Argentina’s President Javier Milei suffered a heavy defeat in Buenos Aires province, where the Peronist Fuerza Patria coalition won 47% of the vote against his Libertad Avanza’s 34%, according to FT.

Pre-election forecasts had predicted a closer contest, which Milei had hoped would boost momentum for the October 26 midterms.

“Buenos Aires province is traditionally very Peronist, but this margin is even worse than expected,” said Alberto Ades of NWI Management. He warned markets would react with weaker bonds, equities, and higher country risk.

FT writes that the setback comes amid Milei’s struggles in Congress, where his veto was recently overturned, and a corruption scandal involving leaked recordings and alleged kickbacks linked to his sister Karina. His approval has dropped below 40%.

“Without any doubt, today we suffered a clear defeat,” Milei conceded. “But the economic course for which we were elected will not change. We will continue to defend fiscal balance tooth and nail.”

Analyst Ana Iparraguirre said, “This result was primarily a negative message to Milei’s government,” warning financial turbulence could deepen voter discontent.

Markets are already stressed: short-term dollar bonds have fallen 15% since July, equities 34%, and debt spreads widened nearly 2 points to 9%. To defend the peso, Milei has raised rates, tightened reserves, and sold dollars, but economists fear recession.

“The resounding defeat of President Javier Milei’s La Libertad Avanza in the Province of Buenos Aires election will likely confirm the worst of market fears and unleash an adverse feedback loop of negative price action, unpleasant policy moves, and more downbeat expectations heading into October’s national mid-terms," Bloomberg economist Jimena Zuniga said.

“The government engineered a sharp recession with high rates to defend the peso, but Buenos Aires voters are saying jobs matter more than squeezing out the last bit of inflation,” said Walter Stoeppelwerth of Grit Capital.

Despite this blow, polls still predict Milei’s coalition will gain seats in Congress, though it holds less than 15% in either chamber. The result, however, bolsters Peronist governor Axel Kicillof, a rising figure in the opposition.

The peso plunged 7% to 1,450 per US dollar, near the upper limit of its trading band, at the start of local trading.

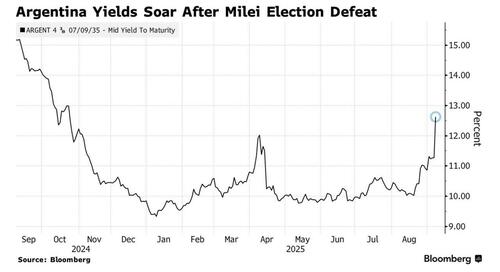

Dollar notes due 2035, among the most traded, slid 5.56 cents to 56.09, pushing yields to 12.6% and leading losses across emerging markets.

“This was Peronism’s bastion. The national election will be different,” said Fernando Marengo of Blacktoro. “The focus has to shift to building agreements — the reforms that could be done by decree are done.”

Argentina’s sovereign bonds tumbled after the defeat in Buenos Aires, according to Bloomberg.

Investors had braced for a selloff if Milei lost by more than five points; instead, the 14-point margin magnified concerns ahead of October’s midterms.

Morgan Stanley swiftly closed its week-old buy call on Argentine assets, warning that Sunday’s outcome increases the risk of a “downside scenario in which the market questions the likelihood of continued reforms, and uncertainty rises around the future external financing sources,” according to economist Fernando Sedano and strategist Simon Waever.