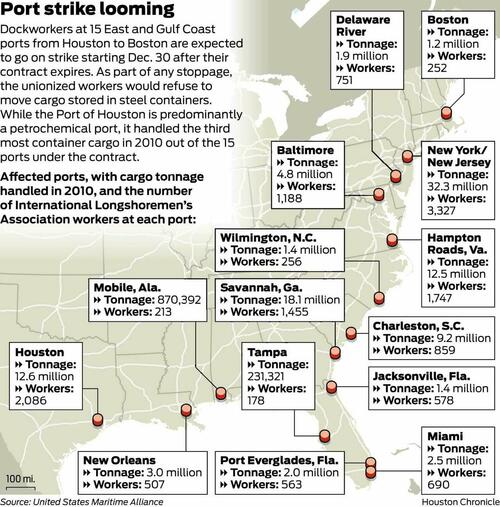

Goldman analysts have created a framework specifying that if the International Longshoremen's Association (ILA) and the US Maritime Alliance (USMX)—a coalition of port operators and carriers—fail to reach a new contract agreement in three days (or by the end of September 30), a strike along East and Gulf Coast ports could erupt, jeopardizing $5 billion in daily international trade.

"We analyzed the potential impact to trade value into the East Coast and Gulf Coast Ports if work disruption were to occur (we take no view on the likelihood of any outcome)," Goldman's Jordan Alliger told clients on Thursday.

Alliger continued, noting that "upwards of $4.9bn per day is at risk in international trade along the East and Gulf coasts, along with the potential for supply chains to likely become less fluid due to emergent congestion, which in turn could result in a re-emergence of transport price inflation."

Clients were reminded about the scale of the potential labor action early next week. Any strike would immediately result in 45,000 ILA workers walking off container ports. These ports represent 52% of all port traffic in 2023. In other words, any disruption would spark massive supply chain snarls for the eastern half of the nation.

Alliger and his team of analysts shared their "high-level" thoughts on the situation:

The analysts estimate "that a potential work disruption could impact ~61% of total US ocean trade and 25% of total US daily trade in October."

Separately, the CEO of Flexport—one of the largest US supply-chain logistics operators—recently warned that "the biggest wild card in the presidential election that nobody's talking about? The looming port strike that could shut down all East and Gulf Coast ports just 36 days before the election."

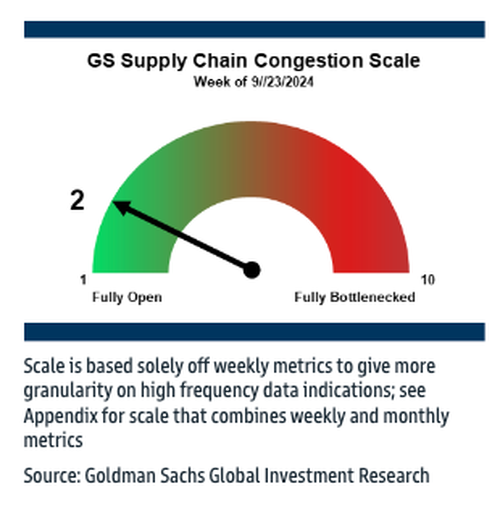

Earlier this week, Goldman's Alliger informed clients that US congestion at ports is 2 out of 10 ahead of potential strikes.

Meanwhile, strike preparations are being made at the Port of New York-New Jersey, as officials at the major port urged shippers to wind down cargo business.

Details about contract proposals between ILA and USMX remain non-existent in the public domain, as contract expiry is slated for Monday.