One year ago, when looking at the 20 most popular stories of 2023, we said that "while 2023 did have a seemingly endless variety of social, economic, political, geopolitical and of course, financial and market, drama, the unprecedented onslaught of 2022 - which saw both the deadliest and most consequential global war since WWII and a historic inflationary onslaught - simply proved too great to beat.... although we are confident that's only because the newsflow was merely resting ahead of 2024 when, thanks to a record number of elections across the world not to mention what may well be the most consequential presidential election in US history, the coming avalanche of news and propaganda will be sheer insanity, especially since the Fed has made its long awaited dovish pivot without successfully stamping out inflation first. So in retrospect, 2023 being somewhat tame by recent standards may have been a good thing: it allowed everyone to rest ahead of the main event."

Boy, were we right, and in retrospect we certainly hope everyone did rest ahead of the countless 2024 main events because even though there were no market crashes yet (for reasons we will touch upon), 2024 was indeed the most exciting and eventful rollercoaster of non-stop newsflow we have yet encountered, one which not only saw the legacy political system finally crumble across "Western democracies" as country after country said "no more" to the three-headed globalist hydra of runaway inflation, corrupt establishment politicians, and uncontrolled illegal immigration, but one where the political economy and capital markets proved beyond a reasonable doubt that they are more inextricably welded together than ever before. Oh, and of course, it was also the year when the Fed's apolitical facade crumbled, exposing the most important central bank in the world as nothing more than a puppet of shadowy establishment forces whose only task is to preserve the status quo.... and failing.

Let's first take a quick look at what happened in the past year through the lens of the masses, and as a quick 4-minute refresher, here is a highlight reel from Googles "year in search" of all the big, but mostly irrelevant, topics that random people around the world obsessed over in 2024.

Of course, much of the stuff in the clip above is just fluff and distractions meant to keep the attention of the masses focused on trivial things. What we tried to do with our reporting throughout the year was to minimize the noise and to bring you, our readers, the signal, and while there was a nonstop barrage of the former, the underlying newsflow largely boiled down to four main categories:

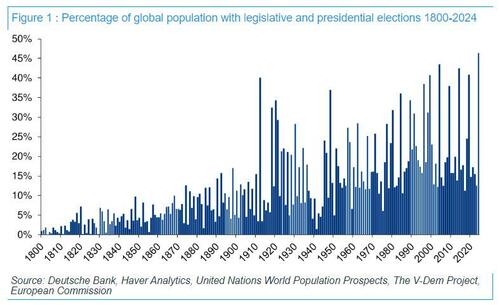

Of the above, by far the most important cross-current across 2024 was the political, and there were two very clear reasons for that. First, as we said in our 2023 year in review post, 2024 would be a year with a record number of elections across the world...

... and second, and even more important, the US presidential election would take place in November, where the choice was clear: a full-blown acceptance of Marxist, DEI, woke ideology coupled with a fascist economy in the classical sense (namely a fusion between government and corporate interests) or some last-ditch hope for a return to normalcy.

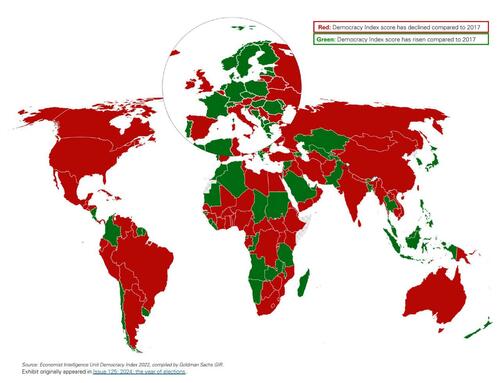

To the first point, amid a global democratic...

... backslide...

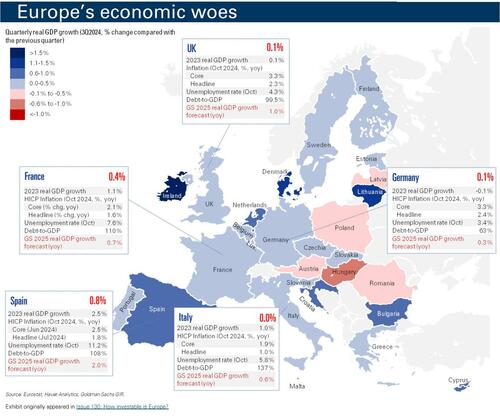

... voters in over 70 nations, representing over half the world's population, went to the polls...

