In our preview of Alphabet's Q1 earnings, we said the company was "Cheap, Room For Error, And Optimism Worst Is Over", and sure enough, the company is surging after hours after the company reported earnings that largely beat expectations across the board, including capex (with the exception of cloud which came in light on revenue but more than made up for it on profit).

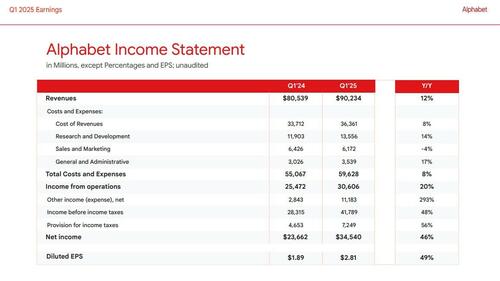

Here is what the company just reported for Q1:

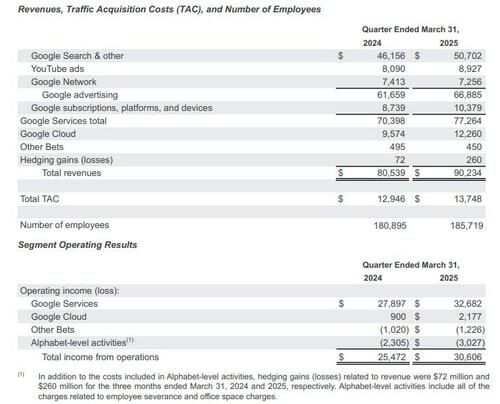

Number of employees 185,719, +2.7% y/y, estimate 183,718

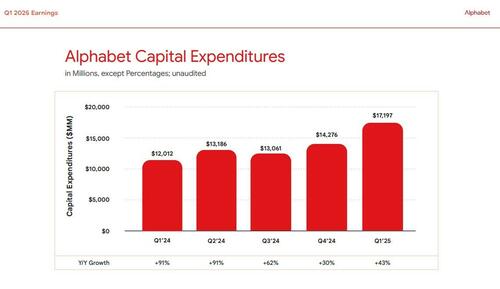

Notably, in a time when many are expecting capex to be slashed, Alphabet's capital expenditures came in hotter than expected, at $17.2BN, up 43% YoY, and just above the median estimate of $17.1BN.

Commenting on the quarter, Sundar Pichai, CEO, said: “We’re pleased with our strong Q1 results, which reflect healthy growth and momentum across the business. Underpinning this growth is our unique full stack approach to AI. This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation. Search saw continued strong growth, boosted by the engagement we’re seeing with features like AI Overviews, which now has 1.5 billion users per month. Driven by YouTube and Google One, we surpassed 270 million paid subscriptions. And Cloud grew rapidly with significant demand for our solutions.”

That said, Alphabet needs to ensure momentum in its search advertising and cloud businesses in order to justify its heightened investment in the artificial intelligence race. Competition is prompting the company and its rivals to spend heavily on infrastructure, research and talent, and as noted above, While Google benefits from AI startups spending on its cloud and business tools, it’s also racing to present an answer to popular conversational AI chatbots, which consumers are beginning to think of as an alternative to using Google Search.

Google’s beginning of the answer to that threat: its “AI Overviews” and “AI Mode” in search, in which summarized responses are drafted by generative AI and highlighted ahead of Google’s web links, have seen mixed success. Meanwhile, Google’s AI changes to search have decimated traffic to independent websites across the open web.

Tough for them, as for Alphabet, just to make sure the stock would not slump despite the solid beat, the company also announced a new $70 billion stock buyback authorization. Then again, with $75BN in LTM FCF and soaring capex, one wonders if GOOGL will soon need debt to meet all its funding needs.

GOOGL stock jumped as much as 5% after hours, precisely what the straddle implied move said it would do, rising just above $169 - the highest price since mid-March and well above its Liberation Day levels - before fading some of the gains.