Since the collapse of Bretton Woods in 1971, the U.S. Dollar has functioned as a fiat currency. The petrodollar agreement in 1974 tied the Dollar indirectly to oil, reinforcing global demand for the Dollar. Today, with increasing skepticism toward fiat currencies and a rising interest in decentralized assets like Bitcoin, the U.S. could consider a new monetary system backed by Bitcoin as a digital, scarce, and decentralized asset. Bitcoin effectively delivers a more modern, automated and software-based approach to central banking.

This piece explores the viability of a Bitcoin-backed monetary system in the context of key historical financial developments, as well as the strategic path for its implementation.

The report concludes with an actionable strategy relevant to policymakers, financial institutions and investors.

Under the petrodollar system, the U.S. effectively allowed the price of oil to rise (in Dollar terms), which increased global oil production and mitigated the strategic threat posed by OPEC. By creating a large, Dollar-denominated asset class (oil), the U.S. also established a mechanism to support the Dollar’s dominance abroad and finance its growing deficits at home. Surplus oil revenues from OPEC nations were recycled into U.S. Treasuries, reinforcing demand for the Dollar and giving the U.S. tremendous economic power globally.

Domestically, this system enabled politicians to engage in extensive borrowing and spending, driving U.S. debt from 36% of GDP in 1971 to ~125% today, a trajectory that now poses a serious challenge to the U.S. as a financial superpower, as well as its energy and national security.

Even at a ~$2 trillion market value, and with over ~$20 billion in average daily trading volume, Bitcoin is not yet large enough to replace the petrodollar as the backbone of the U.S. monetary system. However, a significant increase in Bitcoin’s price could catalyze a new paradigm.

Higher Bitcoin prices would likely drive substantial growth in U.S. Dollar-backed stablecoin issuance (due to the greater total market value of the asset class, and as the network effects of Bitcoin and digital asset transactions take hold);.

In turn, stablecoin issuance would directly boost demand for U.S. Treasury bills, effectively shifting the backstop of U.S. deficits from oil to Bitcoin.

This would allow the U.S. to maintain its monetary dominance while undermining the strategic power of the BRICS nations, who have turned to gold in an attempt to challenge and circumvent the Dollar system.

There are several recent developments that indicate the groundwork for this transition may already be underway.

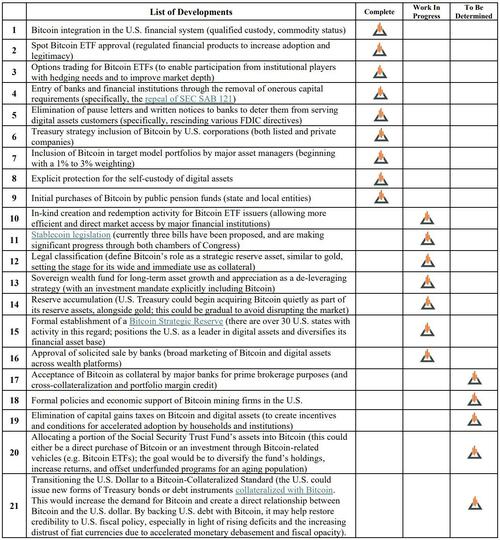

The framework that follows is a preliminary outline of the potential steps towards a Bitcoin-Backed Monetary System.

The 21-Step Integration of Bitcoin into the U.S. Financial System:

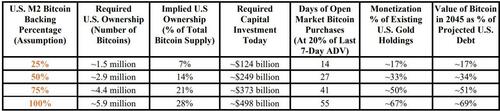

When considering the transition to a Bitcoin-backed monetary system, M2 money supply provides the most comprehensive measure of U.S. Dollar liquidity in the economy. M2 includes not only cash and checking deposits (collectively defined as M1), but also savings accounts, money market funds, and other near-money assets.

This broader measure captures the full extent of Dollar-denominated assets that circulate and store value within the U.S. economy.

Key Assumptions:

Below is a table showing the required U.S. ownership of Bitcoin for different levels of backing by 2045:

Note: Analysis is for illustrative purposes only; market data is as of 2/26/2025 and from publicly available sources.

Scenario Overviews:

1) 25% Backing

- This level of backing by the U.S. could serve as a hedge or partial reserve, similar to the role gold used to play in the early 20th century.

2) 50% Backing

- A 50% backing level implies a much more substantial reliance on Bitcoin within the U.S. monetary system. Increasing Bitcoin’s allocation not only accelerates its global adoption and reinforces its credibility as a reserve asset, but it also provides a meaningful hedge against escalating U.S. debt. With projections suggesting that the national debt could balloon to approximately $115 trillion by 2045 (based on extrapolation), a 50% backing could potentially offset up to 34% of that burden.

3) 100% Backing

Full backing would represent a Bitcoin standard, where the entire U.S. M2 money supply is backed by Bitcoin.

A full Bitcoin backing serves as a complete hedge against fiat debasement and central bank policy errors, positions the U.S Dollar as a purely hard-money asset, and reduces Net Debt to GDP to under 100% by reducing nearly 70% of the nation’s debt burden.

A Bitcoin-backed system would leverage Bitcoin’s superior characteristics as a harder and scarcer asset than gold, positioning the U.S. as a first mover in adopting a supranational, independent and digital reserve asset. The concept of transitioning to a new U.S. monetary system backed by Bitcoin as collateral is both ambitious and transformative. It represents a profound shift from the current fiat-based, debt-financed model towards a digital, decentralized, and scarce foundational asset.