... and cast a historic protest vote which led to the biggest blowback against the existing political system ever observed, with the incumbent establishment in the UK, France, Germany, and many other countries suffering an epic collapse and ushering in new political ideas and paradigms. Even the AP had to admit that "The ‘super year’ of elections has been super bad for incumbents as voters punish them in droves." Why? Because of the unholy trinity we mentioned above, and unleashed by flailing globalists across the globe with catastrophic consequences: runaway inflation, corrupt/crony establishment politicians, and uncontrolled illegal immigration. Oh, and the fact that unlike the US, Europe does not have a reserve currency and can't print its way out of recession leaving its markets in the dust and its population increasingly unhappy, certainly does not help.

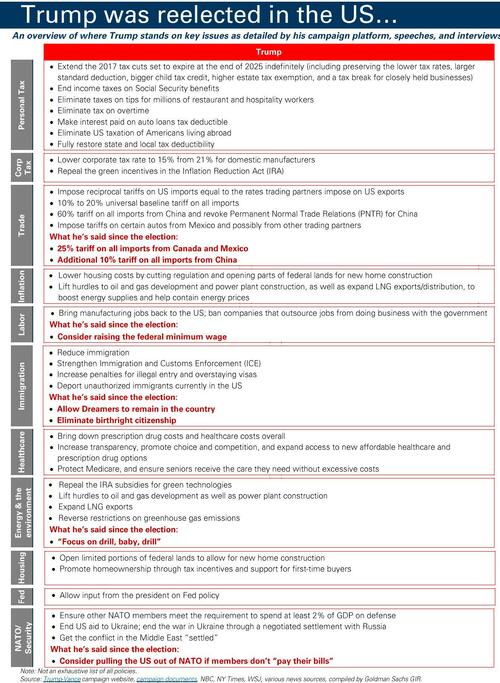

The punchline, however, came on November 5 when, to the shock of liberals everywhere, the mainstream media and the always wrong pollsters, Trump was elected for a third time, only this time the election was such a blowout success as Trump won both the Electoral college and the popular vote (coupled with a Republican sweep of Congress) that not even Soros' countless minions could steal this election. To be sure, much of Trump's hardline campaign promises, speeches and platform views have been since materially diluted...

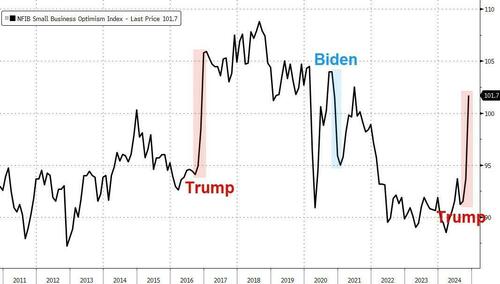

... but even so, the hope that Trump's return to the White House will also return the US to some normalcy after years of unbridled insanity by Biden's woke puppetmasters, was enough to send stocks (and bitcoin) soaring to record highs adding trillions in value as the market gave its clear seal of approval to the new administration (more on the later), not to mention a near record surge in small business optimism which saw its biggest jump since the first time Trump was elected.

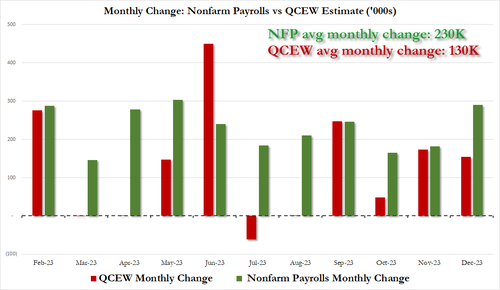

What is ironic about the above chart is that if one believed the Biden admin, that surge in optimism would be impossible: after all, month after month the White House would shovel "data" down everyone's throat that showed the US economy was spectacular and growing at a red hot pace, even though - as we repeatedly warned - the only thing that was coming out of the Biden BLS month after month was completely fake data about jobs (as we warned in March 29, 2024 "Philadelphia Fed Admits US Payrolls Overstated By At Least 800,000"). Just a few months later we got evidence that one should never believe any so-called "data" coming out of Biden's administration, when in late August, just as we had warned, the Bureau of Labor Statistics revised down the number of jobs in the past year by 818,000 - one of the biggest downward revisions to key economic data in history - and admitted that nearly every other job had been faked, and instead of a 230K average monthly jobs increase, the US had been generating on average just 130K jobs.

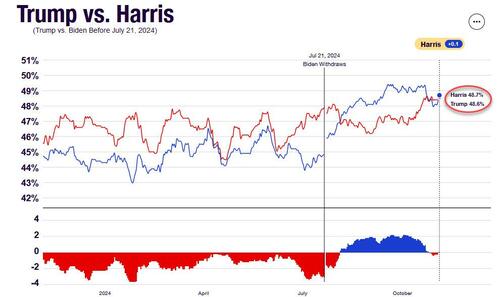

Once the myth of Biden's "strong economy" collapsed, everything else went promptly followed suit, as did Biden's - and soon after - Kamala's chances of winning. But one wouldn't know that listening to the polls which were just as wrong as in 2016 when they said Hillary's odds of winning were "more than 99%". In fact, according to the RealClearPolitics poll average, Kamala had the lead up until the very last day.

