Authored by Charles Hugh Smith via OfTwoMinds blog,

Now that debt is rising faster than "growth," and "growth" is dependent on speculative credit-asset bubbles, the collapse of the Keynesian dream looms large.

Unbeknownst to economists, the Keynesian bedrock of modern economics--using financial repression and government spending funded by debt to manage the business cycle of growth and recession--is an artifact of a century of expansive cheap energy and virtuous demographics.

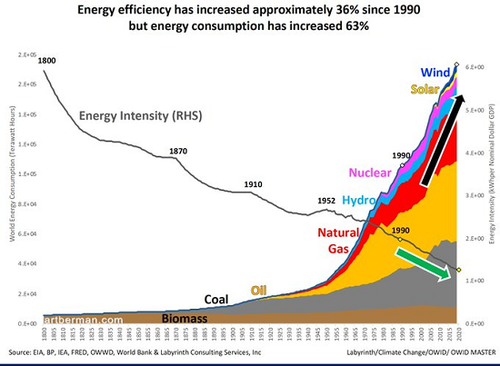

Presented as quasi-scientific "laws of economics," Keynesian policies of suppressing interest rates and funding stimulus with debt were only possible in an era in which energy per capita (per person) always became more abundant and affordable in terms of the purchasing power of wages, i.e. how many hours of labor does it take to buy the energy to fuel a vehicle, prepare a meal, etc.

The demographics of the 100 years of Keynesian supremacy were also uniquely favorable. The workforce paying taxes and funding pay-as-you-go social benefits to retirees (Social Security and Medicare) and the less fortunate (welfare, Medicaid) expanded smartly decade after decade, expanding government revenues and spending as the natural result of an expanding workforce.

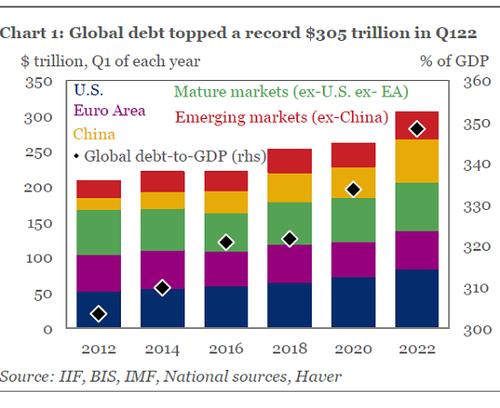

A third uniquely favorable condition was the vast pool of natural capital that had not yet been financialized, i.e. turned into a commodity that could be used as collateral for new debt and leverage. Tapping this untapped pool of capital enabled the vast expansion of debt, public and private. (See charts below)

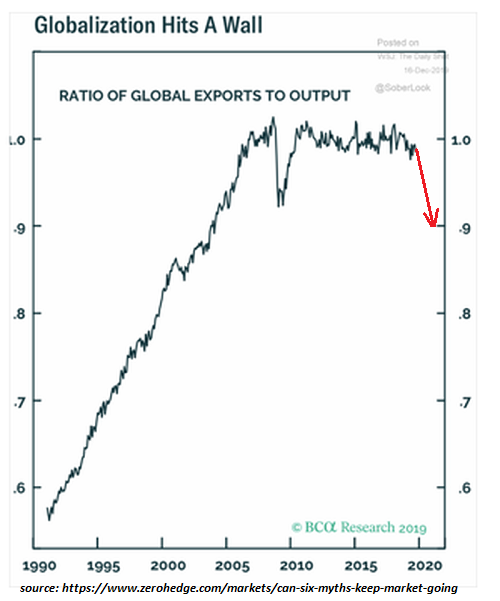

A fourth uniquely favorable condition was globalization, a benign-sounding term for the brazen exploitation of the planet's remaining reserves of resources and cheap labor. Profits swelled as these last pockets of easy-to-exploit sources of wealth were tapped.

