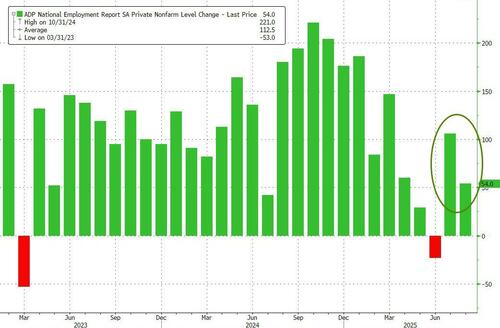

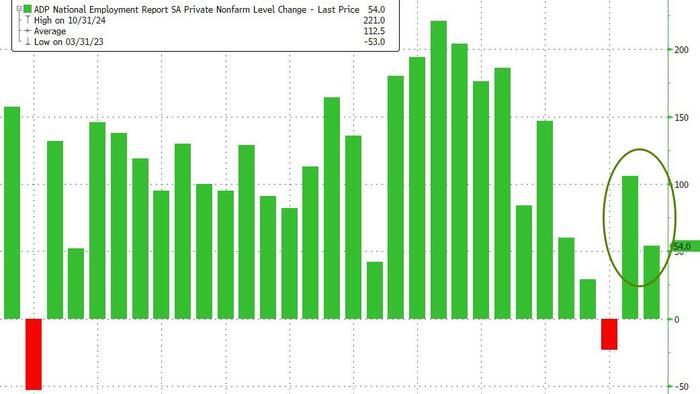

Ahead of Friday's all-important payrolls print (and revisions), this morning's ADP employment report may see more attention as a less 'manipulated' data point.

The headline print was expected to slow to 68k in August (from +104k in July and -23k in June) but in fact slowed further, adding just 54k jobs...

Source: Bloomberg

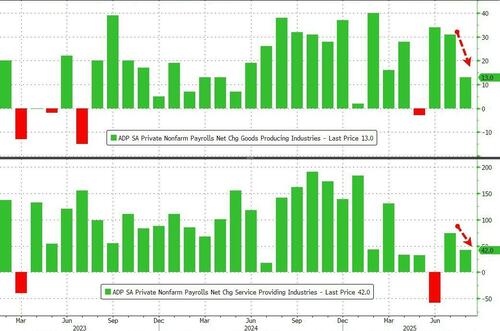

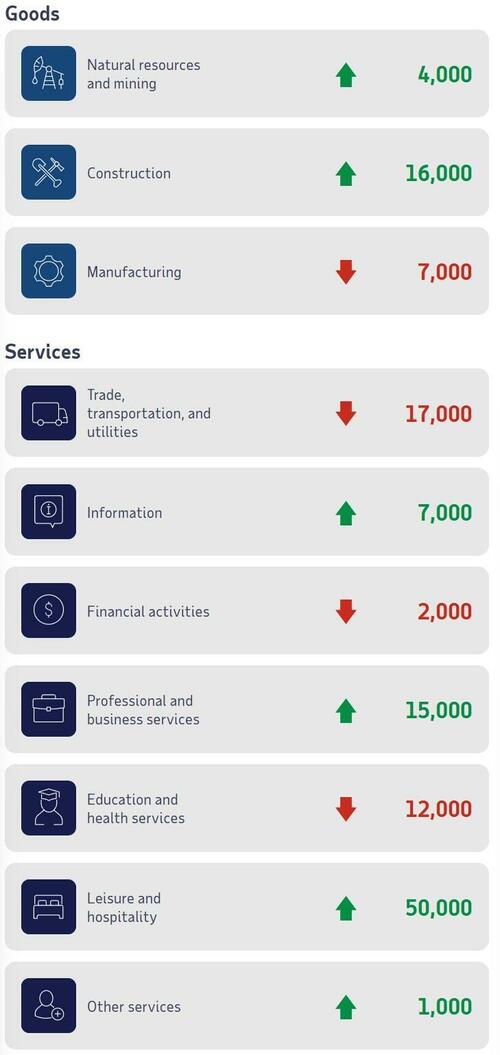

Leisure and hospitality and construction performed well despite a broader month-over-month slowdown in hiring.

"The year started with strong job growth, but that momentum has been whipsawed by uncertainty," according to Dr. Nela Richardson Chief Economist, ADP.

"A variety of things could explain the hiring slowdown, including labor shortages, skittish consumers, and AI disruptions."

Goods and Services jobs both saw slowing in August...

Source: Bloomberg

Manufacturing, Transportation and Education saw job losses in August...

“I think at this point, it’s clear that the labor market is slightly cooling down,” said Nataliia Lipikhina, head of EMEA equity strategy at JPMorgan Private Bank.

“The market is now pricing a 97% chance of the Fed cut. What could change that potentially is if we have very strong inflation data, but we’re not seeing that yet.”

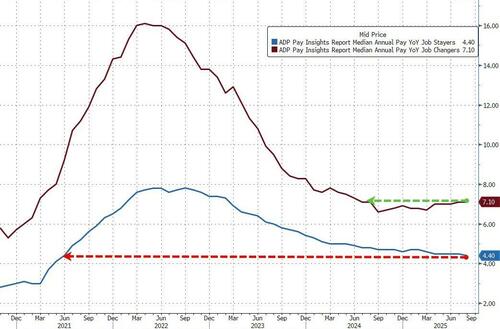

'Job Stayers' saw incomes rise at their slowest pace since June 2021 while 'job changers' are still seeing higher and rising incomes...

In separate figures, hiring plans fell to the weakest level for any August on record and intended job cuts mounted, according to outplacement firm Challenger, Gray & Christmas.