Not everyone was wrong, though. We, along with a handful of other sites, repeatedly warned that most polls are inaccurately biased in favor of Biden/Kamala thanks to chronic, relentless and aggressive oversampling of Democrats. And just like in 2016, we were right... as was Polymarket: the sensational upstart which emerged out of nowhere, which consistently managed to call the correct outcome of every major event, took the country by storm when its opinion diverged dramatically with established polls...

... and in the end, proved to be spot on after Trump's blowout victory which was so large, not even Democrats could steal the election again.

There was more: yes, the economy appeared strong (for all the wrong reasons, as we explain below), but that did not matter to ordinary middle-class Americans who may have had a job, but instead of dwelling on GDP, were much more concerned by the ongoing surge in prices which shrank their inflation-adjusted paychecks month after month. And while Democrats pretended as if prices were not at all time highs and rising at a 3%+ pace, we warned long before the elections, that - to ordinary Americans - only inflation matters. We were right.

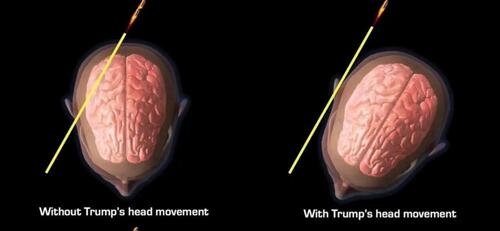

But while it was the runaway inflation on one hand, and the collapsing myth of Biden's strong economy (despite persistently record high prices) which both set the stage for Trump's victory, what cemented it was that fateful evening of July 13 when the former - and future - president survived an assassination attempt on live TV while speaking at a campaign rally near Butler, Pennsylvania. The shooter's bullet grazed Trump's ear after a last second turn of the head saving Trump's life...

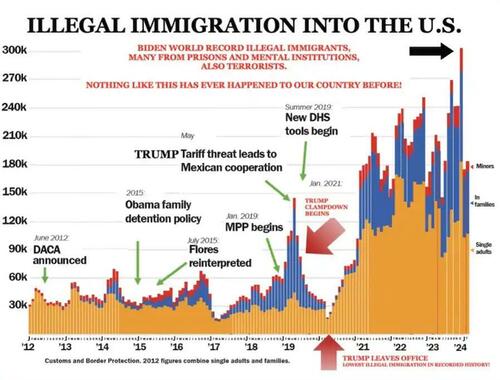

... and set the stage for his victory. Ironically, the trigger that prompted Trump to move in the last second - and saved his life - was a peek at the chart showing the record surge of illegal US immigration under the Biden admin.

Ironic that the same flood of illegals that was supposed to win Kamala's election and cement a dynasty of Democrat presidents for generations, saved Trump's life and put him back in the White House.

While Trump's victory and the landslide against incumbent political parties framed the biggest stories in the political realm, the world of finance and economics was once again dominated by the Federal Reserve, as well as the US Treasury, both of which had a clear mandate: do not rock the boat, do not allow the US economy to fall into recession, debt be damned, and above all make sure that Trump is not elected. It did not quite work out as expected.

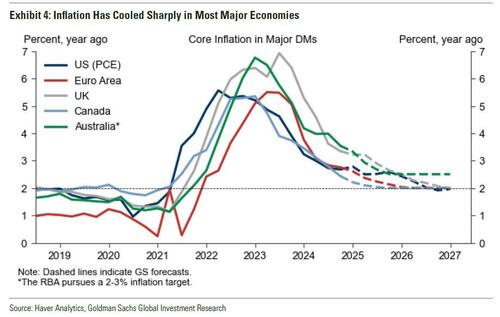

To be sure, 2024 was literally a pivotal year for the Fed: after an aggressive tightening campaign which pushed the Fed Funds rate from 0% in early 2022 to 5.25% less two years later, the Fed decided that with inflation dropping from double digits - if still a red hot (and once again rising) 3.3% for core CPI - it had vanquished inflation, and that Powell was the second coming of Paul Volcker.

