricing.

Modelo: Sales down -3.5% on weaker volumes (-4.6%) but modest price growth (+1.2%).

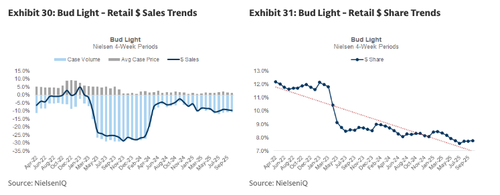

Bud Light: Sales fell -8.9%, losing 44 bps market share to 7.7%.

Michelob ULTRA: Grew +2.5%, gaining 55 bps market share to 9.0%.

Coors Light & Miller Lite: Both declined (-4.6% and -7.8%), with share erosion.

Flavored Malt Beverages (FMBs)

- FMB sales fell -6.8%.

Twisted Tea: Sales dropped -12.8%, though market share edged higher.

Simply Spiked: Severe weakness continued (-32.0%).

Hard Seltzers: Down -5.7%, led by Truly (-13.6%) with share loss.

Ready-to-Drink (RTD)

- Cocktails Strong growth continued: Spirit-based RTDs: +23.1% Wine-based RTDs: +28.5%

Promotions

- Promotional spend moderated slightly to 18.5% of sales (from ~18.6–18.7%).

Herzog's team published an extensive chartbook visualizing the NielsenIQ data, underscoring a "sober revolution" that has gained momentum since the Covid lockdowns. Gen-Z sober behaviors are also changing the drinking landscape.

The charts line up with Gallup's latest survey showing (read report), for the first time in the poll's 90-year history, that a majority of Americans now view even moderate alcohol consumption as harmful to one's health.

Bud Light sales remain depressed after a transgender TikTok in early 2023 nuked the brand.

Hmmm.

Related:

For the full 75 charts and tables on the latest U.S. alcohol trends, ZeroHedge Pro Subs can access the report in the usual spot.