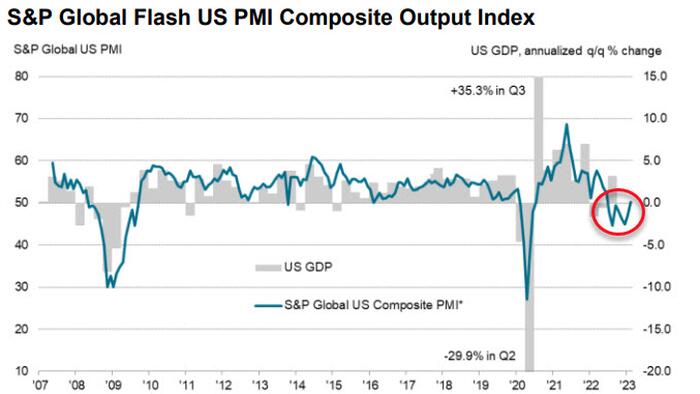

Despite ugliness in regional Fed surveys, S&P Global's US Services and Manufacturing surveys for February (preliminary) beat expectations this morning with the upturn in the headline composite figure driven by a resurgence in the Services sector (50.5 vs 47.3 exp vs 46.8 prior) while Manufacturing improved but remains in contraction (47.8 vs 47.2 exp vs 46.9 prior)...

Source: Bloomberg

Manufacturers registered a fourth successive monthly decline in production during February.

That said, the pace of contraction was the slowest seen over this sequence.

February data signalled a sharper rise in output charges across the private sector. The pace of increase in selling prices was the quickest since last October and steep overall. Firms reportedly passed through hikes in costs to their clients. A faster rise in output prices was seen at both manufacturing and service sector firms.

The headline Flash US PMI Composite Output Index registered 50.2 in February, up sharply from 46.8 in January. The latest reading was the highest for eight months and signalled broadly unchanged output on the month across the private sector. Service sector firms registered a fractional uptick in business activity while manufacturers reported a slower decrease in output.

Commenting on the US flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“February is seeing a welcome steadying of business activity after seven months of decline. Despite headwinds from higher interest rates and the cost of living squeeze, the business mood has brightened amid signs that inflation has peaked and recession risks have faded. At the same time, supply constraints have alleviated to the extent that delivery times for inputs into factories are improving at a rate not seen since 2009.

"However, there are some caveats to the good news. The upturn is being driven by the services sector, which in part reflects unseasonably warm weather, and although the manufacturing survey data are showing signs of improvement, the factory sector remains in contraction and focused on inventory reduction.

“Furthermore, the improved supply situation has taken price pressures out of manufacturing supply chains, but the survey data underscore how the upward driving force on inflation has now shifted to wages amid the tight labor market. By potentially stoking concerns over a wageprice spiral, accelerating service sector price growth will add to calls for higher interest rates, which could in turn subdue the nascent expansion.”

Not what The Fed wants to see.