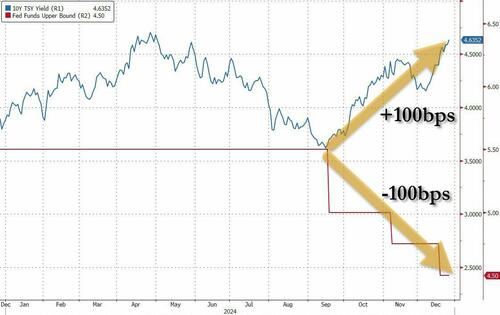

Couple that with the abovementioned shocker from the Biden BLS when the US was "unexpectedly" found to have overestimated jobs by over 800K, and in late September, the Fed - less than three months before the election - decided that the time has come not only to cut rates, but to do so with a bang in the form of a jumbo rate cut, slashing the Fed Funds by a whopping 50bps, as if the economy had suddenly collapsed into a deflationary recession when in reality prices - and the stock market not to mention bitcoin - were record high and rising at a breakneck pace (as we warned in August in "Powell Vows To Cut Rates With Stocks, Home Prices, Rents And Food At All Time Highs"), and just as core CPI had bottomed and was once again on the way up.

It was, of course, a catastrophic policy error, as demonstrated by the market's own reaction because after cutting rates by 100bps in three months, the 10y Yield responded by surging by 100bps, a mirror image of what should be happening if the Fed had made the correct decision.

Instead the market was screaming loudly that the Fed's rate cuts are setting the stage for another 1970's type inflationary conflagration...

... and that instead of the second coming of Volcker, Powell was actually just another Arthur Burns in hawk's clothing.

Ironically, we didn't even need the market to tell us the Fed had made a terrible mistake: less than three months after the jumbo rate cut, Powell himself conceded on live TV that the Fed had been too aggressive in its dovish outlook, and that all those rate cuts penciled in for 2024 (when the assumption was that Kamala would be president in 2025 and onward) were, well, a mistake and by mid-December, just weeks after Trump won an avalanche victory, Powell pivoted into a rabid hawk once again, telling markets that the latest rate cut may well be the last one because, well, you know Trump tariffs or something. Because the Fed, which in its own words, never reacts to political pressure, not only reacted, but preacted and assumed that Trump would impose tariffs which would ignite inflation - when they may just as easily spark another global deflationary recession - over a month before the 47th president was even inaugurated!

So much for the "apolitical" Fed.

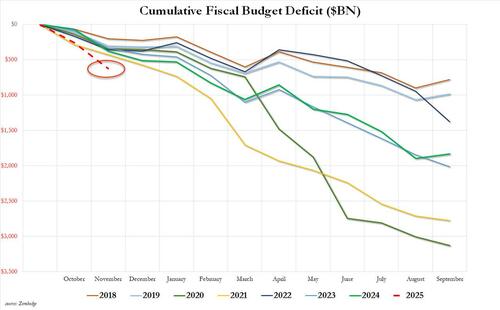

And let's not forget the Treasury, which as we first discussed back in the summer of 2023, had been the mystery force behind the ability of Bidenomics to delay a recession again and again, and all it cost was trillions and trillions in debt. As a reminder, we first explained what was really going on in "Here Is The $1 Trillion "Stealth Stimulus" Behind Bidenomics", when we showed that the recent surge in the US deficit was the artificial, debt-funded sugar high that was redlining the US economic engine. One year later it got even worse, and after the deficit of fiscal 2024 closed out the year right on top of where it was in 2023, the spending spree only accelerated in the last months of Biden's administration...

... and the first two months of fiscal 2025 are already on pace for a new record high!

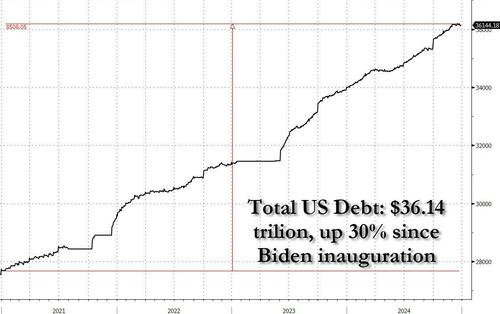

And the trade-off of this unprecedented sugar rush? $1 trillion in new federal debt every 100 days, bringing the total to a gargantuan $36.2 trillion, up $8.5 trillion, or a stunning 30%, since Biden's inauguration....

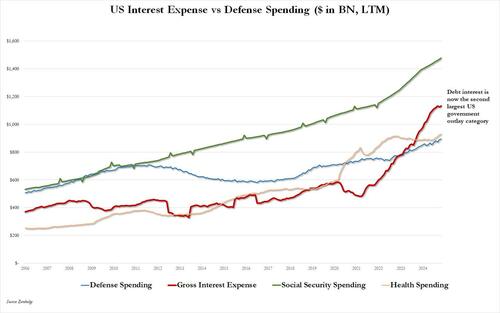

... with gross interest expense on US debt now running at a record $1.2 trillion (and rising every day), surpassing defense and health spending as US government outlays, with just Social Security spending ahead of interest on the debt.

