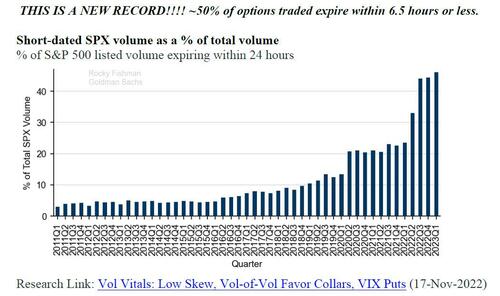

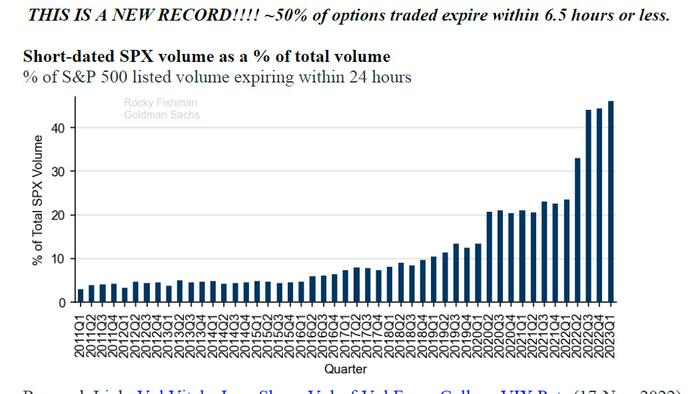

Four months ago, we were one of the very few outlets discussing Zero Days to Expiration (or 0DTE) options.

Fast forward to today when virtually everyone is eager to talk (in most cases, erroneously and with little understanding) about this phenomenon which has taken Wall Street by storm, and which - as we discussed last night - has become the scapegoat for every long and wrong analyst and strategist, who blames the frenzied purchases of same-day options for being... well, wrong in predicting doom and gloom for stocks.

The best example of this emerged late yesterday when JPMorgan's in house stock cheerleader-turned-permabear Marko Kolanovic not only blamed 0DTE (among other factors) for incorrectly calling an end to the rally since November, but went so far as to warn that 0DTE itself could catalyze a market crash and spark some $30 billion in selling (which, more importantly, whould finally make Marko right after being wrong for all of 2022 when he said every week to buy the dip, and 2023, when he flipped and has been saying to sell the rally).

Marko is not alone in blaming 0DTE for pushing the market higher. Speaking to Bloomberg TV, a bearish Academy Securities strategist Peter Tchir slammed 0DTE and said that “people are really literally gambling", adding “it’s almost like watching a horse race.”

“Volumes have exploded,” said Tchir. “It’s why we’re seeing moves that just are amplified — so maybe something that would be a half-percent move based on the news becomes a 1.5% to 2% move and it’s going in both directions.”

Echoing verbatim what we said a week ago (when we joked that Wall Street strategists are now blaming 0DTE for being wrong, just as they blamed gamma squeeze for being wrong several years ago), Tchir said that "It reminds me a lot of what we were seeing about a year and a half, two years ago where you had those gamma squeezes,” Tchir said. During the meme frenzy in early 2021, day traders used short-dated options to bet that as the value of the shares got closer to an option’s strike price, dealers would have to buy more and more of the underlying stock.

Bottom line: there is a lot of noisy innuendo and even more scapegoating out there, yet little actual signal. Which is why we went straight to the derivatives experts, our partners at SpotGamma for the best explanation of what's going on. They did not disappojnt.

Here is an excerpt from their primer:

The amount of attention being foisted back onto the 0DTE narrative is quite remarkable. It’s drawing in comments from macro pundits, and cries of “Volmeggedon 2.0″ (these are risks which we outlined back in October, in this Founders Note, and this video).

As we wrote in that October note, “Volmeggedon” is essentially just a “liquidity cascade” (as well covered by Newfound Research). We are working at a comprehensive SPX 0DTE study, but we wanted to share our key early views:

Lastly, 0DTE is leading some to cry “the VIX is dead!”. The first-order line of thinking here is that because of the effects of heavy 0DTE volume, the VIX isn’t a relevant calculation. It is true that the VIX does only measure the value of SPX options 25-33 days to expiration. The point here isn’t whether or not the VIX is useful (we think it is), but it seems to be that the “VIX is dead” is a way of declaring that “0DTE is all that matters”. This, we think, is incorrect. The VIX likely isn’t doing much because of low hedging demand, and a decline in realized volatility.

If and when large institutions decide they need to start hedging, they will likely do so using options that expire farther out in time. These large flows are, again, something we have not seen for several months, during a time of increasing 0DTE flows.

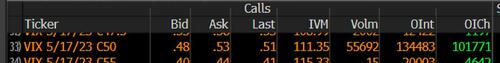

Enter: “50 cent”. This name was bestowed upon a large trader that used to specialize (quite successfully) in buying VIX calls with a price of 50 cents. After a long hiatus, they’re back as you can see below with several large clips of May 50 strike VIX calls.

We’d also highlight the very large VIX call buying from last week, too.

The point here is that as portfolios add equity exposure, the need for meaningful hedges should increase, in turn. This adds volatility-potential during market downturns, possibly in a way which wasn’t seen in the back half of ’22. During times of fear and volatility driven by “real money” hedging, we suspect those 0DTE flows will suddenly subside.