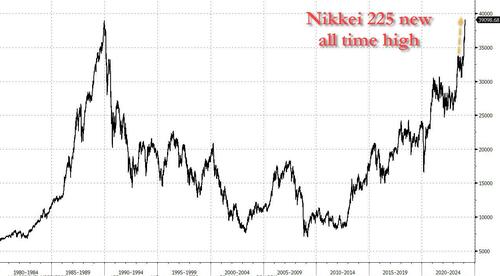

US equity futures blasted higher, and were set to push US the S&P500 to a new all time high when markets open for trading, matching record highs hit earlier in the session for both Japanese stocks...

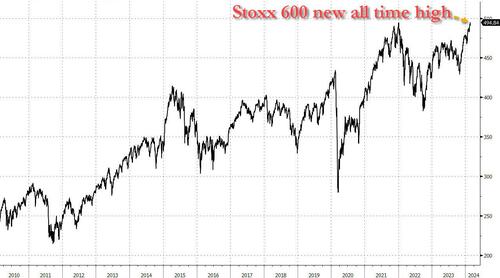

... and European bourses...

... boosted by blowout earnings by Nvidia which surged in early trading after delivering another eye-popping sales forecast - it really was the $2BN delta between NVDA's $24BN revenue forecast for the current quarter and the $21.9BN consensus estimate - that added fresh momentum to a stock rally that already made it the world’s most valuable chipmaker and fanned gains in tech stocks - and really all stocks - around the world. As of 7:40am S&P futures were higher by 1.3% on the day with Nasdaq futures outperforming and higher by 2.1% following Nvidia earnings which sent the stock up as much as 15%; in Europe, the Stoxx 600 hit a new all time high, rising 0.8% with Japan's Nikkei also surpassing its December 1989 record high, and closing above 39K for the first time ever. Meanwhile, even as tech rocketed higher, yields continued their ascent, and the 10Y yield rose to a new 2024 high, while the dollar dipped and oil swung from gains to losses in a narrow range. Today's calendar sees jobless claims (8:30am), February S&P US PMI’s (9:45am) and January existing home sales (10am) as well as several Fed speakers.

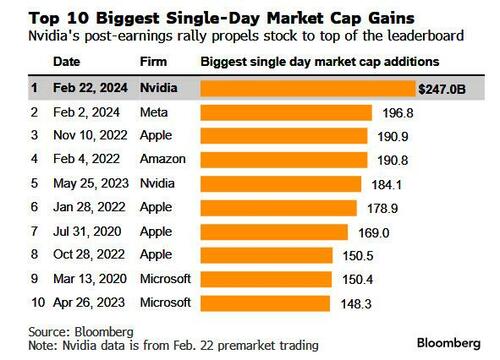

Naturally, all eyes are on Nvidia this morning which soared as much as 15% in pre-market trading after results showed demand continues to be strong for artificial intelligence computing hardware enabling extremely racist chatbots such as Google's Gemini. The company, which will once again surpass Amazon and Alphabet in market value, has been the biggest driver of US stock market gains this year and has gained over $250BN premarket. And here is a stunning fact: the $250BN in market cap NVDA is set to gain today eclipses the previous record, that of Meta, which soared by $197BN just three weeks ago.

Nivida’s gain dragged other chipmakers higher in premarket trading, with Advanced Micro Devices Inc. climbing 6%, Applied Materials Inc. rising 4% and Intel Corp. up more than 2%. Here are some other notable premarket movers:

Yet despite lots of activity elsewhere, this morning is all about AI (which apparently is raginly anti-white racist, forcing Google's Bard or whatever it is called now, to pull all of its image generation altogether). The global market for generative AI may reach $1.3 trillion in 2032, according to estimates from Bloomberg Intelligence analyst Mandeep Singh. Explosive growth in the sector should boost hardware, software and internet companies again this year, he wrote in a recent report.

“As goes Nvidia, so goes the market,” said Kim Forrest, chief investment officer of Bokeh Capital Partners LLC. “It does confirm the narrative that AI is going to continue to be strong for the foreseeable future. This narrative supported the markets last year, why wouldn’t it do the same this year?”

The latest numbers mean Wall Street estimates for Nvidia are set to be revised higher, which will likely bring down the valuation once again if the share price doesn’t keep pace. While some investors have been concerned about a possible bubble forming around AI-related stocks, others noted that Nvidia is still less expensive than peers. The stock traded at about 30 times forward earnings as of Wednesday’s close, compared with AMD at 43 times. The shares are also cheaper than those of Amazon.com Inc. and Microsoft Corp., while the Nasdaq 100 Index trades at a 25 times multiple.

The hype around Nvidia’s earnings overshadowed a hawkish tone to the minutes of the Federal Reserve’s last policy meeting, where most officials expressed concern about the risk of cutting interest rates too soon. Fed Governor Lisa Cook and Minneapolis Fed President Neel Kashkari are set to speak today, providing investors with more food for thought along with jobs and home-sales data.

