By Michael Msika, Bloomberg Markets Live reporter and strategist

US banking sector turmoil is sounding a warning that central banks’ monetary tightening may have gone too far too fast. Markets want to see if policymakers have got the memo.

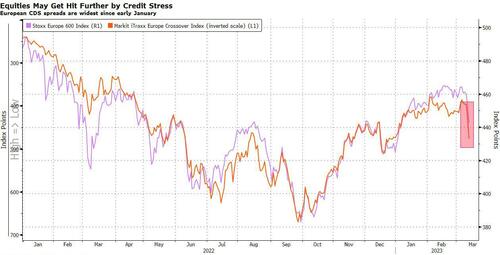

The collapse of SVB and Signature Bank is fanning worries about the health of regional US banks, but it is also sending shockwaves across Europe, where fears of contagion have fueled heavy selling. Unsurprisingly, bank shares are bearing the brunt.

There’s a silver lining, however. Traders’ nerves are being soothed by expectations that the banking troubles will finally bring about that long-awaited Federal Reserve pivot. Goldman Sachs economists, for instance, have dropped calls for a March interest rate hike. And swaps markets, are wagering there may be no more rate hikes at all. A soft inflation print later on Tuesday would encourage such bets.

“March Fed hike should now be off the table,” Crossbridge Capital CIO Manish Singh says. “If we get signs that the Fed has got the message that rates have been tightened too far, then the equity market will remain bid and get in dip buyers.”

Singh does not expect much more equity downside, regardless of whether the Fed pivots or not, because the year-to-date rally is a “hated” one, with asset managers still broadly underweight, he says.

Meanwhile, from a technical point of view, the Stoxx 600 index is already testing oversold territory, plumbing levels that over the past year typically led to a rebound.

The selloff has dented the stocks that were most popular this year — banks and shares in weaker companies. But since Friday, investors are again favoring higher-quality stocks and defensives. Cyclicals and value stocks have erased more than half their year-to-date gains in the past two sessions.

“Quality is the factor to own in the current markets,” says BNP Paribas strategist Ankit Gheedia, who sees equities switching to a recession regime.

The consensus view is that risks for European banks are mostly modest, given their lower deposit concentration and strong capital ratios. But not everyone is optimistic. Vincent Rennella, head of equity strategy at Silex Investment Managers, does not see the sector as immune and disagrees with calls to buy the dip. Positioning in EU banks has “rarely been this high,” he says.

The other risk is that hopes of a pivot could be dashed. For Janet Mui, head of market analysis at RBC Brewin Dolphin, recent events don’t materially change the Fed rate outlook, and she still expects a 25 basis-point hike this month. “We think there is some implication which may cause the Fed to hike less aggressively, but that doesn’t mean it will stop here,” she adds.