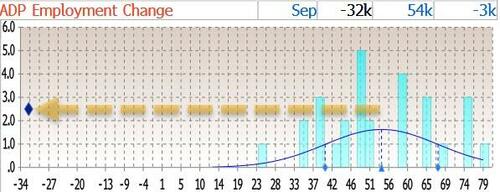

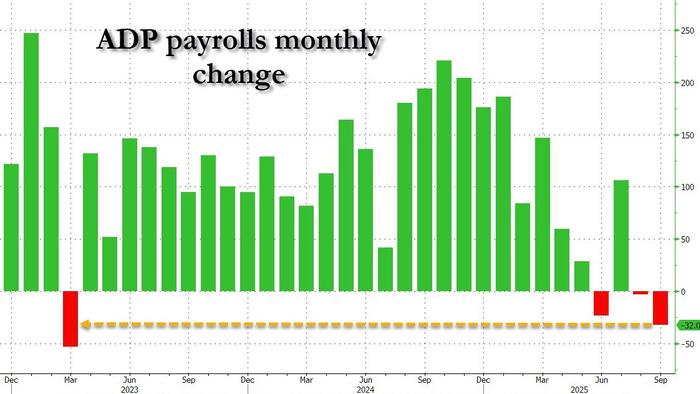

Ahead of today's ADP print we said that traders will be especially focused on the otherwise unreliable number, since the government shutdown which hit at midnight means that this Friday's payrolls report will likely not happen. Well, if that is the case, the market - and Fed - may well be expecting a jumbo 50bps rate cut again in 3 weeks, because moments ago ADP reported that in September, the US private sector shed 32,000 jobs, the worst print since March 2023...

... and far below the lowest estimate; in fact the print was a 6 sigma miss to estimates of which Pantheon's +25K was the lowest.

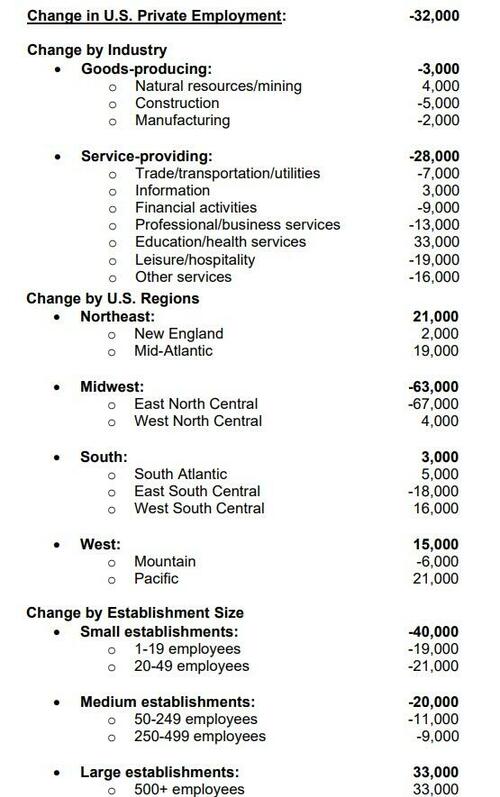

Adding to the confusion is that the original number was actually well higher, at 11K, but after the ADP conducted its annual preliminary rebenchmarking of the National Employment Report in September based on the full-year 2024 results of the Quarterly Census of Employment and Wages (which as a reminder eliminated 911K jobs from the Biden regime that were never actually there), there was a reduction of 43,000 jobs in September compared to pre-benchmarked data. The trend was unchanged; job creation continued to lose momentum across most sectors.

“Despite the strong economic growth we saw in the second quarter, this month's release further validates what we've been seeing in the labor market, that U.S. employers have been cautious with hiring,” said ADP chief economist Nela Richardson.

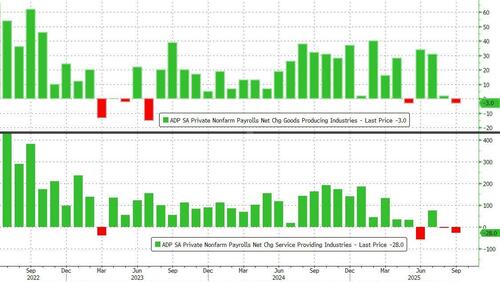

As shown in the next chart, the decline was broad-based...

... with both goods and service producing sectors seeing a slide in jobs.

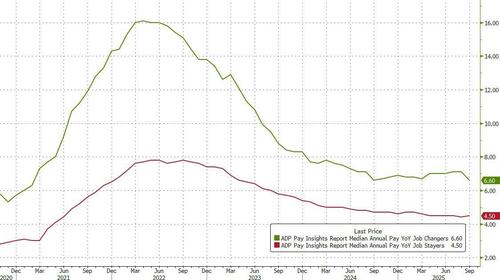

Looking at wages, job Stayers' saw incomes post a modest improvement, rising from 4.4% (which was the slowest pace of growth since June 2021) to 4.5%, while 'job changers' are still seeing higher and rising incomes, although in September this number slumped to 6.6% from 7.1%.

And so, with Friday's payrolls delayed and with ADP traditionally viewed as an unreliable source of information, expect data hungry traders to scour the interwebs for every possible third party provider of employment and labor data in hopes of figuring out just how bad the labor slide truly is.