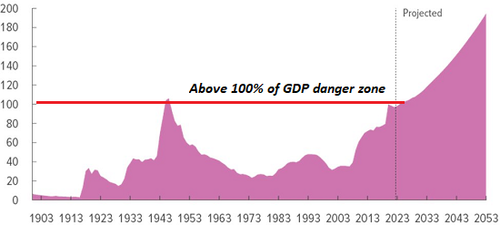

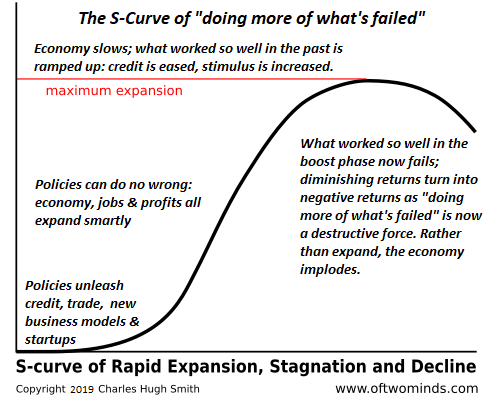

These four conditions have all topped out and are now reversing. The cheap-to-access energy has been consumed, the workforce has shifted from expansion to stagnation while the populace of retirees explodes, globalization has run its course, having stripmined the planet and human populace, and every potential source of new collateral has been financialized / leveraged to the hilt.

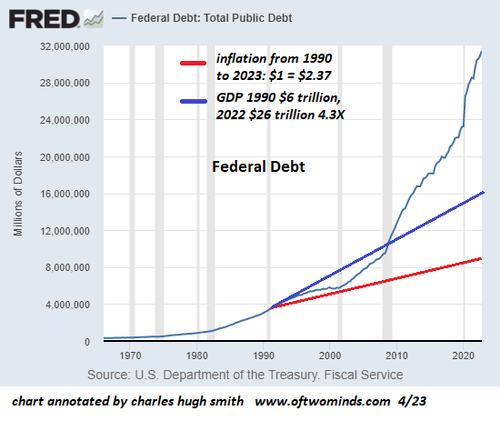

Keynesian policies of pushing interest rates to near-zero to boost private debt and government deficit spending morphed from being "emergency policies" to permanent status quo. Given that greed and laziness are the human default settings, it was always unrealistic to think that the "emergency tools" of borrow-and-spend would be reserved for recessions / depressions. Now consumption, private and public, depends entirely on the permanent expansion of debt to fund not only consumption but the rising costs of servicing the ballooning debt.

The Keynesian fantasy always rested on one dynamic: we can expand production and consumption faster than we're expanding debt and the cost of servicing that debt. With the four virtuous conditions now reversing, the cost of debt is rising far faster than the tepid increases in production and consumption generated by debt-funded spending.

The final desperate trick of the Keynesian fantasy is the wealth effect generated by speculative credit-asset bubbles, in which assets that were once grounded in utility and costs escape gravity and soar into the stratosphere, generating trillions of dollars in "free money" for those fortunate to have bought the assets before the bubble inflated.

The consumption afforded by this bubble-generated "free money" was the last source of Keynesian "growth": just suppress interest rates to juice private borrowing, flood the financial system with liquidity, and voila, trillions in unearned "free money" flows to those who were already rich enough to own the assets catapulted to the moon.

But all dreams end, even the Keynesian one. The risks and costs of rising debt cannot be dreamed away, and the inevitable result is the cost of capital rises along with the risks and costs of soaring debt. Bubbles inflated by policies encouraging speculative leverage all pop, devastating those who thought the "free money" would never end.

The planet has already been stripmined of cheap-to-access resources and cheap labor. Costs are rising and playing financial games with interest rates can't reverse real-world costs or the rising costs of capital. Demographics can't be reversed by financial trickery, either.

The Keynesian fantasy is drawing to a close. Financialization and endless debt-funded stimulus were artifacts of four unique conditions (cheap, abundant energy, demographics, globalization and financialization) that have all topped out and are now sliding down the backside of the S-Curve. AI can put lipstick on the mirror but it is incapable of reversing the end-game decay of these four unique conditions.

Since there's no alternative to the Keynesian dream of eternal "growth" funded by magic, we're doing more of what's failed until the system collapses in a heap: we'll do more of what's failed until it fails spectacularly.

It's worth recalling Peter Drucker's observation that enterprises don't have profits, they only have costs. The same can be said of governments and entire economies. Borrowing to pay rising costs has a short-half life because debt accrues its own costs and piles up risks which have their own uniquely asymmetric dynamics.

Now that debt is rising faster than "growth," and "growth" is dependent on speculative credit-asset bubbles, the collapse of the Keynesian dream looms large. Plan accordingly, i.e. reduce your own exposure to risk via Self-Reliance.

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)