European stocks also benefited from the AIphoria, with the Stoxx 600 rising to a record high after Japan’s Nikkei 225 did the same earlier on Thursday. European semiconductor stocks rallied after Nvidia delivered another eye-popping sales forecast, as demand for chips to power AI algorithms shows no signs of letting up. Among European chip equipment makers, ASML rose as much as +5.1%. Here are some other notable premarket movers:

Earlier in the session, Asian stocks gained as Nvidia’s better-than-expected revenue forecast sparked a rally in tech shares, helping Japan’s Nikkei 225 hit a new record. The MSCI Asia Pacific Index gained as much as 0.7% to its highest level since April 2022, with Toyota among the biggest boosts along with Nvidia suppliers TSMC and SK Hynix. Japan’s blue chip index surpassed its 1989 all-time high.

In FX, the risk-on mood has weighed on the greenback, with the Bloomberg Dollar Spot Index down 0.3% after edging lower in the last three days and looking at its first weekly fall of 2024. Minutes of the Fed’s Jan. 30-31 meeting flagged that policymakers were more concerned about the risks of moving too soon to cut interest rates than waiting too long; a view presaged by Fed Governor Michelle Bowman who said that the time for a rate cut was “Certainly not now." A slip in the dollar is “probably a reflection of overall bullish sentiment, which has been given a boost after Nvidia,” said Kyle Rodda, a senior analyst at Capital.com. “Don’t overlook the China narrative, either. We’ve seen antipodeans a bit firmer over the last few days and I think stronger Chinese markets are having an impact at the margins”

In rates, treasury yields hit session highs with the long-end outperforming, flattening 2s10s and 5s30s spreads through Wednesday session lows. The 10Y yield traded at 4.33%, as treasury yields were richer by up to 3bps across long-end of the curve with front-end slightly cheaper on the day. Spreads including 2s10s, 5s30s are flatter by 2bp and 1.5bp, following similar bull flattening move seen across German curve. Core European rates are choppy following a round of services and manufacturing PMI’s data, while risk sentiment continues to be boosted by Nvidia surging in premarket trading after delivering stellar earnings after Wednesday’s close. US session focus includes jobless claims and PMI data, along with a busy Fed speaker slate. The dollar issuance slate is busy and includes BNG Bank 3Y; Cisco headlined a four-deal $19.4b slate for Wednesday, pushing weekly volume through $33b with more jumbo acquisition financing expected in the coming days. We algo get a $9b 30-year TIPS auction is scheduled for 1pm.

In commodities, oil prices advance, with WTI rising 0.5% to trade near $78.30. Spot gold adds 0.2%.

Bitcoin sits just shy of USD 52k, whilst Ethereum (+2.2%) edges higher and back towards USD 3k.

On today's calendar, we get the January Chicago Fed national activity index, jobless claims (8:30am), February S&P US PMI’s (9:45am) and January existing home sales (10am). Federal Reserve members scheduled to speak include Jefferson (10am), Harker (3:15pm), Cook, Kashkari (5pm) and Waller (7:35pm)

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive amid tailwinds from the tech uplift in US futures following NVIDIA earnings. ASX 200 lagged as participants continued to digest an influx of earnings and after Australia's Flash Manufacturing PMI returned to contraction territory. Nikkei 225 outperformed amid tech strength and eventually printed fresh intraday record highs above 39,000. KOSPI was marginally higher after the BoK kept rates unchanged and signalled an unlikelihood of a cut soon. Hang Seng and Shanghai Comp. were both firmer albeit with price action in Hong Kong choppy amid US-China chip-related frictions, while the mainland remained afloat after the latest stability efforts by China.

Top Asian News

European bourses, Stoxx600 (+1.0%) soared at the open, taking lead from strong Nvidia (+13%) earnings, after-hours. Thereafter, in tandem with the softer-than-expected German PMI data, equities came off best levels and have been edging lower since, but remain markedly firmer on the session. European sectors are mixed; Tech is the clear outperformer after strong Nvidia earnings; peers such as ASML (+4.5%), BE Semiconductor (+15.7%, also on strong earnings) gain. Mercedes Benz (+4.9%) is leading the gains in the Autos sector, whilst Nestle (-4.3%) drags down Food Beverage and Tobacco. US Equity Futures (ES +1.0%, NQ +2%, RTY +0.5%) are entirely in the green, with clear outperformance in the tech-heavy NQ, after yet another strong earnings report from Nvidia (+13%).

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Strong guidance from Nvidia last night has given markets another boost this morning, with the stock surging by +9% in after-hours trading. That rally has extended more broadly, as S&P 500 futures are up +0.74%, and overnight the Nikkei surpassed its all-time intraday peak from 1989. So that’s a very big milestone, and it continues the Nikkei’s recent outperformance, having recorded a +16.5% gain over 2024 so far. That follows similar records in Europe yesterday, where both the DAX (+0.29%) and the CAC 40 (+0.22%) closed at all-time highs, and Euro HY spreads also reached their tightest level in over two years. That being said, there were further losses for sovereign bonds, and yields on 10yr Treasuries and bunds both closed at their highest level since November, thanks to hawkish central bank commentary and weak demand at a 20yr Treasury auction.

