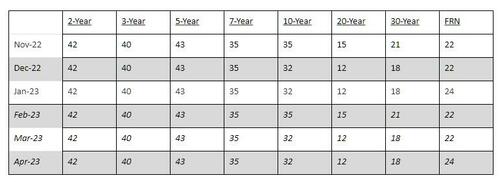

Amid the escalating debt ceiling standoff which is sure to culminate with fireworks some time in September, the Treasury announced on Wednesday morning that it would offer $96 billion of Treasury securities to refund approximately $67.1 billion of privately-held Treasury notes and bonds maturing on February 15, 2023. The amount was inline with expectations and was unchanged from last month. This issuance will raise new cash from private investors of approximately $28.9 billion. Issuance plans for Treasury Inflation-Protected Securities, or TIPS, were also kept unchanged compared with sizes over the prior quarter. The securities to be issued are:

Explaining the unchanged auction size, the Treasury said it "believes that current issuance sizes leave it well-positioned to address a range of potential borrowing needs, and as such, does not anticipate making any changes to nominal coupon and FRN new issue or reopening auction sizes over the upcoming February 2023 – April 2023 quarter."

The balance of Treasury financing requirements over the quarter will be met with regular weekly bill auctions, cash management bills (CMBs), and monthly note, bond, Treasury Inflation-Protected Securities (TIPS), and 2-year Floating Rate Note (FRN) auctions.

While there were no surprises in the refunding amounts, the elephant in the room, of course, is that the department is now operating under the constraints of the $31.4 trillion debt ceiling, having hit the level last month and begun using special accounting maneuvers to help preserve borrowing room.

Last month, Janet Yellen outlined in letters to Congress, that the period of time that extraordinary measures may last is subject to considerable uncertainty due to a variety of factors, including the challenges of forecasting the payments and receipts of the U.S. government months into the future. While Treasury is not currently able to provide an estimate of how long extraordinary measures will enable us to continue to pay the government’s obligations, it is unlikely that cash and extraordinary measures will be exhausted before early June.

“Until the debt limit is suspended or increased, debt limit-related constraints will lead to greater-than-normal variability” in the issuance of bills, as well as significant usage of CMBs the department advised. Dealers have pointed to the importance of tax receipts in coming months as a key variable for the Treasury’s borrowing needs.

Separately, as Bloomberg notes, at some point the Federal Reserve’s continuing QT - or active shrinkage of its portfolio of Treasuries - is expected to force the Treasury to boost issuance of coupons. That’s after the department steadily scaled back sales from November 2021 through last August, as pandemic-relief spending was phased out.

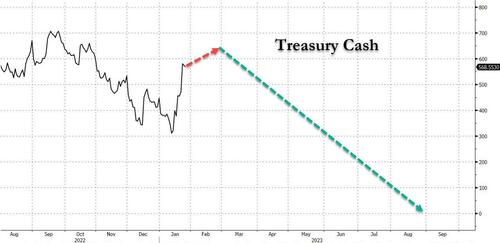

“Eventually, coupon auctions should start to rise again, but we doubt that this will occur until after the debt ceiling is increased or suspended,” Wells Fargo economists Michael Pugliese and Angelo Manolatos wrote in a note before Wednesday’s release. The bank currently sees auctions rising starting with the November refunding. Furthermore, as noted earlier this week and previously, the Treasury will instead drain its cash holdings at an accelerated pace as it struggles to keep the government working without a debt ceiling deal.

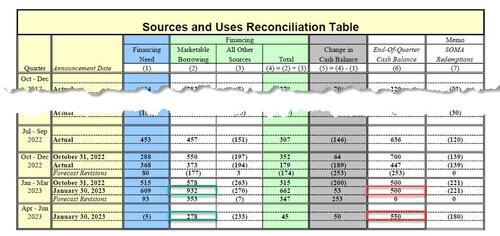

The Treasury on Monday estimated its cash balance at $500 billion for the end of March, slightly below where it is now, but caveated that this number assumes a debt deal is in place, which is not the case, and is also why the cash level will be drained much faster than the TSY forecasts. It also lifted its projections for federal borrowing for the current quarter to $932 billion.

Separately, Bloomberg noted that T-bills are currently hovering near the bottom of the recommended 15% to 20% share of total debt, as specified by the TBAC (aka the shadow group that runs the world).

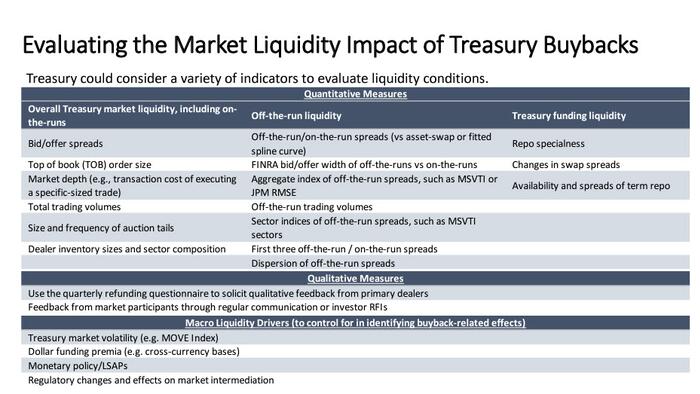

Also on Wednesday, the Treasury highlighted that it’s continuing to examine the idea of launching a buyback program, something that, in October, it asked dealers their views on when illiquidity in the Treasury market prompted some to evaluate Treasury or Fed intervention to unfreeze the bond market (since then a surge in foreign demand has helped alleviate much of the lack of liquidity).

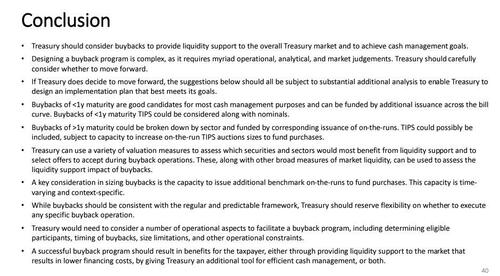

Buying back less-traded securities and selling more of the current benchmarks could be one way to address continuing concerns about illiquidity in the Treasuries market. TBAC in a statement Wednesday said the Treasury “should consider buybacks to provide liquidity support to the overall Treasury market and to achieve cash management goals.” “Treasury expects to share its findings on buybacks as part of future quarterly refundings,” the department said.

Treasury continues to study a potential buyback program. Over the last quarter, Treasury has conducted further outreach with a broad variety of market participants in order to assess the costs and benefits associated with several potential uses for buybacks, including liquidity support and cash and maturity management. In addition, the Treasury Borrowing Advisory Committee provided additional analysis on buybacks at yesterday’s meeting. Treasury expects to share its findings on buybacks as part of future quarterly refundings. Treasury has not made any decision on whether or how to implement a buyback program but will provide ample notice to the public on any decisions.

Some more details from the TBAC Executive Summary on the TSY buyback charge:

Committee presented on considerations for designing a “regular and predictable” Treasury buyback program.

Presenting member proposed a series of guiding principles, noting they should be used “mainly for liquidity support and cash management purposes, but are not intended to mitigate episodes of acute market stress.” Here is the full list:

The TBAC recommended that if the Treasury moves forward with a buyback program that it start small and “expand cautiously”

The presentation then reviewed potential use cases, discussed a framework to size buyback operations, and ended with several considerations for structuring a buyback program.

The conclusion to the buyback discussion:

And the full presentation is below (pdf link).