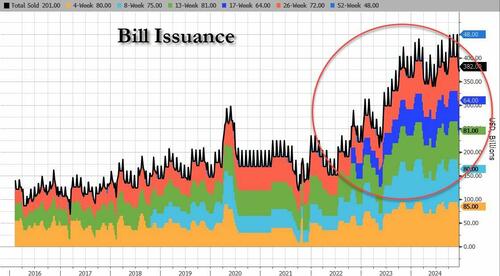

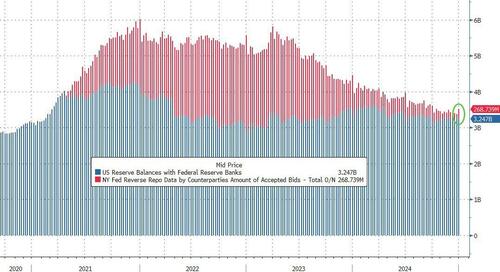

Finally, just to make sure that the status quo persists, and that the 47th president is a Democrat, Biden's Treasury Secretary Janet Yellen threw in a stunning freebie: a T-Bill "reverse-twist" starting in 2022 when in order to drain the $2.5 trillion in inert funds caught in the Fed's reverse repo facility, the Treasury launched a historic Bill issuance spree which culminated with $2 trillion in excess T-Bill sales, which amplified the stimulating effect from the reckless deficit spending, and overstimulated the economy even more.

Putting it all together, with the help of the Fed and the Treasury, the US economy managed to surprise to the upside in 2024 even though, as we now know, all those trillions in excess debt and those recent rate cuts eventually hit "peak stimulus" and the result was that the US labor market peaked some time in 2023 and was all downhill from there as the near record negative revision to jobs showed. One can only imagine if there was no concerted effort by the Fed and the Treasury to keep Trump out of the White House, how deep a recession the US economy would be in right now.

Alas, now that Trump is in the White House and can look forward to little to no support from the Fed or from a US Treasury that will no longer spend like a drunken sailor under Scott Bessent, we have a feeling that it won't take long for the long overdue recession to hit the US economy head on, especially - and somewhat counterintuitively - if Elon Musk's DOGE is even remotely successful. Because for a debt-funded regime like the US, even the smallest hiccup in issuing $1 trillion every 100 days means immediately economic and market calamity. And while Trump and Elon truly hope that the US population is ready and willing to make some sacrifices for the sake of austere belt-tightening if it leads to some nebulous "greater good" down the line, both are in for the surprise of their lifetimes.

Turning to geopolitics, 2024 was unexpectedly an easing from the torrid pace of 2023. Yes, wars in Ukraine and the Middle East continued, but no new military conflicts emerged, and even though Israel ascended rapidly to near hegemonic status in the middle east after blitz campaigns in Gaza and Lebanon which crippled Lebanon and Iran, leaving them bruised and battered and their militaries in shambles, the middle eastern conflict never truly spun out of control. Why? Because Biden's puppetmasters were at least smart enough to realize that had oil soared to $100 or more and sending gas at the pump to $4 and higher, which a real war between Iran and Israel would inevitably deliver, Biden's chances of re-election were nil. Which is why they did everything they could to delay the Middle Eastern conflict until after the election. As for the war in Ukraine, that was largely on autopilot, with Russia methodically and systematically entering deeper and deeper into Ukraine territory, and with funding for Zelensky about to be cut off, an imminent ceasefire now appears almost certain.

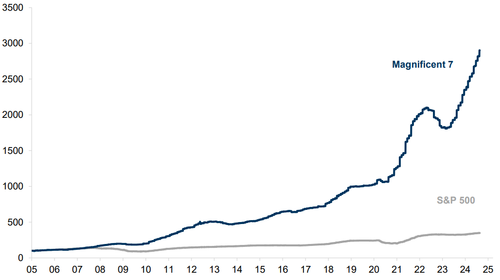

Finally, looking at markets and the continued impact of technology, it was largely a continuation of events in 2023, when the bank bailout early in the year put an end to the Fed's reserve drain which in turn triggered the "Fed put" giving markets a carte blanche to meltup without fear of retribution, while the continued obsession with AI and chatbots meant that the Mag7 winners of 2023 would extend their amazing run into 2024.

We won't bother your with details - after all, we do that every single day on these pages - suffice to say that the combination of an easing Fed, at least for three months ahead of the election when Kamala had a decent chance of winning if not so much after Trump won, coupled with an epic AI bubble serves as an extremely powerful force.

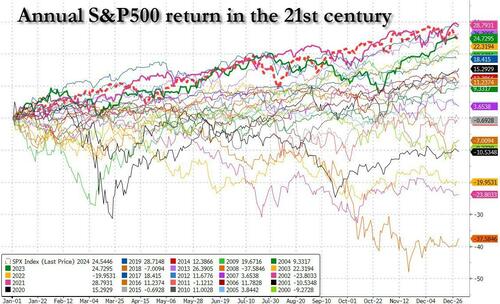

How powerful? Well, up until the Fed's December hawkish pivot, 2024 was on pace to generate the best S&P return this century. After the recent turbulence, what would otherwise have been a 30% return, is down to "only" 25%, which still means that 3 of BIden's 4 years saw the US equity market rise more than 20%!

