Authored by Peter Tchir via Academy Securities,

We covered some of the most important topics in last weekend’s A Million Things to Parse. From DOGE, to Ukraine/Russia, to tariffs, to the so-called Mar-a-Lago Accord, much of what is shaping the global landscape is coming out of D.C. (though the Trump administration seems to be doing a lot of it out of Mar-a-Lago). Academy also wound up being quoted in the FT – Musk and markets: why DOGE is not cutting through, and in Barron’s Up & Down Wall Street.

Clearly the topics are resonating as investors and corporations try to navigate these times. With another week of headlines behind us, we should be closer to “knowing” the answers, but I’m not sure that is the case. As we look at so many issues, it is possible to see a “successful” path where negotiations and actions occur, leaving the economy and markets in a much better spot. It is also possible to see this playing out in a way that leads us to a much worse economy and weaker markets. And in between those two “binary” options, there are a lot of other possibilities.

Here is what I think we can add to last weekend’s report along with an update on how we are trying to interpret the policies and likely outcomes.

In capital markets a “deal is a deal.” You really cannot go back and change the terms later, and certainly not unilaterally. For much of my career I traded bonds and credit derivatives. You agreed on price and size and moved on. Occasionally you had trade disputes, but it was rare. But sometimes traders developed the reputation of being “flaky.” They didn’t live up to their word. Very few people who developed that reputation went on to thrive.

I think this is important because I cannot help but characterize two things as “re-trading:”

Re-trading is not good policy and could lead to countries looking for alternatives to the U.S. and hasten deglobalization, which would not be good for American companies. The S&P 500 is up 2% YTD, while most of Europe is up more than 10% and the Hang Seng is up 17%.

This administration, at many levels, has made it clear that when they focus on getting lower interest rates, it is across the curve. They aren’t just worried about a Fed cut here or there; they want the 10- year yield much lower.

Markets have liked that and there are things that are working in their favor, in a positive way:

4.4% on the 10-year now seems too low, especially given many of the reasons for the recent price action (in the face of higher-than-expected inflation data – which I think is suspect and subject to bad seasonality adjustments).

The one thing that is concerning is that yields are justified if the economy isn’t that strong!

Service PMI came in below 50. Not good.

We have argued that seasonal adjustments to the jobs data are incorrect and have overstated jobs in the first part of the year. While that effect is diminishing over time, it is still real, and we could see some job losses.

We have no idea (yet) what the economic implications are from the DOGE cuts so far. If it is all “fat” and excess spending, great. However, to the extent it was important and feeding into the economy, we could see some reverberations in the coming months.

Without a doubt, laying off government employees will affect the economy (with the D.C. area being hardest hit). But how easy is it to find jobs in the market? I think the JOLTS Quit Rate tells us that it is not so easy (and certainly not as easy as you might be led to believe by the NFP prints).

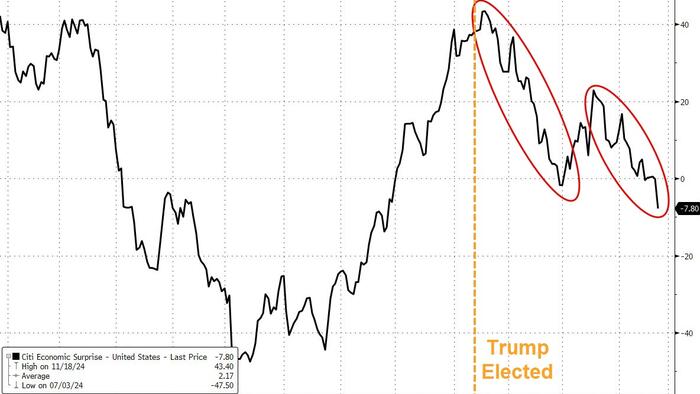

Look for further signs of economic slowdowns here and the ongoing reversal of the American Exceptionalism trade. I think yields should be higher but I am rethinking that as my concern about the state of the economy evolves. We’ve discussed increasing delinquencies in prior T-Reports, and updated data on that front is doing nothing to assuage our concerns.

We mentioned that we see the potential for some very good outcomes from what is being strategized in Mar-a-Lago and D.C. Having said that, even if we get to some really positive outcome (which is not my base case), there will be hiccups along the way.

If you believe, and it seems reasonable, that most companies have designed efficient supply chains given the existing rules, then the changes made to deal with new rules will be suboptimal.

Any behavior changes in response to new rules (or even the threat of new rules) has to be negative for companies and the economy (if the existing world is optimal).

There is so much uncertainty. We are halfway through the 30-day stay of execution on the initial Mexican and Canadian tariffs, with little insight into what will happen when the first reprieve expires.

Start looking for “problems” or signs that the uncertainty is hurting the global economy, which will impact the U.S. and our markets the most.

I am forced to lower my target on the 10-year yield (for the wrong reasons). We’ve been looking for 4.8% or higher, but now 4.6% seems reasonable given what the government can do. That rate level assumes a decent economy, which I’m increasingly worried is too optimistic. Expect 2 rate cuts this year, 1 in May and 1 in autumn, but even with inflation expectations rising, the number of cuts might need to be higher, as disruptions to the global economy and further (potentially rapid) deglobalization is creeping its way up the league table in our list of probable outcomes.

On equities, I continue to look for trades that will benefit from National Security = National Production. We have been overallocated to Chinese stocks and that has been great. We have been very concerned about the Nasdaq 100 and continue to think that the risk of a 10% or greater pullback is high. A pullback to pre-election levels would be close to 10% from here and given what we are seeing in the economy and economic policy so far, that is now my target. Basically an “unwind” of the gains made since the election as so far policy has done little to convince me that those gains are warranted.

Credit spreads should widen in sympathy with equities, but I’m still not particularly concerned (though, again, this is dependent on a decent economy, which might not be the case).

It is difficult to believe that we are “only” one month into Trump 2.0 given the sheer number of headlines we have been forced to digest, but the picture isn’t much clearer to me than it was before he was sworn in, and that makes me nervous for the economy and markets.