In terms of those Nvidia results, the company reported $22.1bn of revenue in Q4 (vs $20.4bn analyst expectations), representing a dramatic +265% increase in sales compared to a year earlier. It projected $24bn of revenue for the current quarter (above $21.9bn expectation), with Nvidia’s CEO speaking of a “tipping point” for generative AI. This strong outlook led Nvidia shares to post an impressive +9% gain in after-hours trading, though the magnitude of this move might be seen as par for the course given that, ahead of the release, options were implying a move of more than 10% in Nvidia’s share price today.

Before the release, US equities had actually had a mixed day yesterday, with the S&P 500 trading -0.6% lower less than an hour before the close, before recovering to advance +0.13%. Tech underperformance saw both the NASDAQ (-0.32%) and the Magnificent 7 (-0.31%) post modest declines, and Nvidia (-2.85%) had actually been the worst performer among the Magnificent 7 group. Things looked more promising outside of the big tech names, with 6 5% of S&P 500 companies gaining on the day. Moreover in Europe, the Euro Stoxx 50 (+0.32%) closed at a 23-year high, and both the DAX (+0.29%) and the CAC 40 (+0.22%) closed at an all-time high. The broader STOXX 600 was down -0.17%, but that was in large part due to the weakness among UK equities, where the FTSE 100 was down -0.73%.

On the rates side, a key story yesterday were the FOMC minutes, which reinforced the narrative that the Fed was in no rush to ease policy. According to the minutes, “most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent”, while “several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate“. Meanwhile on QT, the minutes confirmed plans to begin in-depth balance sheet discussions at the March meeting, though this came with a view “to guide an eventual decision to slow the pace of runoff”, so not just suggesting that a change on QT is imminent.

The minutes came an hour after a 20yr Treasury auction, where weak demand helped to push up yields further, as the share of indirect bidders fell to its lowest since May 2021. Moreover, there was some hawkish commentary earlier in the day, which further contributed to the bond selloff. For instance, Richmond Fed President Barkin said in an interview (recorded on Tuesday) that “You do worry that when the goods price deflation cycle ends, you’re going to be left with shelter and services higher than you like it”. And over in Europe, the ECB’s Wunsch said “I believe one should not discard a scenario in which monetary policy stays tight for longer than currently expected”.

Collectively, that led investors to dial back their expectations for rate cuts again. In fact, the chance of a rate cut at the Fed’s March meeting was down to just 7%, which is the lowest in over three months. Bear in mind that a cut by March was fully priced at the start of the year, so we’ve seen a significant turnaround in expectations so far this year. And looking further out, the amount of cuts expected by the December meeting was down to just 86.7bps by the close, the lowest in more than three months, and a major decline from the 168bps expected less than six weeks ago.

Given all that, sovereign bond yields ended the day noticeably higher on both sides of the Atlantic. For instance in the US, the 1 0yr Treasury yield (+4.4bps) closed at its highest level since November, at 4.32%. Moreover, there was evidence that the recent increase in rates was filtering through to the real economy, as with 30yr mortgage rates back above 7% for the first time in over two months, according to data from the Mortgage Bankers Association for the week ending February 16. Back in Europe it was a similar story, with pricing of a rate cut by April down to 38%, its lowest in four months, while yields on 10yr bunds were up +7.5bps to 2.45%, also their highest closing level since November.

Overnight in Asia, we’ve seen all the major indices advance, with gains for the Nikkei (+1.91%), the Shanghai Comp (+1.00%), the CSI 300 (+0.73%), the Hang Seng (+0.74%) and the KOSPI (+0.34%). That’s been driven by the technology sector, and tech stocks in the Nikkei have led the index’s advance with a +3.97% gain. Separately, we’ve also seen growing confidence overnight that the Bank of Japan will adjust their ultra-loose monetary policy, as Governor Ueda said he expected the virtuous economic cycle to continue, and pointed out that services prices were continuing to rise. Indeed, yields on 2yr JGBs are currently at their highest level since 2011 overnight, and investors are now pricing in a 78% chance that they’ll deliver a hike by the April meeting.

Otherwise, today will bring the release of the February flash PMIs from around the world, and we’ve already had a few releases overnight. In Japan, the composite PMI fell back to 50.3, down from 51.5 the previous month, but in Australia, the composite PMI was back in expansionary territory at 51.8, marking its highest level in 10 months.

To the day ahead now, and data releases include the flash PMIs for February from Europe and the US, along with the US weekly initial jobless claims and existing home sales for January, as well as the euro area final inflation print for January. From central banks, we’ll get the ECB’s account of their January meeting, and also hear from the Fed’s Jefferson, Harker, Cook, Kashkari and Waller.