One reason for this unprecedented meltup in the past two years was the fact that while Fed reserves remained unchanged (and even rose for a while after the bank bailouts in March '23) during 2023 and 2024, the funds held in the Fed's reverse repo facility were slowly drained day after day (thanks to Bill issuance), giving dry powder with which to push stock higher.

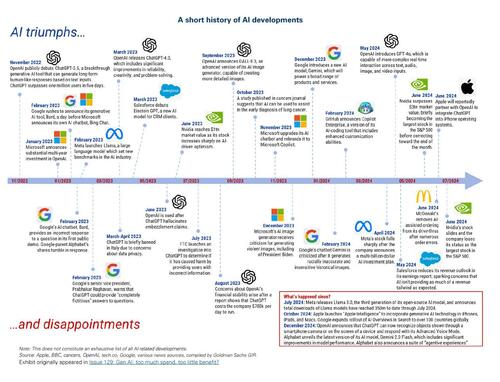

As for the AI bubble which took the market by storm ever since OpenAI released ChatGPT3.5, here is a brief snapshot of the last two years...

... which shows that there have been triumphs and disappointments, although the reality is that we have seen chatbots come and go, and the world always moved on to a new, bigger and shinier fad. This time, however, prices may have pulled just a little bit too much from the future, as this breakdown of the Mag7 vs the S&P shows.

In any event, we don't have that much new to add here: exactly one year ago we said that "we would be remiss not to mention the single biggest market narrative - and tech story - of 2023, namely the unprecedented AI mania, which manifested itself in an explosion in the "Magnificent 7" mega tech stocks which now make up a record 30% of the S&P's market cap."

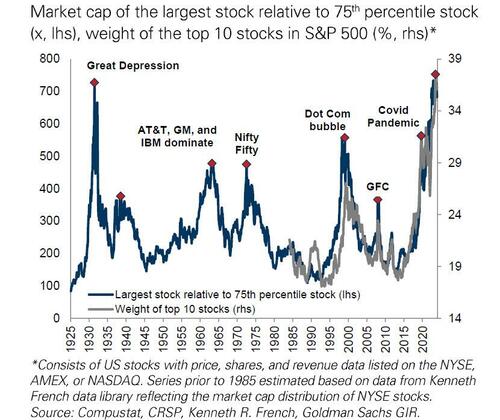

Maybe the biggest difference from a year ago is that "more of the same" means that never before has so much market influence and impact been concentrated in so few stocks, and at last check, the 10 largest stocks in the S&P now account for 38% of total market cap. Actually, one correction: it's not "never before" - the last time so few stocks had such a big impact on the market was... just before the Great Depression.

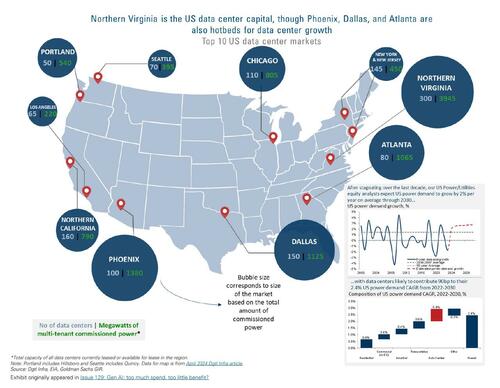

But surely this time it's different. One thing that is not different, however, is that all those chips and data centers will need power... lots of power, and the US is woefully unprepared to power up the AI revolution.

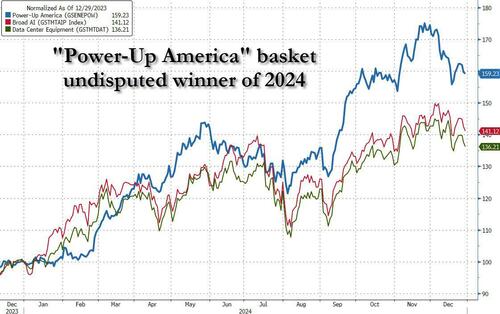

Which incidentally is why back in April we urged our readers to invest not in AI, but in the utilities and companies that will power and enable AI and provide the infrastructure to build out the hundreds of data centers that will be needed should AI prove to not be a bust (see "The Next AI Trade" from April 3). To those who took our advice, congratulations: your basket of "Power up America" stocks (blue line below) significantly outperformed both the "Broad AI" basket and the "Data Center Equipment" baskets.

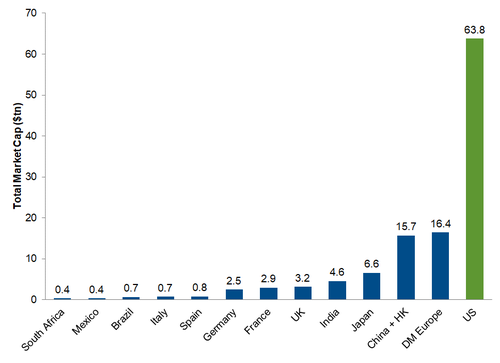

And no matter what else happens in the next four years, we expect that investments in US energy infrastructure will continue at an unprecedented pace as Donald "America First" Trump seeks to preserve the US status as the world's AI leader, not to mention the world's most exceptional nation, one whose total market cap is now substantially larger than the rest of the world combined!

To be sure, there are legitimate reasons for US exceptionalism besides Fed balance sheet financial engineering and chatbot fads: the ability to catch a 100 ton starship, the heaviest object that has ever left the earth with two chopsticks, as Elon Musk did in October, is certainly one of those memorable "where were you when..." moments that everyone will carry with them for the rest of their lives.

And speaking of Elon, he also deserves congratulations for converting X (f/k/a Twitter), from what was once the most corrupt and censored social media network in the world controlled by an army of woke, bluepilled Karens, into a bastion of free speech, one which many will agree was instrumental in Trump's victory on November 5. Many smirked one year ago this day when we said that "in less than a decade, Elon Musk's $44 billion purchase of Twitter will seem like one of the century's biggest bargains." Fast forward to today when Elon Musk is not only the world's richest man once more, but he is that by a huge margin, worth some $200 billion more than Jeff Bezos' $240 billion, and he largely has X to thank for this, even as virtue-signaling corporations (who all work in conjunction with the deep state in hopes of getting some fast-track access to those very generous taxpayer-funded government contracts) are doing everything in their power to demonetize and starve the company by continuing to pull their ads.

We say this as one of the first media outlets that was dubbed "conspiracy theorists" by the authorities, long before everyone else joined the club. Oh yes, we've been there: we were suspended for half a year on Twitter for telling the truth about Covid, and then we lost most of our advertisers after the Atlantic Council's weaponized "fact-checkers" such as Newsguard put us on every ad agency's black list while anonymous CIA sources at the AP slandered us for being "Kremlin puppets" - which reminds us: for those with the means, desire and willingness to support us, please do so by becoming a premium member: we are now almost entirely reader-funded so your financial assistance will be instrumental to ensure our continued survival into 2025 and beyond.

The bottom line, at least for us, is that the past five years have been a stark lesson in how quickly an ad-funded business can disintegrate in this world which makes the dystopian nightmare of 1984 seem more real each day, and we have since taken measures. Four years ago, we launched a paid version of our website, which is entirely ad and moderation free, and offers readers a variety of premium content. It wasn't our intention to make this transformation but unfortunately we know which way the wind is blowing and it is only a matter of time before the gatekeepers of online ad spending block us and those like us for good as traditional media continues to melt away, losing more credibility and readers each and every day. As such, if we are to have any hope in continuing it will come directly from you, our readers. We will keep the free website running for as long as possible, but we are certain that it is only a matter of time before the hammer falls as the deep state retaliates to the shocking loss of 2024 and lashes out at all new media, as the deep state will stop at nothing to silence all independent voices in order to preserve mind control over the population.

How long do we have? Matt Taibbi may have said it best a few days ago when he wrote the following:

If you subscribe to this site it’s likely because, like me, you felt the world slipping off its axis and were looking for someone to reassure you you weren’t crazy. We lived through a difficult time together, but the fever finally broke this fall, and the world is now allowed to remark on the Emperor’s lack of clothes. It feels like good news, but what now? Can we go back a normal life? Will it last?

I think so, for a time.... A core reflex in these decades of postmodern insanity was constant rejection of things we thought we knew in favor of New, Improved Beliefs packaged from above. But some things don’t change. Until we do away with holidays, little kids will always have the same look on their faces I’ll see tomorrow morning, when mine unwrap their presents. Farts will always be funny, teenagers will always menace cars and have too much sex, NBA players will always travel, and parents bound by love for their children will always find peace growing old together. Fundamental things do apply, as time goes by.

Mad scientists who think they can redesign human experience are always undone by eternal truths that arrogance won’t allow them to grasp, one being that life isn’t so bad, another that there are some things people will never understand. But that’s the good news. Learning to embrace the unknown is what allows us to be happy, in our handful of turns on the planet. Heavy thoughts for Christmas, but I mean it in a good way. I don’t know what’s coming. I do know that first the first time in ages, the exhaustion of managing parallel truths has subsided. Now we just have one crazy world to worry about. Normal feels normal. Christmas feels like Christmas. We’ve won a panic reprieve.

As always, we thank all of our readers for making this website - which has never seen one dollar of outside funding (and despite amusing recurring allegations, has certainly never seen a ruble from either Putin or the KGB either, sorry CIA) and has never spent one dollar on marketing - a small (or not so small) part of your daily routine.

Which also brings us to another critical topic: that of fake news, and something we - and others who do not comply with the established narrative - have been accused of. While we find the narrative of fake news laughable, after all every single article in this website is backed by facts and links to outside sources, it is clearly a dangerous development, and a very slippery slope that the entire developed world is pushing for what is, when stripped of fancy jargon, internet censorship under the guise of protecting the average person from "dangerous information." It's also why we are preparing for the next onslaught against independent thought and why we had no choice but to roll out a premium version of this website.

In addition to the other themes noted above, we expect the crackdown on free speech by various deep state tentacles to accelerate in the coming year (although it will be mostly in the shadows, at least for the time being, until Trump gets bored or tired of fighting the infinitely more powerful octopus that is truly in control of the United States) especially as the following list of Top 20 articles for 2024 reveals, many of the most popular articles in the past year were precisely those which the conventional media would not touch with a ten foot pole, both out of fear of repercussions and because the MSM has now become a PR agency for either a political party or some unelected, deep state bureaucrat, which in turn allowed the alternative media to continue to flourish in an information vacuum and take significant market share from the established outlets by covering topics which established media outlets refuse to do, in the process earning itself the derogatory "fake news" condemnation.

We are also grateful that our readers have, for the 16th year in a row, realized that it is incumbent upon them to decide what is, and isn't "fake news."

* * *

And so, before we get into the details of what has now become an annual tradition for the last day of the year, those who wish to jog down memory lane, can refresh our most popular articles for every year during our no longer that brief, 16-year existence, starting with 2009 and continuing with 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020 , 2021, 2022 and 2023.

So without further ado, here are the articles that you, our readers, found to be the most engaging, interesting and popular based on the number of hits, during the past year.

And with all that behind us, and as we wave goodbye to another bizarre, exciting, surreal year, what lies in store for 2025, and the next half-decade?

We don't know: as our frequent readers are aware, we do not pretend to be able to predict the future and we don't try, despite repeat baseless allegations that we constantly forecast the collapse of civilization: we leave the predicting to the "smartest people in the room" who year after year have been consistently wrong about everything, and never more so than in 2024 when not long after the entire world realized just how clueless the Fed had been when it called the most crushing inflation in two generations "transitory", the professional predictors reputation hit new lows as described in "How the Experts Got 2024 So Wrong", and "What the Mainstream Media Got Wrong about the 2024 Election", in the process adding strategists and analysts to the clueless ranks of economists, mainstream media and the professional polling class, not to mention all those "scientists" who made a mockery of both the scientific method and the "expert class" with their catastrophically bungled response to the covid pandemic, and then the response to the response, and so on... We merely observe, find what is unexpected, entertaining, amusing, surprising or grotesque in an increasingly bizarre, sad, and increasingly crazy world, and then just write about it.

We do know, however, that with central banks having flip-flopped yet again, and re-pivoting hawkishly less than three months after their surprise dovish pivot as stubborn inflation still rose more than 3%, with wages - especially for unionized and government workers - once again surging, home prices and rents refusing to drop despite 7% mortgage rates, and overall prices stuck at all time highs, the most likely outcome is another surge in inflation, and Jerome Powell becoming not the second coming of saint Paul Volcker but of satan Arthur Burns.

But even ignoring the impact on prices, one can't just undo almost 20 years of central bank mistakes by willing them away (despite what Elon Musk and DOGE hope to achieve in the next few years); after all it is the trillions and trillions in monetary stimulus, the helicopter money, the MMT idiocy, and the endless deficit funding by central banks that made the current runaway inflation possible, the current attempt to stuff 15 years of toothpaste back into the tube, will be a catastrophic failure.

We are confident, however, that in the end it will be the very final backstoppers of the status quo regime, the central banking emperors of the New Normal, who will again be revealed as completely naked. When that happens and what happens after is anyone's guess. But, as we have promised - and delivered - every year for the past 16, we will be there to document every aspect of it.

Finally, and as always, we wish all our readers the best of luck in 2025, with much success in trading and every other avenue of life. We bid farewell to 2024 with our traditional and unwavering year-end promise: Zero Hedge will be there each and every day - usually with a cynical smile (and with the CIA clearly on our ass now) - helping readers expose, unravel and comprehend the fallacy, fiction, fraud and farce that defines every aspect of our increasingly broken economic, political and financial system.